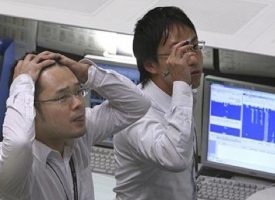

On the heels of the Nasdaq hitting all-time highs and crude oil and gold moving higher, this is why things can change in a hurry in global markets.

Momentum: Gaining or Waning?

By Bill Fleckenstein President Of Fleckenstein Capital

August 29 (King World News) – Once again, the market was fairly strong through midday, led by the Nasdaq, which gained 0.5%, with the Dow and the S&P lagging. In the afternoon, the Nasdaq added to its earlier gains to finish the day 1% higher (the FAANG was quite strong), while the S&P added about 0.5%.

Away from stocks, green paper was sort of flattish, as was fixed income, oil gained 1.5%, and the metals were a bit higher.

Not Just a Technicality

Given that there is not much to discuss regarding the current action, I thought it would be worth bringing to readers’ attention a technical problem lurking below the surface that I’m sure many are not aware of…

IMPORTANT:

KWN receives so many emails from its global readers and listeners about which high-quality mining companies they should invest in, and as a result we have added another remarkable company to the list. This is one of the greatest gold opportunities in U.S. history and you can take a look at this remarkable company and listen to the just-released fantastic interview with the man who runs it by CLICKING HERE OR BELOW

I can’t explain exactly why or how, but I have felt for some time that a lot of the mechanical/algorithmic trading strategies have more to do with momentum than they do with fundamentals. And I feel that the positive market action has fed on itself, creating the environment we are in today. I don’t know if my thesis is correct or not, but until I can decide one way or another I am going to believe that momentum has been a critical variable in keeping the party going.

In the past I have discussed Momentum Structural Analysis (MSA), a technical analysis service that monitors momentum, and yesterday, Mike Oliver, who runs MSA, sent out a research report pointing out that even though we have seen new highs, momentum has been waning. Thus, if we were to see any sort of selloff, the market is much more pregnant from a momentum standpoint now than it was last February.

He Makes Some Good (Breaking) Points

I would like to share one quote that he made so that readers are aware that, despite the fact that it looks like nothing can change, in reality it would not take much to disrupt things quite dramatically:

“The main point to be made is that the breakage levels of intermediate trend momentum are very near. And when the intermediate trend is broken (let’s assume in September — though MSA will wait for the numbers to be triggered), then the long-term breakage numbers are only about 3.5% below the market, and those adjust upward weekly. Very much unlike the February situation when the long-term momentum breakage numbers were 12% below the peak price and 9.2% below the point of the intermediate momentum sell signal. Proximity is the issue. Intermediate and long-term momentum trend trip wires are now very close together.”

We Have a Description of the Suspect

In other words, all it would really take for that to occur would be if we traded down to around 2,850 in the S&P. That would set off the first alarm bells. That said, there is no point getting too much into the gory details yet, because that will be easier to discuss and more useful should we get a bit of exhaustion that actually causes the market to sink. At that point we will be better able to strategize about the possible trading opportunities.

Hopefully, this will be a useful variable for folks to consider prospectively.

ALSO JUST RELEASED: Rick Rule – We Are Now At The End Of Panic Selling In Gold, Silver And The Shares CLICK HERE TO READ.

***To subscribe to Bill Fleckenstein’s fascinating Daily Thoughts CLICK HERE.

© 2018 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.