With Russia about to head the BRICS in 2024, the setup for gold and silver looks incredibly bullish.

Alasdair Macleod’s latest audio interview was just released! But first…

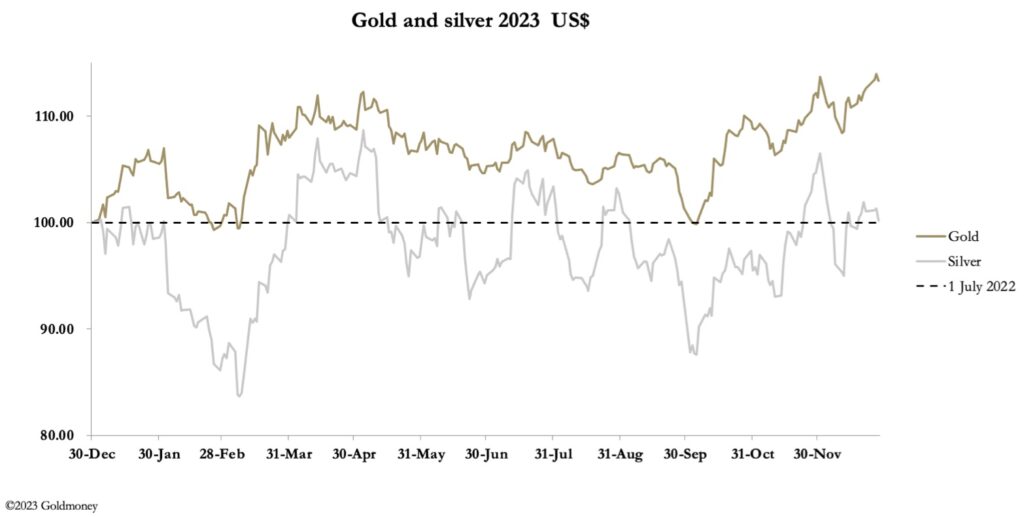

December 30 (King World News) – Alasdair Macleod: The risk at the year-end is that the establishment manages gold prices lower to favour their short positions. There is no evidence yet of this occurring for gold, though it appears to be true for silver. In a Sherlock Holmes story, the theft of a valuable racehorse did not trigger barking from a guard dog, which seems an appropriate metaphor for the absence of a takedown.

In European trade this morning, gold was $2065, up $13 from last Friday’s close, and up 13.2% on the year. Silver was $23.65, down 56 cents on the week and barely changed on the year.

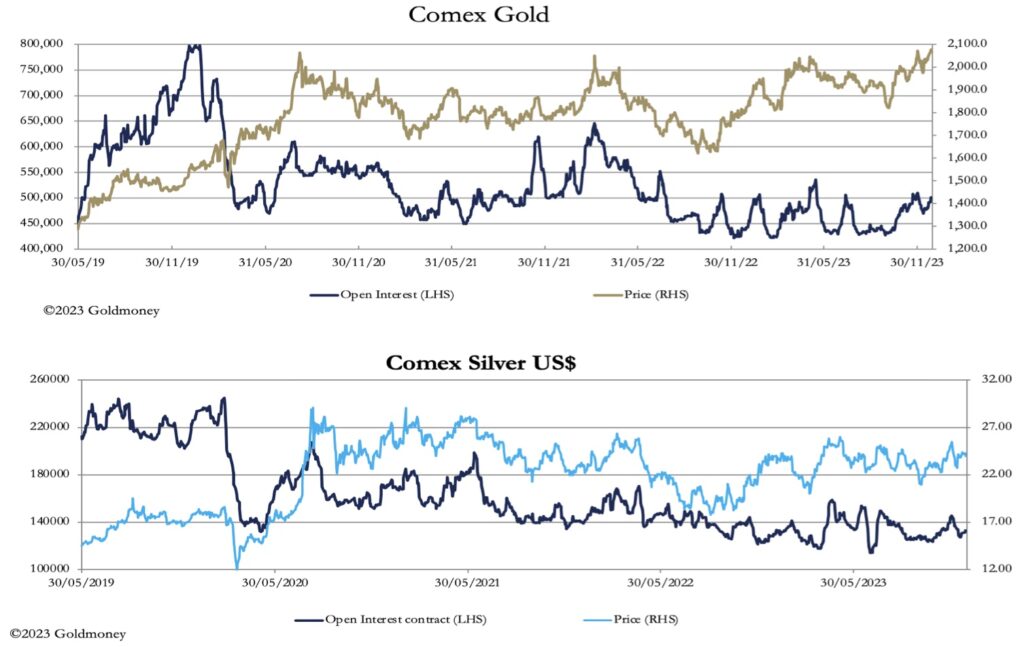

Comex volumes in both contracts were seasonably low.

Comex deliveries continue, with 16.45 tonnes of gold delivered in December totalling 412.73 tonnes for the year. Silver saw 395.3 tonnes and 4,315 tonnes respectively. These delivery quantities were never intended when these contracts were first issued, the delivery option being little more than and expiry reference point.

The next chart tracks Open Interest for both Comex contracts. The widening gap between gold and silver prices and the number of futures contracts underpinning them illustrates how gold is rising and silver remains where it is without the support of speculative interest. Perhaps this is why no dog is barking despite the gold price stealing ahead.

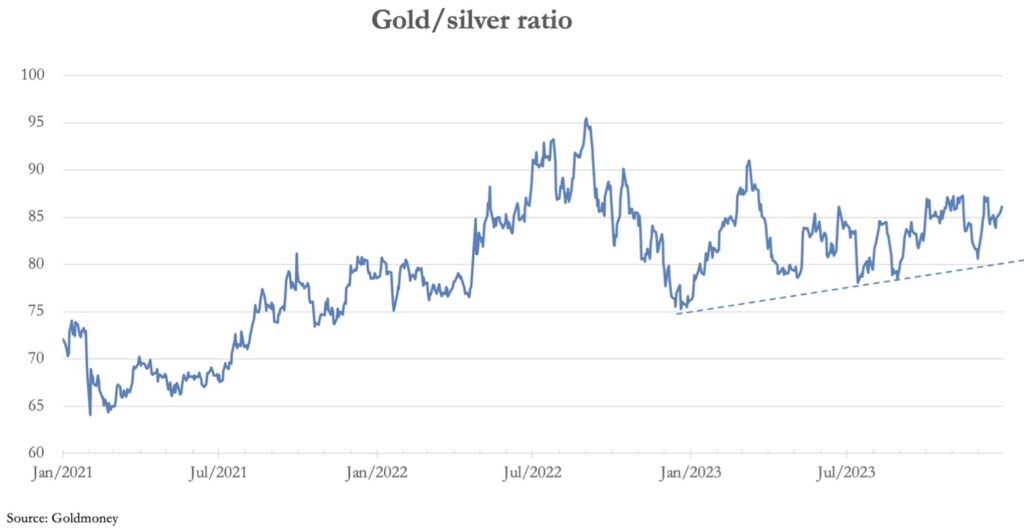

The reason for gold’s relative outperformance is obviously due to its pricing as money in difficult times for fiat dollars, while there is no similar price premium in silver. While silver still notionally takes its lead from gold, it is clearly priced as an industrial metal today. The demonetarisation of silver is what the gold/silver ratio is all about.

The ratio must break below 80, before we can speculate that some moneyness is returning to silver.

The outlook for gold is undoubtedly bullish, as the next chart shows. If the shorts attempt a last-minute bear raid today, the downside appears to be limited. But with the price now breaking out of a three-year consolidation pattern and the underlying moving averages in perfect bullish formation, it is a technical illustration for future textbooks.

The reasons are clear. The Fed has signalled that it is abandoning aTempts to manage inflation in favour of managing debt, which is soaring out of control. In this context, the drop in the US 10-year Treasury note yield from 5% to a current 3.9% in only six weeks is highly inflationary, reflected in the falling dollar’s trade weighted index, which is next.

When the TWI breaks below 100 it is bound to be seen as uber-bearish. And with the US Government’s runaway debt problem sure to emerge, it seems inevitable.

Russia To Head BRICS In 2024

The outlook for the gold price in 2024 is all about the dollar, rather than gold. From Russia taking the presidency of BRICS next week, to the failure of America’s proxy war in Ukraine along with Middle Eastern uncertainties there will be much that can go wrong for the dollar’s global status.

No wonder the outlook for the dollar price of gold is so good. To listen to Alasdair discuss how 2024 will kickoff for gold, silver, and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.