The world is changing as gold becomes the most important global reserve currency.

Fed Decision

January 27 (King World News) – Charlie Bilello: Tomorrow’s News Today…

BREAKING: NO CHANGE.

THE FED HOLDS INTEREST RATES STEADY AT 3.50-3.75%.

POWELL CITES CONTINUED TARIFF UNCERTAINTY AND THE NEED TO SEE FURTHER DOWNWARD PROGRESS ON INFLATION BEFORE CUTTING AGAIN.

Game On

Tavi Costa: There it goes.

Brazil’s largest energy company is on the verge of a major breakout.

KING WORLD NEWS NOTE: Petrobras Is Going To Skyrocket On The Heels Of This Major Upside Breakout

If you don’t see the connection to the recent breakdown in the US dollar, I can’t help you.

Game on.

No Bubble In Precious Metals Stocks

Peter Schiff: Today’s action in precious metals mining stocks is more evidence that there’s no precious metals bubble. Despite record-high closes in GLD and SLV most gold stocks posted modest gains, and most silver stocks closed lower because the pullback from their highs scared investors…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

The World Is Changing

Peter Boockvar: The world is changing big time in front of our eyes, the direction of global trade flows is morphing and diversifying and investors need to have a global lens when investing in the coming 5-10 years as it’s not going to be just about the US, the S&P 500 and the Mag 7. At the same time, gold is now becoming the most important global reserve currency.

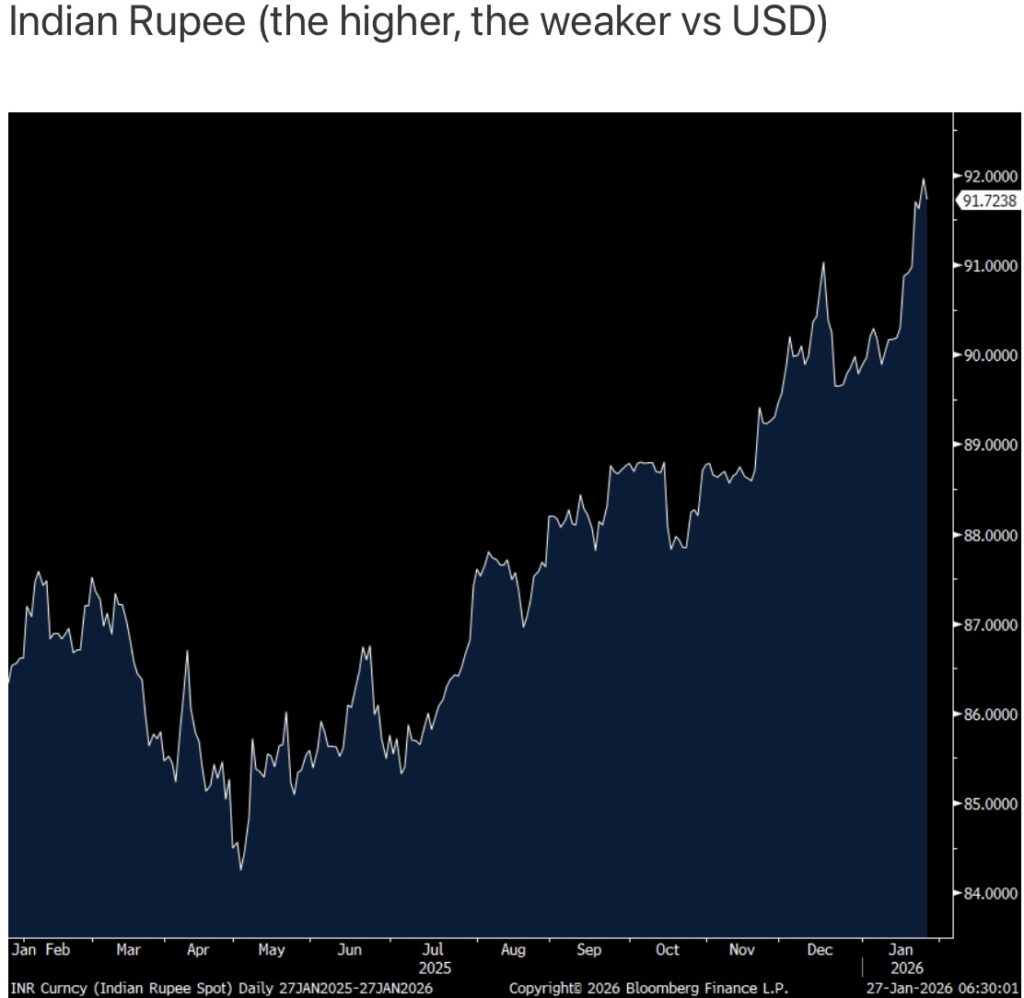

I wanted to quantify the last point and add some more. At the end of 2024 gold made up about 19% of global official reserves. It ended 2025 at 30%. The US dollar’s share is now down to 40% from 50% at the end of 2024. I expect this trend to continue, especially when we see more and more global trade take place in currencies that are not the US dollar. Take the announced deal today between the EU and India where tariffs will fall dramatically. More trade between the two regions will take place in euros and rupees and gold will be the settling currency with any surplus. The rupee has been very weak over the past year but is getting a lift on the deal and is a cheap currency. We are long along with Indian stocks.

The gold rally is not a safety trade, it is reflecting a tectonic shift in where global participants are most comfortable parking their money in preserving value. Also in terms of physically protecting it in light of the continued freeze on half of Russia’s central bank reserves. We remain long gold but acknowledging that at any moment it could be due for a rest after the extraordinary run.

ALSO JUST RELEASED!

The Amount Of Gold Needed To Buy A BMW Has Collapsed! CLICK HERE.

Buckle Up Because This Is About To Massively Rock Global Markets! CLICK HERE.

James Turk Predicts Silver Will Skyrocket Above Fair Value Of $300-$500 CLICK HERE.

Gold & Silver Record Highs! Look At What Just Hits A Level Not Seen Since 1972 CLICK HERE.

Gold Quote Of The Day! CLICK HERE.

What Could Go Wrong? CLICK HERE.

The US Is Now Headed For Total Collapse CLICK HERE.

GOLD & SILVER SOAR: This Time The Global Financial Crisis Will Be Much Worse CLICK HERE.

RECORD HIGHS! Silver Soars Nearly 8% As Gold Surges $134 CLICK HERE.

Michael Oliver – Gold & Silver Mining Stocks Coiled For Violent 355% Surge CLICK HERE.

Costa – Two Major Catalysts For Gold & Silver In 2026 CLICK HERE.

Nomi Prins Just Predicted A Jaw-Dropping $150-$180 CLICK HERE.

Michael Oliver – Gold & Silver Pause But Look At This Massive Upside Breakout CLICK HERE.

Silver’s Spectacular Rise Has Become Disorderly, But Silver Remains Radically Undervalued CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

Silver Will Skyrocket Above $300-$500!

To listen to James Turk’s predictions for the price of silver and gold as well as what to expect from mining stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2026 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.