What is happening in the gold market is stunning.

Central Banks Are Quietly Buying Gold

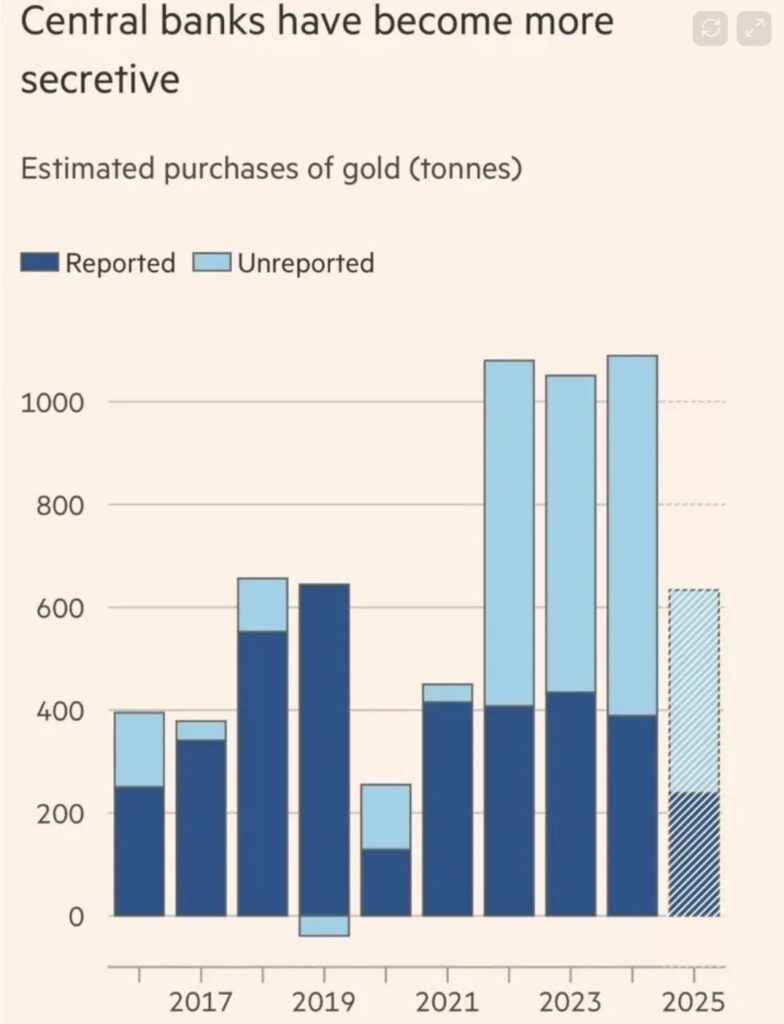

November 25 (King World News) – Jeroen Blokland: Officially, central banks are already purchasing record amounts of gold. But the unreported portion is even more impressive.

Behind the scenes, more and more countries are shifting their reserves away from currency risk and toward geopolitically neutral assets.

Some analysts have been signalling this shift for months: real gold demand is happening outside the spot market, outside the statistics, and outside the view of Western regulators.

The result? A gold market that is far tighter than the official numbers suggest.

Gold Returns 1,160 Percent in 25 Years

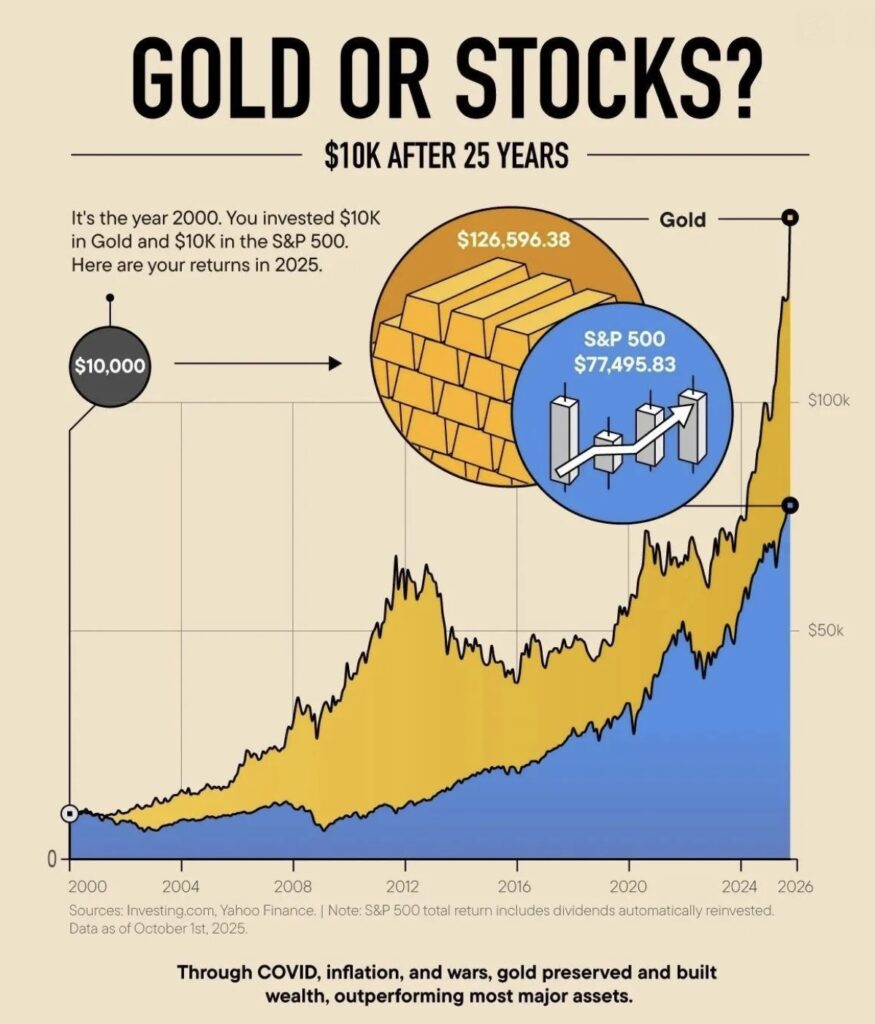

Gold can look back on one of the strongest years in decades. It has proven to be a store of value throughout history.

For equities, many still believe inflation suppresses stock prices. Yet there are two reasons to think equities do offer inflation protection.

The first is common but crucial. Companies with strong business models and pricing power can pass price increases on to customers. Not pleasant in the supermarket, but great if you’re a shareholder of that same supermarket.

Even after the extraordinary post-pandemic inflation spike, many companies successfully passed on higher costs, boosting revenues and profits.

The second reason is more recent and requires understanding today’s financial system: fiscal dominance.

In economies heavily reliant on debt, where demographic growth is slowing, as seen in China, for example, debt becomes the engine of economic growth.

To keep that system running, you need structurally low interest rates and higher inflation. That keeps debt affordable and reduces its real value.

So both assets, gold and equities, are valuable and generate returns. Consider the chart below, based on several financial sources.

What is $10,000 worth after 25 years? In the S&P 500, it grows to $77,495, pretty impressive. But in gold? The investment multiplies by 12.6×, a return of 1,160 percent.

Expect Major Surprises For The Rest Of 2025 & 2026

***To listen to Gerald Celente discuss what surprises to expect for 2025 & 2026 CLICK HERE OR ON THE IMAGE BELOW.

Something Very Strange Is Going On In The Gold Market

***To listen to Alasdair Macleod discuss the highly unusual events occurring in the gold market CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: Just What We Need: More Inflation & Cheap Money, Plus A Look At Oil And Gold Miners CLICK HERE.

ALSO JUST RELEASED: Another Bull Market Is About to Kickoff As Everybody Is Worried About The US Dollar CLICK HERE.

ALSO JUST RELEASED: Celente – Surprises To Expect For The Rest Of 2025 & 2026 CLICK HERE.

ALSO JUST RELEASED: Macleod – There Is Something Very Odd Going On In The Gold Market CLICK HERE.

ALSO JUST RELEASED: There Is Something Highly Unusual Occurring In The Gold Market CLICK HERE.

ALSO JUST RELEASED: Harvey Organ Explains The Massive Fraud In The Gold Market CLICK HERE.

ALSO JUST RELEASED: John Ing – Gold’s New Trading Range Ahead of The Move To $5,000 CLICK HERE.

ALSO JUST RELEASED: Silver Just Saw Another Historic Upside Breakout, Plus A Stunning Gold Chart! CLICK HERE.

ALSO JUST RELEASED: UK Regulator’s Admission Of 41% Inflation And Systemic Fear Of Bank Runs CLICK HERE.

ALSO JUST RELEASED: Crisis, Crash, Control The US CLICK HERE.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.