This caused all hell to break loose.

This Took On A Life Of Its Own

March 25 (King World News) – Peter Boockvar: By now I’m sure you’ve heard about the concept of the “Mar-a-Lago Accord,” a reworking of the financial system with the US dollar at the center of it. Well, the whole idea came from a paper that the current Chair of the White House Council of Economic Advisors, Stephen Miran, wrote last November and with the help of Zoltan Pozsar. The paper was titled “A User’s Guide to Restructuring the Global Trading System.”

In Miran’s mind, “The root of the economic imbalances lies in persistent dollar overvaluation that prevents the balancing of international trade, and this overvaluation is driven by inelastic demand for reserve assets. As global GDP grows, it becomes increasingly burdensome for the United States to finance the provision of reserve assets and the defense umbrella, as the manufacturing and tradeable sectors bear the brunt of the costs.”

Also in the paper, he advocates tariffs and the “possible implementation schemes” and how it will influence the dollar now (should go higher) and thereafter (will be an attempt to get it lower). He also gives his idea about strong arming foreign holders of US Treasuries to take 100 year bonds in return for the holdings they have and a defense security guarantee we will give them. And the concept of revaluing the 8,000 tons of gold that the US Treasury/Fed holds was also raised by Miran and even the possibility of selling some of it.

In the paper he said “As currency accords are typically named after resorts where they are negotiated, like Bretton Woods and Plaza, with some poetic license I’ll describe the potential agreement in the Trump Administration as others have done as the prospective “Mar-a-Lago Accord.”

As to what it would do, “Such a Mar-a-Lago Accord gives form to a 21st Century version of a multilateral currency agreement. President Trump will want foreigners to help pay for the security zone provided by the United States. A reduction in the value of the dollar helps create manufacturing jobs in America and reallocates aggregate demand from the rest of the world to the U.S. The term-out of reserve debt helps prevent financial market volatility and the economic damage that would ensue. Multiple goals are accomplished with one agreement.”

Miran in the paper made it a point to say “This essay is not policy advocacy…My analysis reflects only my own views, not those of anyone on President Trump’s team or Hudson Bay Capital” but when he took his new position we all assumed these policy steps were on the docket and all of this has created quite a stir (I first mentioned it last month after Jillian Tett talked about this in an FT article which came soon after I was with Zoltan Pozsar at a conference in which he laid out a lot of this) when it was first released but greater focus over the past few months as tariffs have taken center stage in terms of policy and we’ve seen big rallies and declines in the US dollar.

I bring this all up because as he said in the paper that this was “not policy advocacy” he repeated that in an interview with Bloomberg yesterday. In an answer to the question “Can you tell me how much of this is in the works?”

He said:

“So I’m glad you brought that up because this paper seems to have taken on a life of its own, against all my intents. Look, I’m pretty clear in that paper that it’s a catalog of available options and you know, it’s a recipe book and I’m trying to evaluate how useful or not useful or easy or difficult those various receipes are to make. Some of them are easy, some are tough, some are filling, satisfying meals and some will leave you hungry again in a half an hour.

And my goal in that paper was to provide an evaluation of options so that a cost benefit analysis of risks and rewards so that whoever was making the decision, sort of could have that available if helpful. To be clear, I’m not the chef, right? The President is the chef and he’s been very clear, very clear that he’s focused on fair and reciprocal tariffs. He couldn’t be clearer. And so anybody who’s anybody who’s thinking that something that I included in a catalog in November is the source of what the policy agenda is now, I think that’s wrong.”

So if the US dollar is theoretically supposed to rise with the implementation of tariffs but the ultimate goal is to have it drop thereafter, is this Accord going to happen Miran was asked?

He said:

“Could it be something that is entertained down the road? Sure it could, but right now the president is focused on tariffs.”

Here is a link to the original paper he wrote which many of you I’m sure have seen, https://www.hudsonbaycapital.com/documents/FG/hudsonbay/research/638199_A_Users_Guide_to_Restructuring_the_Global_Trading_System.pdf

Meanwhile In Europe

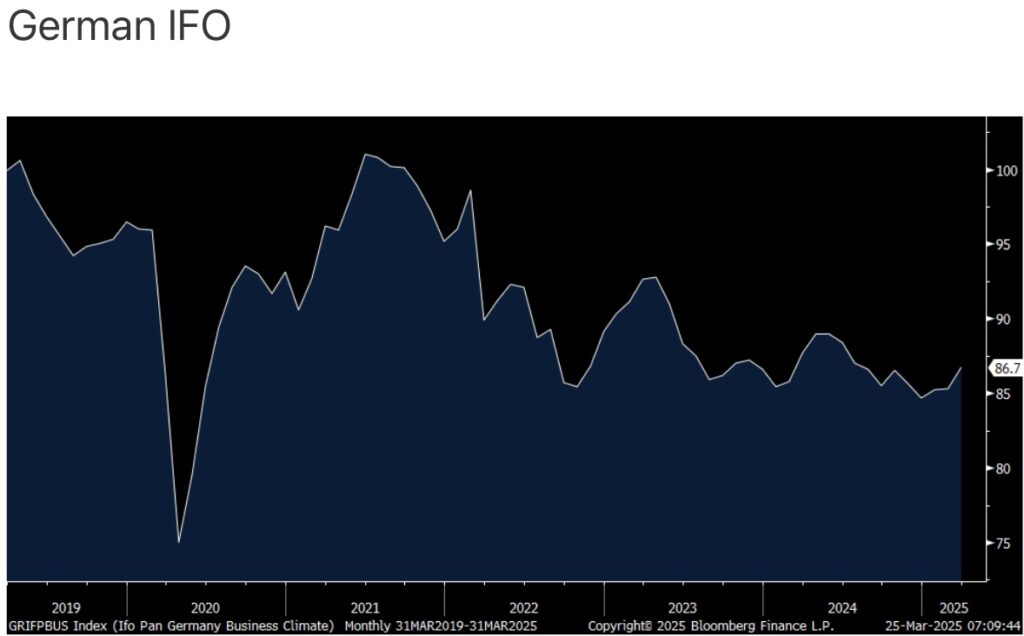

Economic confidence has risen in Germany with the new Chancellor and release of the ‘debt brake’. The March IFO business confidence index rose to 86.7 from 85.3 as expected but is now at the best level since July 2024, though still dancing along the bottom.

Most of the lift off the lows has come in the Expectations component as Current Conditions are still muted. The IFO said succinctly, “German businesses are hoping for a recovery.” Improvement in manufacturing confidence led the m/o/m increase with also a lift in services, trade and construction.

The euro is up, bund yields are lower and stocks in the DAX continue to rally. I think there is a growing chance that the ECB holds rate policy unchanged in April.

Global bond yields though are rising too as any dilution to the upcoming Trump tariffs would be well received economically speaking and why the US 10 yr yield is back to 4.35-.36% and the 2 yr yield is back above 4%.

BUCKLE UP: Expect Brutal Bear Market In US Stocks

To listen to Rob Arnott discuss what could be a brutal bear market in the US stock market as well as what to expect from stock markets around the world, and much more CLICK HERE OR ON THE IMAGE BELOW.

JUST RELEASED! Gold Closes The Week Above $3,000

To listen to Alasdair Macleod discuss the gold and silver markets and more CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.