Take a look at what is booming right now.

Central Banks Continue To Struggle

May 21 (King World News) – Peter Boockvar: There is more Fed speak today, especially from Governor Waller who has clear authority on the committee in terms of his opinions matching up with Powell for the most part. What we’ve heard so far from others is their belief that policy is ‘restrictive’, though certainly not in the financial markets, but it remains a wait and see, play it by ear, stance when it comes to when it will be time to cut interest rates.

Keep in mind that while the ECB is going to cut rates in June, rents in the Eurozone are only about 6% of its harmonized index of consumer prices (HICP) so not really capturing anywhere close to the allocation households have to their housing budget. The Fed of course does include it in a much bigger way when they see CPI/PCE, though it’s much greater in the former than the latter in terms of weights.

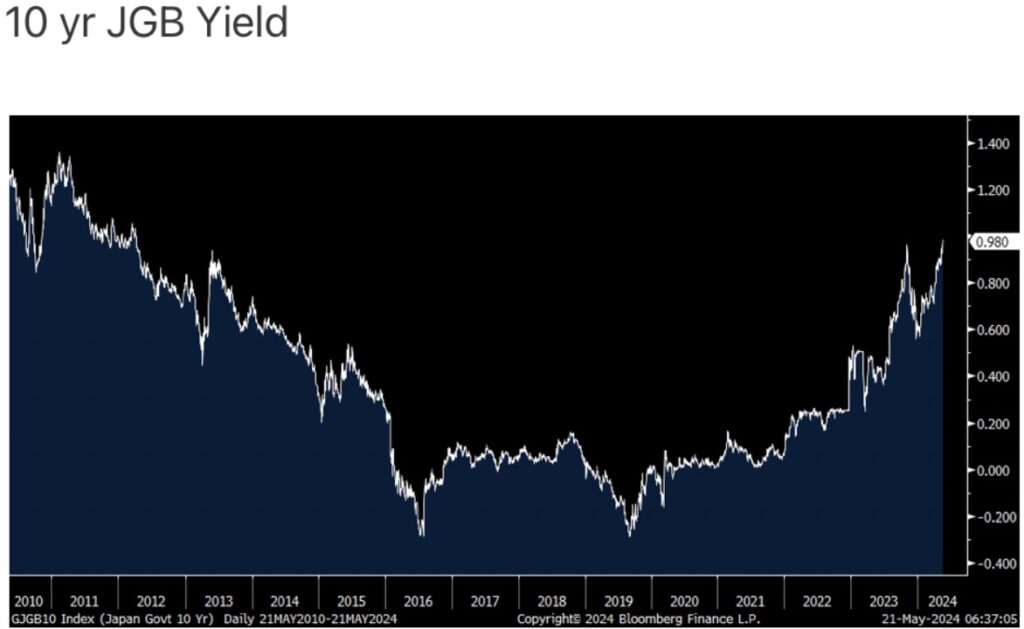

Meanwhile, the BoJ could be hiking again in a few months and their 10 yr JGB yield closed Monday (unchanged Tuesday) at the highest level since 2012.

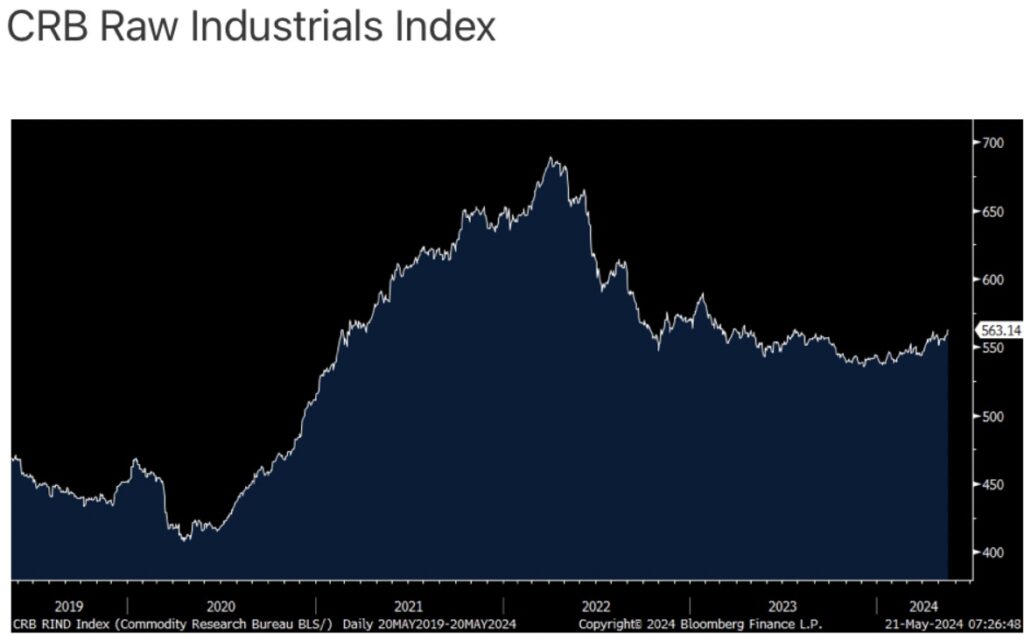

We’re of course seeing what’s going on with industrial metal prices, discussed here many times and yesterday too. The CRB raw industrials index yesterday closed at highest level since April 2023.

Look At What Is Booming Right Now

Just like us here and those in Europe, the travel bug is seen in China, even with all their other issues. Trip.com, a stock we own, reported earnings yesterday and said this:

From China, “outbound hotel and air ticket bookings on our platform fully recovered to 2019 levels during the major holiday periods, indicating a strong rebound in demand. In addition to outbound travel, the China domestic travel market continued to exhibit strong performance in the first quarter in response to growing interest of Chinese travelers in exploring their homeland.” They also are benefiting from an increase in travel by “the silver generation” as they mentioned.

And travel is growing all throughout the Asia Pacific region “with revenue growing at an impressive rate of around 80% y/o/y.” This includes travel into China “driven by the benefits of visa-free policies.”

I’ll argue again that the growing middle class in Asia, where half the world’s population lives, is a very exciting economic growth story over the coming 10 years.

This Could Be The Big One

Eric King: “Bryan, in its early stages your project in Victoria is mirroring the legendary high-grade Fosterville discovery. And now you just released results from your project in PNG that shocked everyone because of the high-grade. In fact, it looks like that project is mirroring K92s historic high-grade discovery. So the company has now become a twin threat in terms of making world class discoveries.”

World Class Assays in the Right Neighborhood

Bryan Slusarchuk: “Yes, Eric, this week’s Great Pacific Gold assays show that the veins on the company’s Kesar Project, along strike and having the same orientation as major K92 vein sets, carry high grade mineralization. Multiple samples from outcrop and from small underground workings returned ultra high grades – one sample graded as high as 244 g/t gold. Note also, in addition to the sampling from in-place occurrences on the property, Great Pacific also conducted a soil sampling program with more than 300 samples taken over a strike length of 5.5km. These soils returned exceptionally remarkable values (see 20.9 g/t gold). As soil sampling has proven to be a very effective tool for K92 Mining next door, these high grades in the soils at Kesar are very encouraging.

Well Positioned for Massive Upside

Great Pacific Gold has assembled a commanding 2500 sq km land package in PNG, known as “The Land of Giants” in the mining world for good reason. These properties range from the early stage and highly prospective Kesar Project through to the more advanced stage, former producing Wild Dog asset. Copper and gold are both important in these systems and Great Pacific Gold has a multitude of high-grade epithermal vein targets along with porphyry style potential. PNG has become a hot exploration jurisdiction due to the success of K92 Mining and the recent entry of the world’s largest gold company to the country. The early mover/first mover advantage that the Great Pacific Gold team has in this new era of PNG mineral exploration is important.

Twin Threat For Major Discoveries

At current budget, Great Pacific Gold has two years of working capital and is therefore well financed to conduct exploration. And as you mentioned, Eric, in addition to the company’s substantial PNG copper-gold project, the company also has a new discovery next door in Australia called Comet where a hole grading 8m at 106 g/t gold was announced at the start of 2024 and is being followed up on now with additional drilling. So, Eric, PNG provides an excellent foundation while Australia provides some amazing lottery ticket blue sky potential. Great Pacific Gold, symbol GPAC in Canada and FSXLF in the US.

Billionaire Lassonde Says Gold Headed Thousands Of Dollars Higher

To listen to billionaire Pierre Lassonde discuss what he is buying right now as well as the wild trading he expects to see in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss this week’s explosive upside action in gold, silver and mining shares and what to expect next CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.