With bonds tumbling recently and stocks surging along with the US dollar, while gold and silver remain volatile, this is a big deal in the context of the biggest financial bubble ever blown.

Desperate In Japan

November 12 (King World News) – Peter Boockvar: “I’ll emphasize again the profound change possibly happening in bond yields overseas and what that can mean for US yields. The Japanese 10 yr JGB yield jumped another 4.3 bps to just a hair below zero at -.02%. This is the least negative since mid April and is now really jumping. In response, the Topix bank stock index is at the highest since April. Last week there was a soft 10 yr auction and today was a messy 30 yr auction. I’ll repeat, for the first time in more than 20 years of BOJ easing, they are telling everyone that they want higher long term interest rates in order to breath some life into their banks. This is a big deal in the context of the biggest financial bubble ever blown. Sorry for the hyperbole. Yields are up slightly in Europe and the US 10 yr is at 1.94-.95%.

The October NFIB small business optimism index improved by .6 pts m/o/m to 102.4 after falling in the two prior months by a total of 2.9 pts. For perspective, this number has averaged 102.9 year to date and the peak in the expansion was 108.8 in August 2018 just as the tariff fight was about to intensify. After falling by 3 pts in September, Plans to Hire rose by 1 pt but finding the needed help is still the big challenge. With this, current Compensation Plans rose by 1 pt while future Comp Plans jumped by 4 pts to the highest since May…

ALERT:

Mining legend Ross Beaty (Chairman Pan American Silver) is investing in a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Those planning an Increase in Capital Spending was up by 2 pts to 29% after dropping by 1 last month. That is the most since it printed 30 in May and there was also an increase in those expecting to increase inventory. Those that Expect Higher Sales, Expect a Better Economy and said it’s a Good Time to Expand all were up by 1 pt after declining in the month prior. With respect to inflation, those that want Higher Selling Prices rose 2 pts but after declining 3 pts in September. Finally and seen in Q3 corporate earnings season, earnings are declining. The Positive Earnings Trends component fell 5 pts to the lowest level since February.

Bottom line, the NFIB President is optimistic, “Small business owners are continuing to create jobs, raise wages, and grow their businesses, thanks to tax cuts and deregulation, and nothing is stopping them except for finding qualified workers.” With respect to this last point, “Firms are likely to continue to offer improved compensation to attract and retain qualified workers because the only solution in the short term to an employee shortage is to raise compensation to attract new workers and to train less qualified employees.” On that earnings stat above, labor costs are the biggest driver of corporate profit margins.

On the impact of tariffs, “30% of small firms reported negative effects from trade policy“ and “Making major commitments about production and distribution will be more difficult until import and export prices are stabilized with trade agreements.” My bottom line, small business confidence is still hanging in there but has certainly moderated. Either way, the number is not market moving.

Lowest Since The 1970s In The UK

In the UK for the 3 months ended September, 58k jobs were lost after a drop of 56k in the prior month but not as bad as the forecast of a decline of 102k. The unemployment rate did tick down by one tenth to 3.8% which is still near the lowest since the 1970’s. Earnings growth was still good ex bonus’ but slowed to a 3.6% y/o/y increase from 3.8% in the prior month. Of note and pointing to more jobs weakness, jobless claims in October rose to 33k, the most since March 2017. Of course the Brexit uncertainty has its fingerprints all over this data so until this is resolved most likely in early 2020, the economic visibility will still remain cloudy. In response the pound is down slightly while gilt yields are little changed. The FTSE 250 is flat and includes mostly domestic UK stocks.

Germany Hoping For A Bottom

Investors in Germany in November are hopeful (‘hope’ is the key word here) that a China trade truce and Brexit deal will lead to a bottom in their economy. The ZEW index improved to -2.1 from -22.8 and that was better than the estimate of -13. Current Conditions though were little changed at -24.7 vs -25.3 in October. The estimate was -22.3. The ZEW said “There is growing hope that the international economic policy environment will improve in the near future..In the meantime, the chances for a agreement between Great Britain and the EU and thus for a regulated withdrawal of Great Britain have noticeably increased. Punitive tariffs on car imports from the EU to the US are also less likely than the projections a few weeks ago. An agreement in the trade conflict between the US and China is appearing more likely too.” The DAX is rallying but the euro and bund yields are little changed. The IFO is more relevant for markets as it surveys actual businesses.

***KWN has released the powerful audio interview with Alasdair Macleod and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

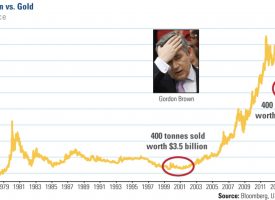

Big Picture For Gold & Silver

READ THIS NEXT! The Big Picture For The Gold & Silver Markets CLICK HERE TO READ.

© 2019 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged