The price of gold is hitting new price records in all global fiat currencies, but take a look at silver.

Gold Hitting New Record Highs In All Global Currencies

April 3 (King World News) – James Turk: We are finally seeing real momentum building in the precious metals, Eric. Given both the fundamental backdrop as well as the positive technical outlook from strong chart patterns, we can expect this momentum to continue.

Gold has been making new record highs against all the world’s currencies. It’s just like what happened in gold’s great bull market in the 1970s, and it’s happening for the same reason that it happened back then – people are losing confidence in national currencies, and for good reason.

Government spending in many countries is out of control, causing huge budget deficits. Central banks make these budget deficits possible by working with the banking system to conjure up the fiat currency the governments are spending, which debases the currency’s purchasing power. Rising prices are the result.

Consequently, to seek safety, purchasing power is moving out of paper promises and into things. It’s no surprise that commodity prices are rising across the board. Look for example, at crude oil, which is back at $85 and causing gasoline prices to relentlessly creep higher…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Silver Waking Preparing To Blastoff

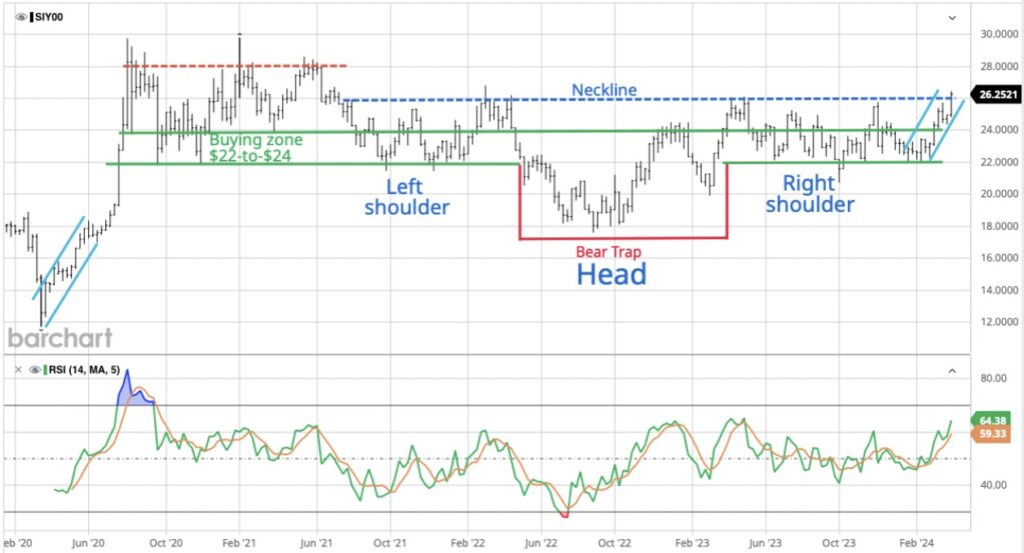

And look at what just happened with silver, probably the most undervalued commodity. It broke above resistance at $26, reaching its highest price in two years, as we can see on this long-term chart that will be familiar to KWN readers.

Massive Reverse Head & Shoulder Pattern On Silver

Initial Price Target $30

The question I’m now asking myself is how much further do the precious metals have to run?

To answer this for silver and to open up our minds about possibilities, look at the two blue uptrend channels I have added to the chart. Let’s see if history repeats and silver follows the same pattern it did when breaking out of the uptrend channel in 2020.

We cannot, of course, predict the future. All we can do is move out of overvalued assets, and move that wealth into undervalued assets, like the precious metals.

The last time we spoke, I used my Fear Index to explain why gold is undervalued. It’s long-term chart indicates gold’s upside potential.

But silver is undervalued even when viewed in terms of gold. It’s looking increasingly likely that the gold/silver ratio peaked in the low 90s. It’s now under 87, and I expect 80 in the near-term, say, within a month or two.

So just to give some price targets to aim for, if gold manages to climb to $2400, which looks reasonable given the momentum to acquire physical metal, then a ratio of 80 would mean $30 silver.

By the way, Eric, I find it very interesting that bitcoin has for now at least stopped climbing, while both gold and silver are moving higher. It’s reversing a longstanding pattern – the precious metals are now outperforming bitcoin.

JUST RELEASED!

Michael Oliver on gold hitting all-time highs and why silver is set to explode higher along with the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss gold hitting new highs and what surprises are in store for next week CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.