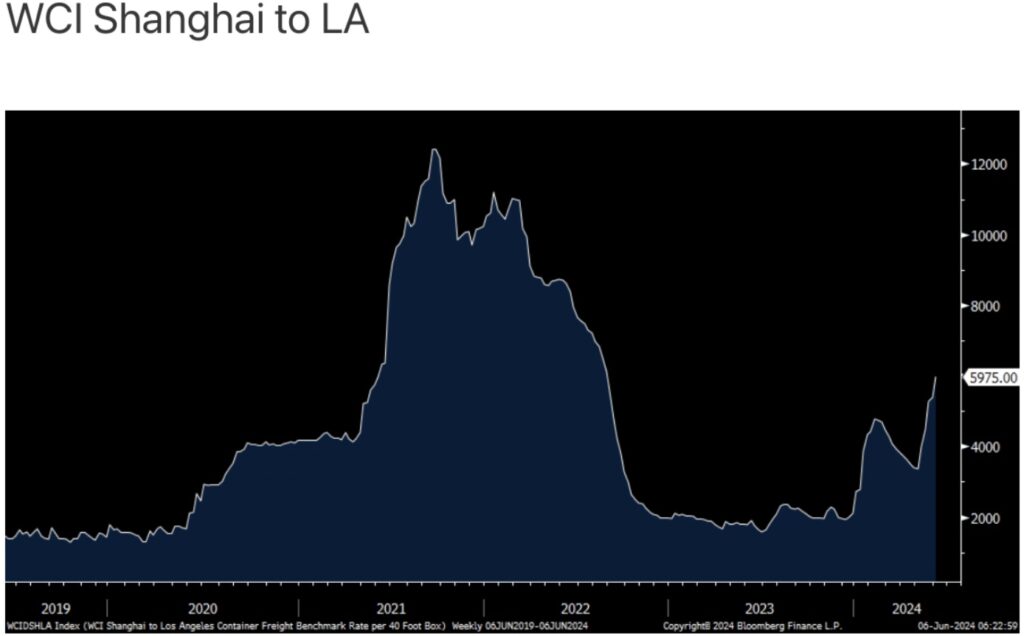

This is what a speculative mania looks like. But first, look at what is happening with shipping rates…

Inflation: No Problem As Long As You Don’t Have To Ship Anything Overseas

June 6 (King World News) – Peter Boockvar: World container prices continue to spike higher and the problem is not just the lengthier trips but also the lack of containers in China as empty ones don’t come back to them as fast as they did. The Shanghai to Rotterdam trip was up 15% w/o/w to $6,032, higher by $762 on the week. It’s doubled since late April and is up from $1,667 at year end. That’s also triple where it was in February 2020, though still well below the panic peak in 2021 of $14,807.

More “Transitory” Inflation?

The Shanghai to LA trip was higher by 11% w/o/w to $5,975.

A Little More “Transitory” Inflation?

While I see certain inflation pressures are definitely receding, others are not and reiterate my belief we are in a new world of greater inflation volatility and the days of consistent 1-2% inflation are over for a while.

By the way, this was the wording on inflation from the S&P Global services US PMI seen yesterday. “Despite lower employment, wage pressures remained a key factor pushing up input costs, which increased sharply again in May and promoted a faster increase in selling prices, providing further evidence that inflation remains sticky.”…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

With the S&P 500 and NASDAQ closing at fresh highs, though the Russell continues to badly lag, let’s do a stock market sentiment check. The Citi Panic/Euphoria index seen on Saturday remained in Euphoria land, though a touch less so vs the previous week.

The Bull/Bear spread in the Investors Intelligence survey dipped slightly below the extreme read of 40 as Bulls fell .6 pts to 57.6 and Bears were up .3 pts to 18.2 (this was as of Friday). AAII saw no change in Bulls at 39 while Bears rose by 5.3 pts to 32 (this was as of Monday). The CNN Fear/Greed is in the Neutral camp at 45.

Bottom line, putting aside still squishy breadth, with the headline indices the bulls certainly continue to be right as AI excitement from and front running the hopes for rate cuts power us higher. With Nvidia, just looking at the chart and another parabola is being formed fyi.

MADNESS OF THE CROWDS:

This Is What A Speculative Mania Looks Like

… the ECB … cut 25 bps today and we’ll see what talking points Christine Lagarde uses, encouraged by the Germans, that the pace of rate cuts will be gradual and another one won’t necessarily be followed up in July. With regards to the Bank of Canada’s expected move yesterday, the simple reason they gave was “With continued evidence that underlying inflation is easing…” Pointing also to a gradual, uneven likely pace of rate cuts, “Nonetheless, risks to the inflation outlook remain.” QT continues on as “The Bank is continuing its policy of balance sheet normalization,” a slight tweak in wording from the prior meeting statement.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.