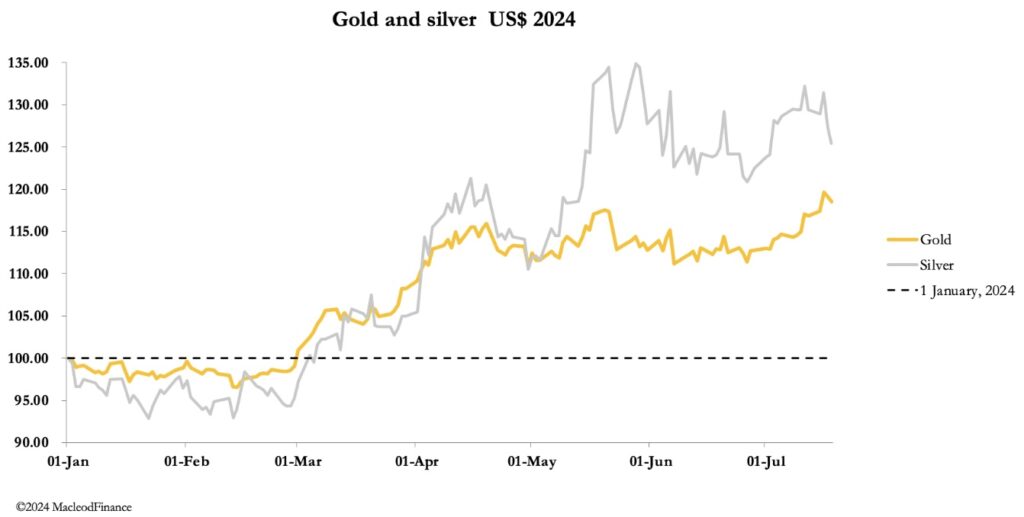

This week saw some wild trading in the gold and silver markets. Take a look…

King World News has now released a second audio interview (linked below)! But first…

July 19 (King World News) – Alasdair Macleod: This week saw profit-taking in gold and silver, no doubt encouraged by bullion banks whose short positions doubtless became extremely uncomfortable.

After a strong start to the week, profit-taking set in, driving gold $60 below its Wednesday intraday high, and silver $2.50 below its high point on the previous Thursday. In early morning European trading gold was $2418, up $7 net from last Friday, while silver was down $1.50 on the same timescale at $29.30.

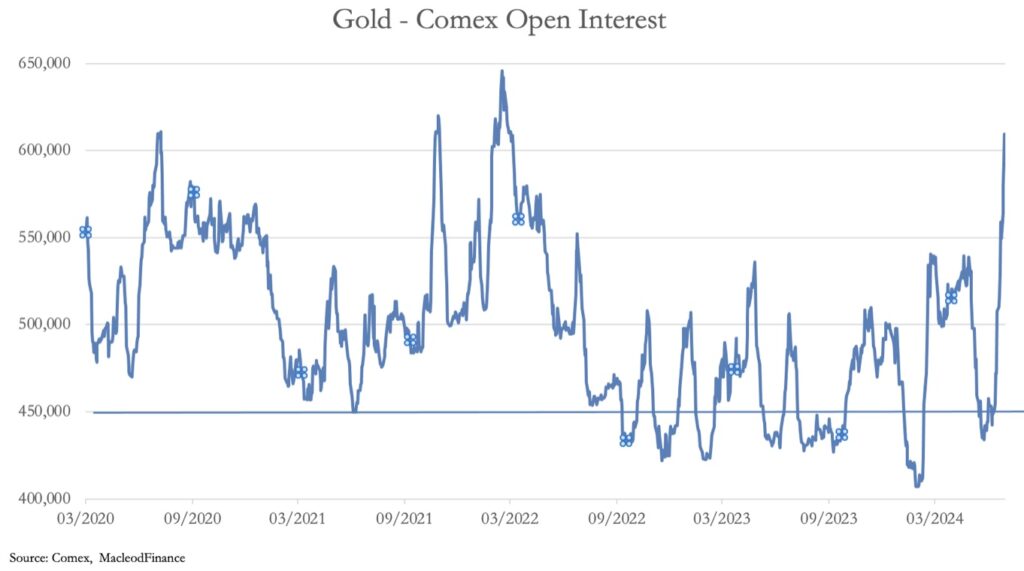

Gold, rather than silver, had become rapidly overbought, doubtless due to speculators joining the game late. This is reflected in Open Interest on Comex:

CAUTION: Open Interest In The Gold Market Has Exploded Higher

It has soared in the last fortnight. Interestingly, despite yesterday being a down day, on preliminary estimates, Open Interest rose by 17,110 contracts when it would have been expected to fall as open long positions were liquidated. One can only conclude that the bullion banks took out additional bear positions to deliberately trigger hedge fund stops.

The problem for bullion banks is that they are being cleaned out of physical by China’s continuing demand. Their principal hope is that gamblers on the Shanghai Futures Exchange can be frightened out of their positions. And overnight, there is some evidence that it might have worked because gold and silver prices continued to decline during Shanghai’s trading session ahead of the weekend.

While goldbugs complain about these shenanigans, they are a fact of life, temporarily overriding more weighty considerations. It is important not to be caught up in these games, because most likely they will be costly. Instead, it is better to put them in the context of the underlying trend. The next two technical charts are of gold and silver respectively.

Gold has found support at the 55-day moving average, and silver is consolidating similarly. This is perfectly normal, and while there is no guarantee that prices might dip further, technically, this is a bullish setup.

What technical analysis can’t tell us are fundamental factors, and it is here that we must use our judgement. This is why it is vital to understand the relationship between precious metals and credit, which is the lifeblood of modern economies. Doubtless, after five decades of dismissing gold as the ultimate form of money, the bullion banks simply regard gold as a trading counter, hoarded by those old fashioned enough to still believe in it. It gives them a trading counter suited to market manipulation as the hopes and fears of gold bugs are exploited.

There is, however, a contradiction in all this. The LBMA is pushing the Bank for International Settlements to define gold as a high-quality liquid asset. The BIS is not buying the LBMA’s story because its argument is based on a collateral status central to forward transactions. The BIS appears to concede that gold in possession is an HQLA. The dispute centres on its abuse in paper markets.

But if the bullion banking community stopped trying to pursue its short-term pecuniary interests and considered the consequences of their lobbying, they would realise that they are lobbying for the reintroduction gold as a central pillar of the western monetary system, which heightens the distinction with credit. They better start praying that the trend for central banks to dump dollars and euros for physical gold is not reinforced by a change in the BIS’s definition!

Just Released!

Gerald Celente’s King World News audio interview has just been released discussing the gold market and much more and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

Also Just Released!

To listen to Alasdair Macleod discuss the wild trading in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.