As we continue the first month of trading in 2024, there is no question that global markets are totally detached from reality.

Detached From Reality

January 24 (King World News) – Gregory Mannarino, writing for the Trends Journal: For a VERY long time now I have outlined in my work how we were, and are now, going to see an interesting phenomenon play out; “The Faster the World Economy Craters, The Higher Stock Markets Will Go.”

To grasp how this phenomenon is even possible, we need to understand what is driving stock prices/the market.

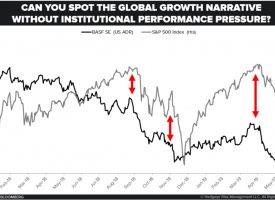

In times past there was a direct correlation between the economy and the stock market. Well today there is no correlation whatsoever between world markets and the world economy. Today both the economy and stock market operate absolutely detached from each other.

In times past fundamental market factors played a key role in the price action of a company’s stock. Things like PE ratios, Forward Guidance, Cash Flow, Return on Assets, Balance Sheet Debt, ETC. were essential components to establishing a company’s stock share price. Also, in times past it was these same factors which gave value to the overall markets themselves.

The economic meltdown/financial crisis/stock market crash of 2008 allowed central banks to completely remove the fundamental drivers of the markets, and collectively replace them with an easy money policy in the form of direct capital injections into the banking system, massively and continued suppressed rates, and by directly monetizing the debt.

Today, the Federal Reserve directly monetizing the debt has become a key component of monetary policy. This includes providing ALL THE FUNDS NEEDED to fund war, and the expansion of war as a key component to this policy…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

It could certainly be argued that war, and the expansion of war has always been a key monetary policy component of the U.S./Federal Reserve as no other endeavor on Earth creates more need for borrowed dollars than war… I personally believe this to be true.

As direct fallout from the “financial crisis,” the markets then and even now having access to OCEANS of cheap money gleefully provided by runaway central banks via artificially suppressed rates and direct monetization of the debt, have VERY successfully reinflated and HYPER-inflated the largest world stock market bubble in human history.

Today, being that fundamental factors which are supposed to support the market no longer matter, a freefall economy is stock market positive. A freefall economy is positive for the stock market in that the market will continue to receive access to continued suppressed rates, which by design drives cash into risk assets/the stock market. A freefall economy will also cause more and more corporations to lay off workers by the tens of thousands, which is positive for a company’s stock price and therefore the overall market.

Expanding war will also drive cash into the perceived safety of debt, further suppressing rates, which is again stock market positive.

We should expect that “The Illusion” of the market will be maintained throughout this Presidential Selection Cycle. The illusion of the market is a very powerful thing. People still believe that there is a direct correlation between the economy and the market. They believe that a high stock market means a strong economy, but today nothing could possibly be farther from the truth.

Nomi Prins Best Audio Interview Ever: Gold Price May Double In 2024!

To listen to one of Nomi Prins’s greatest audio interviews ever where she warned the price of gold may double in 2024 CLICK HERE OR ON THE IMAGE BELOW.

Latest Audio Just Released!

To listen to Alasdair Macleod discuss the big surprise in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.