While the price of gold recently hit an all-time high of $2,200, what is happening in the gold market is shocking.

March 17 (King World News) – James Turk: There is an interesting development with the gold ETFs, Eric, and it has a lot of precious metal owners puzzled.

While gold has soared to record highs, the weight of metal recorded in ETFs has been declining worldwide. It’s a contradiction to many who would have expected the opposite to occur.

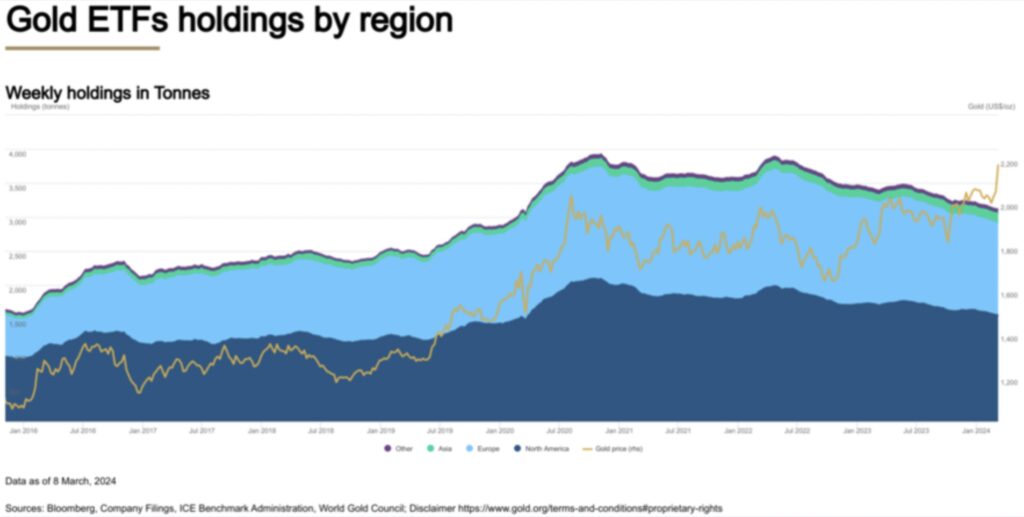

This phenomenon is shown in the following long-term chart of the gold price and the total holdings of the several gold ETFs offered around the globe.

The weight of gold recorded by ETFS worldwide reached a peak of 3930 tonnes in November 2020. In April 2022 it was 3900 tonnes, with gold still below $2000.

The weight of metal then began to decline to about 3120 tonnes at present. This 810 tonne (26 million ounce) decline translates into a drop of about $56 billion in gold ETF assets. But the last 18 months is what has so many puzzled.

The ETFs recorded 3500 tonnes in October 2022 when gold ‘s bullish uptrend corrected to a low of $1625. Since then gold has hit new record highs and is $525 per ounce (+32%) higher, while the ETFs have lost a further 380 tonnes (-11%).

Since the first gold ETF was launched in 2004, conventional wisdom has been that gold would fall in price as the ETF assets declined, or rise as the size of these ETFs grew. This widespread view was based on the belief that buying shares of the ETF would result in the ETF buying gold because they are supposedly backed by physical gold sitting in a vault.

The Great Bankster Gold Con

While that may be true for some ETFs, the reality for some is very different. A careful reading of the prospectus of the large gold ETFs like GLD tells a different story, which is a point I have been making many times since the gold ETFs were first launched.

Most of these ETFs have been designed to track the gold price, so that buyers of the ETF shares would profit or lose if the gold price went up or down. The GLD prospectus says its investment objective “is for the Shares to reflect the performance of the price of gold.” That is their purpose; it is not to own gold in a vault. It’s only the mainstream media that says that these ETFs are backed by physical gold.

An ETF may own some gold, or may not. But even if they do own it, it may be loaned out.

For example, the audited 10-K balance sheet that GLD files with the SEC reports that it owns “Investments in Gold”. It does not say that it owns gold, a tangible asset. An “Investment in Gold” is a loose term. A gold loan owed to GLD by a bank could be deemed as an investment. It’s paper, not physical metal in the vault. And keep in mind that it is the big bullion banks that are the managers of many of these ETFs, which highlights potential conflicts of interest.

There are so many loopholes in the prospectus of some of the gold ETFs, it has been my contention that they are used by central banks and their bullion bank agents to control the gold price. Their aim is to make fiat currency look better than it deserves by killing the canary in the coal mine, which is the role of an unfettered gold market.

Central Bank Slight Of Hand

Consequently, it has been my expectation that eventually when the nominal weight of metal in ETFs began to decline, gold would rise. So I am not surprised by what has been happening with the gold ETFs, and here’s why. With overvalued stock prices and a banking system being propped up by central bank sleight-of-hand, people are seeking safety for their wealth.

They recognise the difference between owning physical metal in contrast to just having exposure to the gold price. With physical metal you do not have counterparty risk. You own wealth outside the banking and currency system. It’s a goal more people are achieving, which is why the gold price is rising and also why ETFs have seen more sellers than buyers since 2022.

I expect this 2-year trend to continue. The collapse of Silicon Valley Bank was a wake-up call for many. To protect their wealth they have opted to own physical metal, not ETF shares.

The resulting global demand for physical metal is driving gold to new highs. And, Eric, I expect silver to catch-up by making new record highs too as the gold/silver ratio falls from its current heights.

Alasdair Macleod’s latest audio interview discussing the short squeeze in the silver market has just been released CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.