What is happening right now is catching nearly everyone around the world totally off guard. Take a look at what is happening because we haven’t seen this since 1998.

What were you doing in 1998?

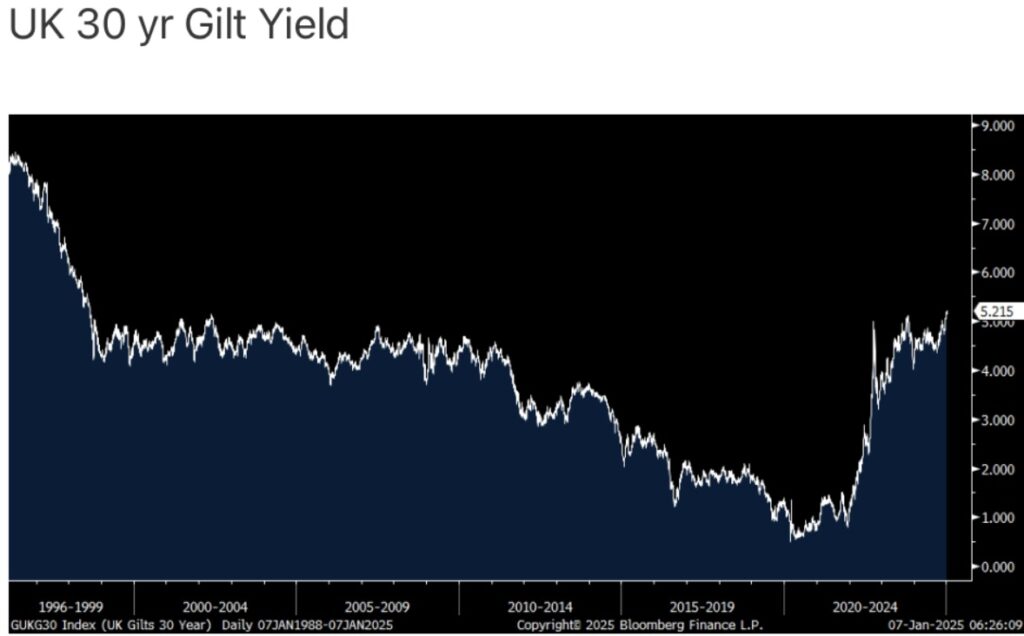

January 7 (King World News) – Peter Boockvar: I mentioned yesterday that the Japanese 5 yr JGB yield rose to the highest since 2009 and the 10 yr yield went to a near 14 yr high. Today, the 30 yr UK gilt yield rose by 3.6 bps to 5.22%, a level last seen in 1998.

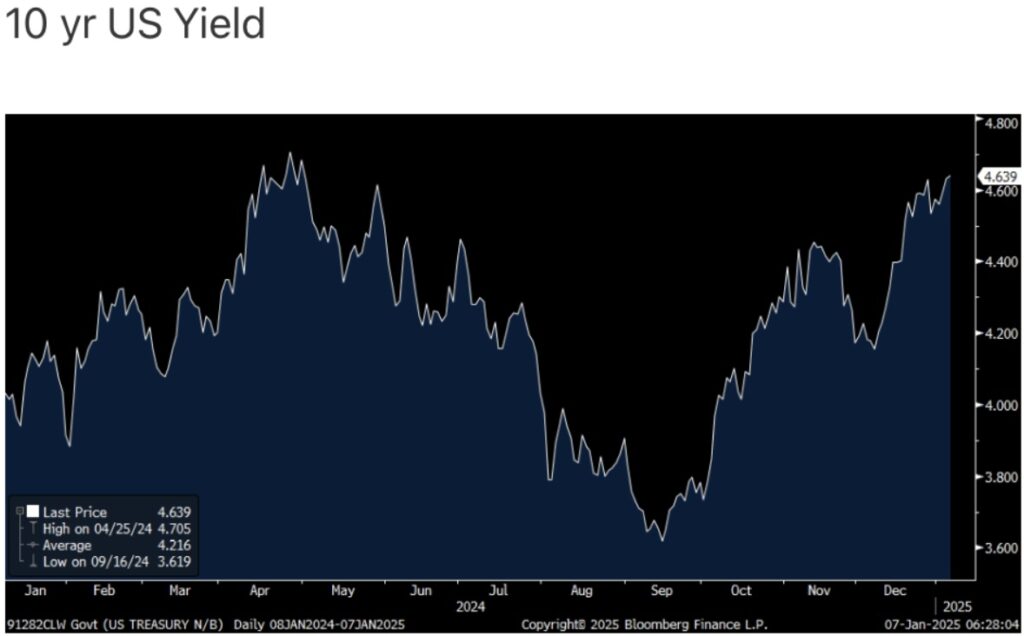

Yes, 1998. Yields elsewhere are rising too and the 10 yr US yield is now at 4.64%, the highest since last May. I remain bearish on duration and at some point if this yield rise continues, it’s going to matter for a variety of valuations in other things like highly valued equities and credit spreads. Higher for longer interest rates is real and what is most interesting is that it is happening just as many central banks are cutting short-term rates as we know.

The December Eurozone CPI rose from November but as expected. The headline rise was 2.4% y/o/y, up two tenths from the 2.2% seen in November. The core rate was higher by 2.7% y/o/y, no change with the prior month. Services inflation remains their issue as it was up 4% y/o/y vs 3.9% in November and 4% in October. With the ECB continuing to cut rates to 3% that is barely above the rate of inflation, it’s clear they are more focused on economic growth rather than solely on its inflation only mandate.

Turk Just Warned Financial Crisis Set To Erupt In Early 2025!

To listen to what this financial crisis that is set to erupt in 2025 will look like and how you can safely navigate your way through the coming global shockwaves CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.