We are seeing a short squeeze in the gold market despite the US Dollar Index continuing to surge as the index hit 108 at one point during today’s trading.

November 22 (King World News) – Alasdair Macleod: A bear squeeze in progress for gold is set to drive prices higher. A catch up could prove explosive for silver, which is being left behind.

Gold and silver diverged this week, with gold rallying strongly following the previous week’s fall. Silver’s recovery was more hesitant. In Asian trading overnight, gold was $2670, up $108 from the previous Friday’s close, and silver $30.80, up 58 cents on the same timescale. Turnover in both futures contracts on Comex was good, but not spectacular.

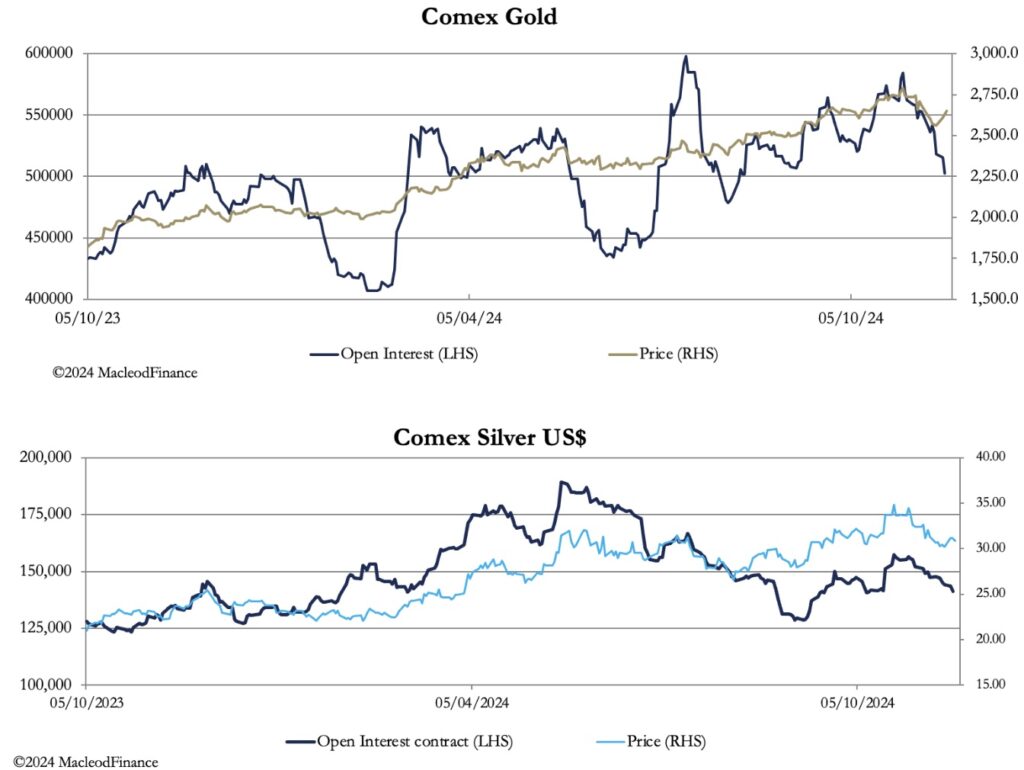

The charts below show how Open Interest and price have evolved on both contracts.

The lower chart shows how the silver price has declined along with Open Interest (OI) since late-October. This is what one expects: as the price declines, the bulls sell down their longs, so OI declines.

Now look at the upper chart of gold. Open interest has contacted sharply, yet the price has risen. Between 14—20 November, OI fell by over 34,000 contracts, yet gold rose from $2564 to $2670 currently. Virtually all the fall in OI has been in December contracts not being rolled over into later maturities.

How can this happen, and what does it mean? There can only be one answer, and that is the Swaps are reducing their positions and refusing to create new contracts to supply buyers. Consequently, short-term traders opening new longs have had to bid up for existing contracts to obtain their longs, bidding against the Swaps and other shorts closing their positions. In other words, the squeeze is firmly on the shorts.

This is good news for the bulls, because the balance of probability is that bear squeeze conditions will continue into next week, driving gold higher still. Furthermore, with the war in Ukraine being escalated by NATO members providing cruise missiles and guidance systems so as to attack targets well inside Russia, gold may be appearing to be a safer haven for those already long of dollars.

But more importantly for traders, overnight demand from Asia seems to have reemerged, which appears to be in the driving seat for now. That being the case, there is a good chance that the pullback in gold is over. However, with a gold/silver ratio of 87 it does seem to have left silver behind.

According to Metal Focus, a London-based analyst specialising in precious metals and very much “in” with the bullion establishment,

“For the fourth year in a row, the silver market is expected to see a sizeable deficit in 2024. Solid growth in industrial demand remains the key driver, and relatively steady supply also plays a part. These were some of the key findings that were delivered by Philip Newman and Sarah Tomlinson during last week’s presentation in New York, at the Silver Institute’s Silver Interim dinner.”

One wonders how long this can go on. These deficits have been covered by declining investment demand, and certainly silver’s disappointing performance in recent years points to a market which has been dominated by stale bulls. But that’s now changing and rising demand for gold is bound to reverse investment outflows in silver. There will then be panic with silver as rare as hen’s teeth.

Finally, a look at gold’s technical chart:

It seems that gold has found support at the 55-day moving average, and the other factors mentioned in this report confirm that the correction of recent weeks may be over.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.