With the Dow nearing 18,000 while gold and silver consolidate recent gains, here is the truth about D-Day and what is happening in the markets.

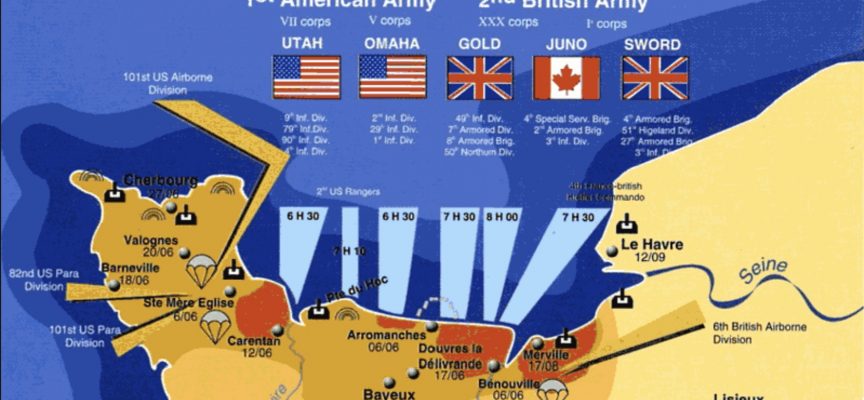

Art Cashin: This day in history is riddled with decisive battles that turned the tide of conflict. Just to stay in this century – The Battle of Belleau Wood in 1918; Admiral Yamamoto’s order to his 132 ship armada to withdraw from the Battle of Midway in 1942, and of course, in 1944, the arrival of John Wayne at the Invasion of Normandy. The latter monumental effort deserves review. On this day, one of the great sea-driven invasions in all of human history took place. The scale was awesome. The number of people and equipment deployed within the first 24 hours makes the pyramids of Egypt look like sand pails on a beach. It was one of the greatest pieces of logistical warfare ever known since time began.

Then there was the commitment of human sacrifice and bravery. A bunch of 19 and 20 year-old kids came to save folks they’d never met and whose language they could not speak.

Management (AKA the Generals) as usual had planned the wrong dance and the wrong music. Each of the soldiers about to be dumped into the roaring surf of Omaha Beach had been assured that the enemy would be devastated by air and sea bombardment. That must have been less reassuring as machine gun bullets pelted against the steel drop gate that would shortly deploy and allow you to walk many, many meters through the rough surf at low tide.

As you may know, if you have studied history or maybe just seen “Saving Private Ryan”, all did not go as planned. The bombing and naval barrage was each a bit off time and location. The result was nearly 97% casualty rate in the first wave. Luckily, the few survivors were street kids who opted not to die on the beach adhering to a bad plan. They did what street kids do – adapting to the key goal – survival.

Okay…..you say…..that was great but don’t blame management. Who could have guessed things might go that wrong? But maybe you never heard of Dieppe.

Back in 1942, the management…..er…..the generals in charge…..deployed a trial raid on the French coast. They sent some 6,000 men (almost all Canadian) in an amphibious landing at a place called Dieppe in mid-August.

They were accompanied by all the D-Day add-ons…..destroyers, LST’s, PT boats, and tank landers. Additionally, thousands of British fighters and bombers pounded the target beach area over 24 hours. All that planning and preparation resulted in a vicious and violent fire fight on the beach. In less than ten hours nearly two out of every three of all the Allied forces were killed. The few survivors and the naval flotilla headed back.

When they tell you that D-Day was a masterpiece of dedicated planning based on prior results, don’t scoff – they’ll think you are a smart alec street kid.

The payroll data could have used some D Day style planners or even a few street kids to avoid being so far off the market.

Different Assets Take Different Paths On Payroll Data – The disappointing payroll numbers and the markdowns in the prior months sent a shock through markets both here and in Europe.

The most pronounced move came in the currency markets with the dollar plunging, while the yen and euro soared. The next biggest reaction was in bonds where the yield on the short end of the curve (ten years and under) was falling sharply. There were spikes in some commodities, especially gold, as people fled the uncertainty and volatility in paper money. U.S. stocks opened sharply lower and continued to move down until shortly after 10:00, when scattered bids began to pare losses. In midmorning, I sent this summary to some friends:

Market reaction a bit muted. The S&P circled the wagons at 2085, above the 2080 danger zone earlier in the week.

The muted reaction in stocks is two pronged. The number was such a shock it might be an outlier or even an error (U6 showed little changed). Other factor is that bears fear another afternoon “rescue rally” in crude, which could spill into stocks.

While the crude pits never quite provided a full blown “rescue rally”, the selling did temper enough to put some supportive bids throughout the afternoon. A little posturing and game playing at the close prevented stocks from making it into plus territory. In the final hour, the indications for the “on close” orders were nearly 80% to the buy side with nearly $1 billion to buy on balance. When the market failed to react to that indication, traders began to think it was a fraud. Sure enough, stocks actually ticked down in the final minutes, suggesting somebody had been hiding in the weeds.

Rate assumptions were the primary influence, with financials taking the biggest hit, while the dividend paying utilities were the day’s clear winner. Advances overall edged out decliners in slightly higher volume.

Overnight And Overseas – Asian markets were a bit confused in sorting out the impact of Friday’s non-farm payroll surprise. Hong Kong was somewhat higher while Japan, India and Shanghai all closed with mild losses.

In Europe, stocks were a bit better on the continent, while London was much firmer on the overnight bounce in commodities which helped the miners. Helping also was pronounced weakness in the pound as new polls show rising chances for a Brexit vote.

The yield on the ten year inched up very slightly as did the dollar after Friday’s pronounced swings in both assets. Gold is flat and crude is up a touch.

Base metals are better with copper hitting a one month high. Grains are generally better.

Consensus – Volumes are generally light around the globe, suggesting that many traders will leave the wallet on the hip, awaiting Yellen. S&P support at 2080/2085 and resistance at 2105/2110. Watch the biotechs. Stick with the drill – stay wary, alert and very, very nimble.

***Andrew Maguire’s remarkable KWN audio interview has now been released and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

***Also just released: Maguire Is Right – China Will Send The Prices Of Gold & Silver Into The Stratosphere CLICK HERE.

© 2015 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.