Will this make investors a fortune in the gold market?

“The intelligent investor is a realist who sells to optimists and buys from pessimists.” — Benjamin Graham

Gold Mining Shares

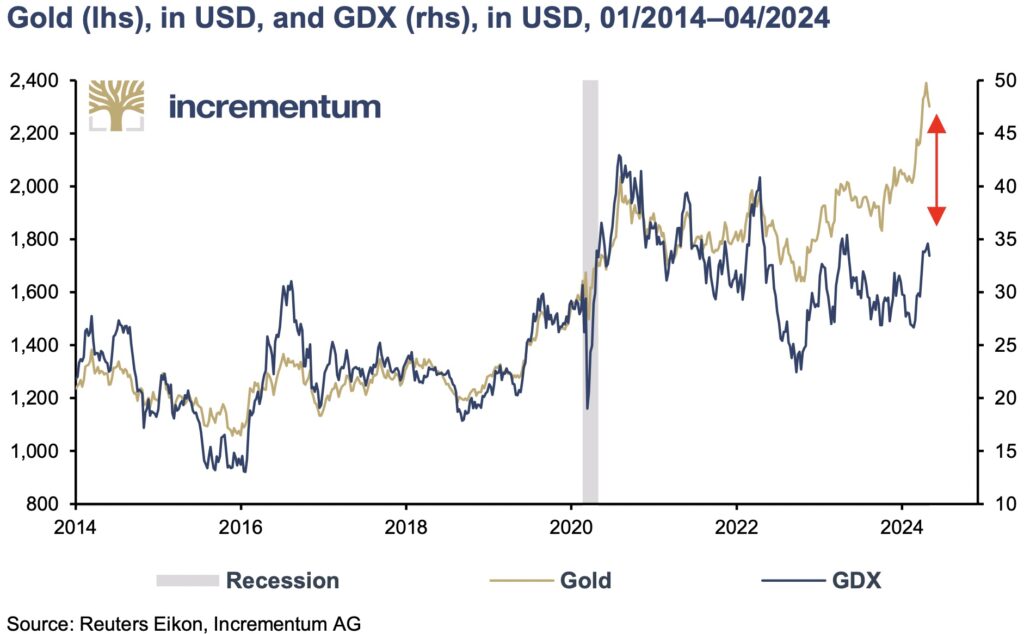

May 28 (King World News) – Roni Stoferle at Incrementum: The performance of gold and silver mining shares has been disappointing for most investors in recent years. The divergence between the development of the gold price and gold mining shares has been truly remarkable. As the next chart shows, the shares of gold mining companies have performed significantly worse than gold.

Mining Stocks GDX (BLACK LINE) Coiled To Massively Outperform Gold GOLD LINE)

The main reasons for this were the sharp rise in costs (AISC) in 2022 and 2023 and the general lack of interest from Western financial investors. The divergence between gold and mining share performance can also be explained by the fact that investors in Asia do not usually invest in mining companies. They prefer to hold physical gold and silver. Western financial investors, on the other hand, have cut their allocations to mining stocks in line with their reductions in gold ETF holdings.

Within the equity spectrum, other topics such as AI have recently stolen the show from gold miners. Nevertheless, there is no doubt that mining stocks are under- valued on a fundamental level. In recent months, this undervaluation has attracted the attention of well-known investors who are famous for contrarian investments. Stanley Druckenmiller sold technology stocks in Q4/2023, including Alphabet and Amazon, and invested in Newmont and Barrick. Shortly thereafter, the Financial Times reported that Elliott Management, led by Paul Singer, is launching a fund called Hyperion to invest in precious and base metals, led by the former CEO of Newcrest Mining…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

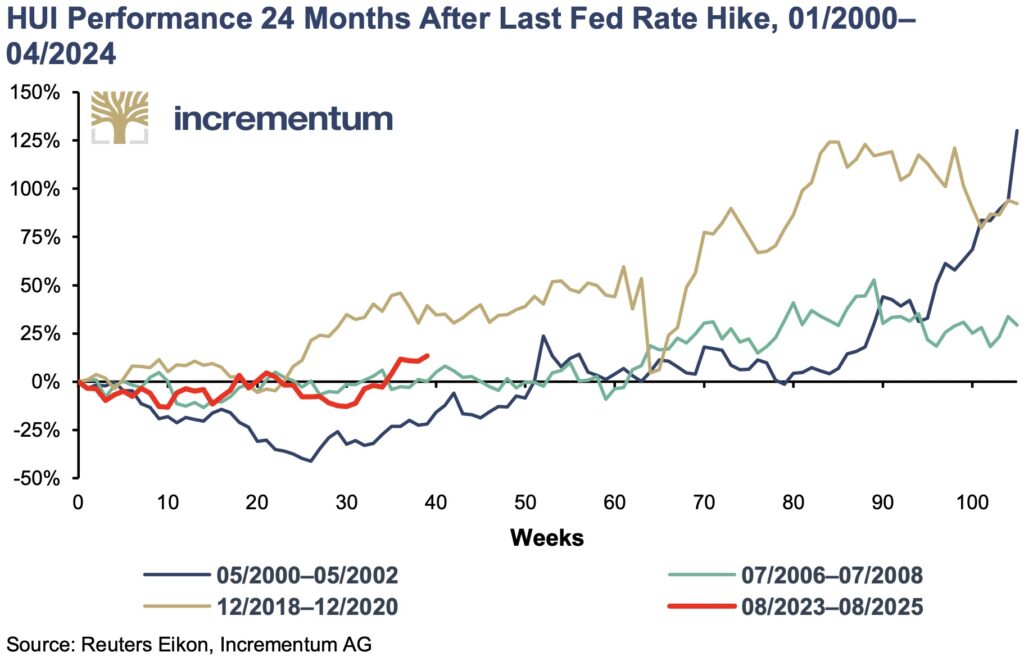

The gold mining sector is unique in many respects. While fundamental bottom-up research is essential for careful stock selection and sensible diversification, macro-specific top-down influences play a particularly important role. As far as sensitivity to monetary policy is concerned, a look at the past shows that investment times around the last interest rate hike have usually been excellent entry points.

HUI Gold Mining Index Soared After Last Fed Rate Hike (GOLD LINE, BLACK LINE, GREEN LINE)

HUI (RED LINE) Preparing To Soar Once Again!

Due to the historical undervaluation of the mining sector, in mid-February 2024 we launched a top-down-driven investment strategy in line with these top-down influences and other ideas of the new gold playbook. The Incrementum Active Aurum Signal presented in this In Gold We Trust report plays a central role in the investment strategy. Further information on the strategy can be found at www.incrementum.li.

King World News note: The HUI Gold Mining Index is at one of the most undervalued levels in history. Gold mining stocks will radically outperform in the future. And yes, investors that invest in high-quality mining stocks will make a fortune in phase III of the gold bull market.

Ultra-Wealthy Moving Into Physical Gold

To listen to Egon von Greyerz discuss the ultra-wealthy moving into gold and how that will impact the gold market CLICK HERE OR ON THE IMAGE BELOW.

Silver Shorts Are Desperate And Trapped

To listen to Alasdair Macleod discuss the silver shorts being trapped and what to expect from gold and silver in the coming weeks CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.