More “transitory” inflation is on the way. Look at what is skyrocketing…

Debts & Deficits Matter

June 20 (King World News) – Peter Boockvar: With the Congressional Budget Office raising its fiscal 2024 deficit estimate to almost $2 trillion I believe we are sooner rather than later going to resolve the debate over whether ever rising debts and deficits matter for the direction of borrowing costs. The danger though now is that part of the rising estimates is due to higher interest rates. I get the question all the time as to when will DC care which would result in some action to slow the pace of rising debts and deficits and my only answer is when the bond market forces them to and I’ll define that as a 6% 10 yr note yield. That would create some shock to the system I’m guessing that could create some crisis where something might get done.

And, while I don’t know if 6% is something we’ll see, I still believe the bond bear market didn’t just end in a few years and that at least a retest of 5% will happen in the 10 yr yield.

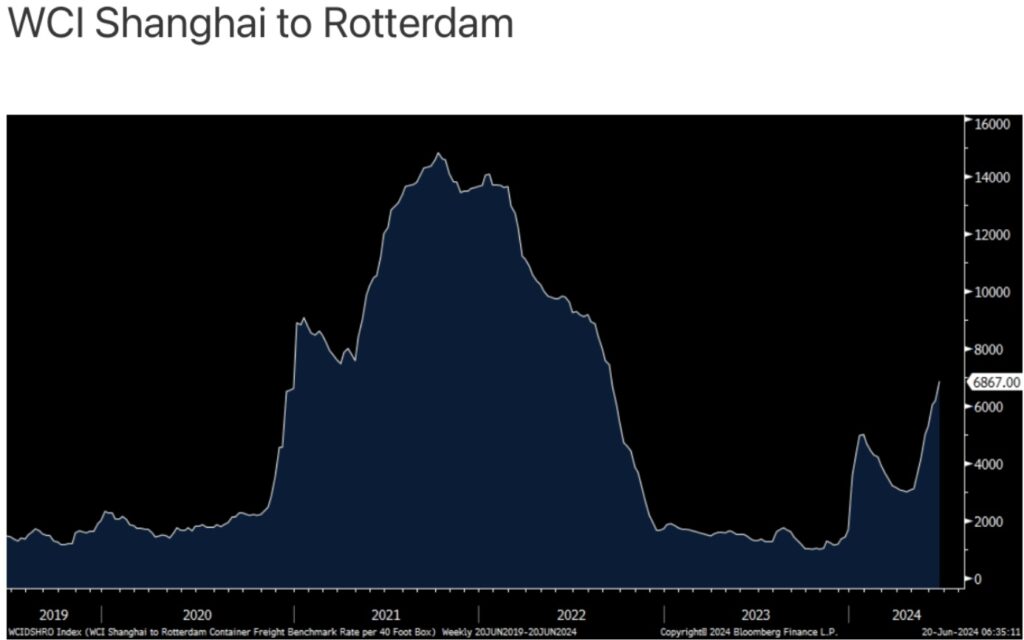

Let’s update shipping costs, reminding everyone that almost every single thing that gets produced in this world ends up on a ship at some point. The World Container Index Shanghai to Rotterdam route for a 40 foot container jumped for the 9th straight week by another $690 to $6,867, more than doubling over this 9 week time frame and about 4x where it started the year.

More “Transitory” Inflation On The Way:

Shipping Costs Skyrocket Again

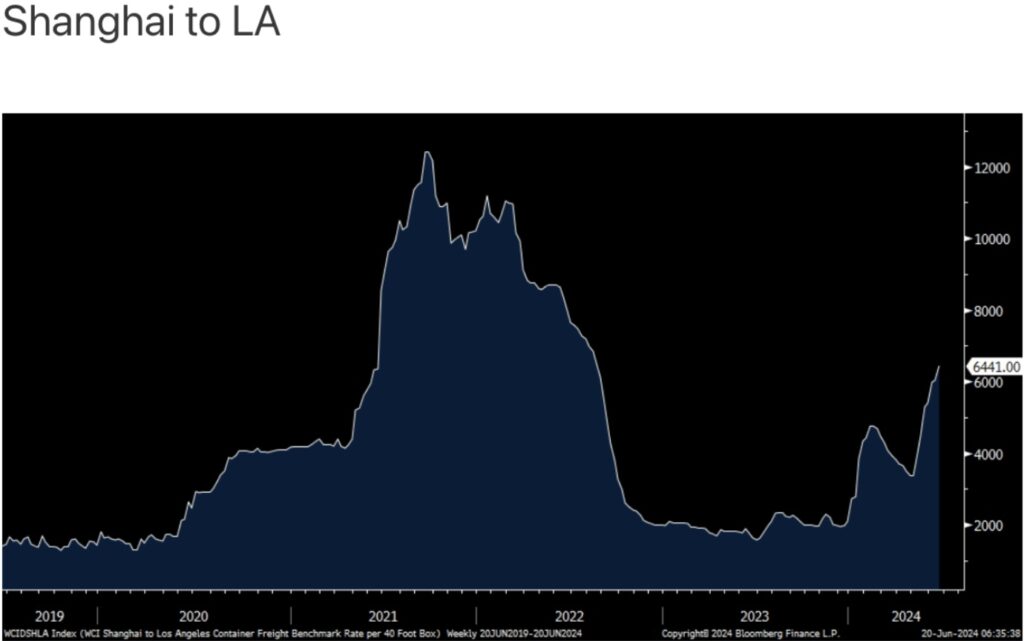

The price for a trip to LA rose by $416 to $6,441.

More “Transitory” Inflation On The Way:

Shipping Costs Skyrocket Again

Understand too that we are just months away before holiday stuff hitting the seas. And, air cargo freight rates are spiking too as I’ve mentioned previously. Inflation is not dead, inflation volatility is here to stay.

“Rent Too Damn High”

The trend in rents is something I watch very closely, not just from an economic, rates and Fed perspective, but because we own multi family REIT stocks. In case you didn’t see this WSJ article, https://www.wsj.com/real-estate/rent-hikes-loom-posing-threat-to-inflation-fight-e6797e39

Yes, we have huge multi family supply coming on line this year but much is concentrated in the overbuilding that has gone on in the sunbelt states. But, I’ll argue again that the supply will be easily absorbed with home buying affordability challenges still acute. Throw on the lack of new projects getting started and we’re headed for another jump in rental prices in the coming years, after the current slowdown. Inflation is not dead, inflation volatility is here to stay.

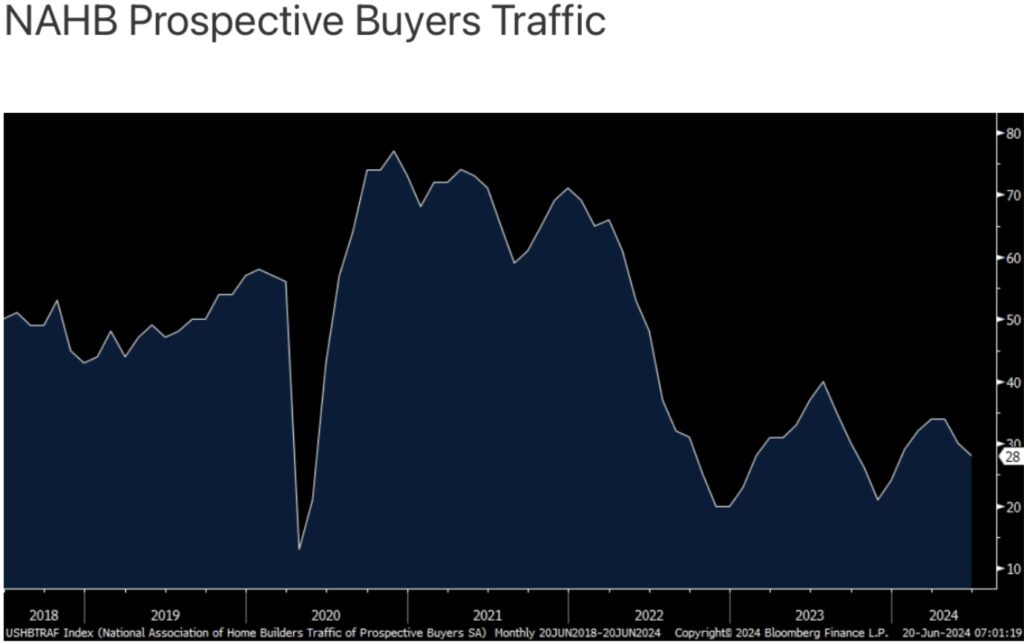

Home Builder Sentiment Hits 6 Month Low

By the way, the June NAHB home builder sentiment survey out yesterday weakened again, falling to 43 from 45, a 6 month low. The estimate was for a 1 pt gain to 46. Highlighting the challenged affordability problem, the Prospective Buyers Traffic component fell to just 28 from 30 and that is the lowest since December too and well below 50. The NAHB said “Persistently high mortgage rates are keeping many prospective buyers on the sidelines. Home builders are also dealing with higher rates for construction and development loans, chronic labor shortages and a dearth of buildable lots.”

Prospective Home Buyers Traffic Deteriorating Again

Swiss National Bank

The Swiss National Bank continues to try to catch that falling inflation knife betting that it will stay down. They cut again by 25 bps to 1.25% where no cut was expected. They said “The underlying inflationary pressure has decreased again compared to the previous quarter. With today’s lowering of the SNB policy rate, the SNB is able to maintain appropriate monetary conditions.” For perspective, a few weeks ago we saw May CPI in Switzerland at 1.5% y/o/y so the SNB is back to NEGATIVE REAL RATES. Playing with monetary fire I say. On the surprise move, the Swiss Franc is falling vs the euro and dollar after its recent rally.

Norway Remains Firm On Interest Rates

The Norges Bank in Norway disagrees with the SNB approach as they kept rates at 4.50% as expected and said rates will stay at current levels through the rest of the year. “If the economy evolves as currently envisaged, the policy rate will continue to lie at 4.5% to the end of the year, before gradually being reduced.”

I wonder if the ECB saw Monday’s request by IG Metall, Germany’s largest industrial union, asking for a 7% wage increase because of “a persistently high price level.” This would be for one year.

Meanwhile In The UK

After the UK reported a 2% headline CPI rate, as expected, and a higher than headline core rate gain of 3.5% because of stubborn services inflation, the Bank of England kept its policy rate at 5.25% as forecasted. Wholesale prices were mixed as input prices rose more than expected while output charges were about as estimated.

Seven voted to keep rates unchanged while two doves wanted to cut but this was the key line in the minutes from their meeting, “finely balanced” was the decision to sit tight. The pound is falling as are gilt yields in response to that line. So, they seem to have an easing bias too but the challenge the BoE faces is the 5.7% service price inflation seen for May though they remain confident that “Key indicators of inflation persistence have continued to moderate, although they remain elevated.”

Their bottom line, “Monetary policy will need to remain restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term in line with the MPC’s remit.” But maybe less restrictive by year end it seems.

The Bank Indonesia kept its overnight rate unchanged at 6.25% as expected. They have acted and continue to state that they want to stem the weakness in the rupiah.

Gold & Silver

King World News note: All of these central banks are struggling with crippling inflation that is crushing what’s left of the middle class. The fact that so many want to lower rates into what has been massive inflation is madness, but that is the Orwellian world we live in today. Regardless, all of this is adding fuel to the gold and silver bull markets. Although they are consolidating at the moment, we should expect new highs after the consolidation ends and prices resume their upward trend.

Alasdair Macleod discusses collapsing Open Interest in the gold market as well as some other wild developments from around the world CLICK HERE OR ON THE IMAGE BELOW TO LISTEN.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.