Today a legend in the business sent King World News a powerful piece that warns the global economy is in deep trouble even after $10 trillion was injected into it. John Ing, who has been in the business for 43 years, also discussed a coming short squeeze in gold.

By John Ing of Maison Placements

October 2 (King World News) – Global Economy In Serious Trouble, Short Squeeze In Gold

Every newspaper headline is about whether the Federal Reserve would increase rates in September, then October, and maybe December? As in Charles M. Schulz’s comic strip, when Lucy always pulls the football away before Charlie Brown can kick it, the Fed threatens but takes the opportunity away every time. The return to “normalized rates” just adds to the confusion already in the marketplace.

Every Fed meeting or Chairwoman Yellen’s body language is scrutinized. Actually, these oracles don’t know whether to raise rates, fearing doubts about the health of the global economy. To be sure, there is the need for an increase, because seven years of easy money has led to bubble-like conditions in the stock market, paintings, classic cars and other hard assets. At the very least, QE was to have triggered an economic recovery, but instead central bankers addicted to low rates have just fueled asset prices, consumption and leverage. And each time, the proverbial can gets kicked down the road as America postpones the day of reckoning…

Continue reading the John Ing piece below…

Advertisement

To hear which company investors & institutions around the globe are flocking to

that has one of the best gold & silver purchase & storage platforms

in the world click on the logo:

Money is Not Money

The confusion is such that a 25 basis point increase is already factored in the markets. Yellen has been caught in a box of Bernanke’s creation. What has turned into a “Lucy” moment is really symptomatic of the Fed’s underestimation of the dangers of zero interest rates and loading its balance sheet with debt. Consequently, the Fed’s credibility has taken a hit. And with the mighty US dollar already reaching a peak, the world’s central bank is stuck with a problem of their own making. The Fed is supposed to keep prices stable but it seems they are not stable enough, slipping afters rounds and rounds of quantitative easing and currency devaluations. Devaluations makes imports more expensive leading to higher inflation.

To date, the inflationary impact of easy money have been offset by cheap imports from the emerging world. That has ended. What seems certain however, this lack of indecisiveness likely paves the way for QE4, particularly with China’s slowdown and weakness in emerging markets. Nonetheless, it appears this easy policy is one of diminishing returns, where additional money generated from QE appears to have less and less of an impact. In fact, the rest of the world has responded to US monetization with monetization of their own, devaluing money in a defacto currency war. In this global race to the bottom, money is no longer money.

And in doubling America’s debt, the Fed has made the problem worse by the much publicized dithering over establishing “normalcy”. What will happen when the Fed will have tighten in order to prevent inflation, having exhausted its monetary arsenal? Like Charlie Brown attempting to kick the football, even though he knows Lucy could pull it away from him, the market would be fooled, yet another time – or would it.

Purchasing Power Declining

We believe the Fed’s radical quantitative easing tackled the financial problems not the investment problems. Bond prices were bid up, interest rates were pushed down. The banks were allowed to rebuild their balance sheets. Traditionally, the banks would lend that money, recycling the dollars into the economy. The experiment failed because the big Wall Street banks instead paid out dividends, financed buybacks, mergers and acquisitions which were up 20 percent from a year earlier.

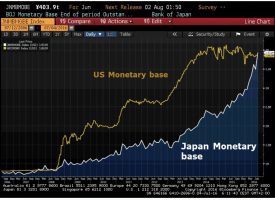

Quantitative easing requires central banks to purchase their government’s securities with freshly minted paper dropped from a helicopter in an incestuous relationship between governments and their central bankers. As a result the Fed now owns the bulk of US Treasuries and Japan too will own over half of its debt by 2018. In soaking up debt from the private sector, more than $10 trillion sits on the stretched balance sheets of the Fed, ECB, Bank of Japan and England. The market has become more illiquid with supply ironically becoming an issue. The irony is that just about every central bank is copying the Fed’s bond buying programme, believing that it works but the results are the same, growth remains elusive.

Low interest rates disincentivized risk. Credit has been misallocated. The concept of purchasing power is hard to quantity because the world’s financial system is denominated in dollars. Creditors and debtors do not realize losses as long as they hold dollars. However, the creation of trillions of dollars has eroded the underlying purchasing power.

Too Little Return for Too Much Risk

As a result, investors are chasing yields and riskier-types of assets driving down the returns on bonds such that capital and risk has become unbalanced. Investment is low because the returns cannot match the casino-like returns of the market, ensuring a fast return of inflation when those freshly minted trillions flow into hard assets. Inflation is back but in the hotspots from condos to cars to commercial real estate fueled by cheap money and leverage. The problem is that in a world of zero interest rates, the carrying cost and thus risk is ultra-low. Too little return for too much risk. However, zero rates are not the cure, but part of the problem.

One would have thought that the central banks would have learned by now. Somehow the Fed and policymakers think that providing ample credit and monetizing debt has nothing to do with the sky-high stock prices or real estate prices and instead are a signs of prosperity and growth.

Were that to be true, there would be no question about China’s growth and financial market volatility. Another concern is how the Fed and other central banks, after buying up bonds to keep interest rates low, are to reduce their mammoth balance sheets and dispose their holdings into a market when rate increases are expected. Like the proverbial “roach hotel”, central banks will learn it is easier to get into positions than out of them. Its time for the central banks to stop this pump priming, because sooner or later, whether by design or as the Greeks found out, the piper must be paid.

The World’s Largest Debtor

America is sitting on a debt bomb. Total national US debt without future social security and medicare obligations is at 100 percent of GDP. Compare the balance sheets of government, companies and consumers three decades ago with today. In 1980, the US government’s net external debt was zero, today it is $18 trillion and still rising. In 2004, U.S. consumer debt was $8.9 trillion. But ten years later, Americans owe a whopping $12 trillion or an increase of 35 percent. US corporate debt is currently over 50 percent of GDP, up from 18 percent from 1980. So what does the government do with this debt problem? It froze the statutory debt limit postponing any decision and raised the prospect of yet another shutdown in Washington. The only casualty it seems was John Boehner, Speaker of the House.

Today, the overriding concern is a Japanese-style deflation rather than inflation. US consumer price inflation is only at 0.2 percent, shy of the Fed’s two percent target, due more to the collapse in energy, food and fears of a slowdown in China. The CPI has been configured differently over the past two decades with energy and housing prices “smoothed” out. Ironically it is not deflation which should concern us but as any student of history knows, inflation is always a problem lying dormant. Once the embers are fed by say, a central bank’s profligacy or an experiment like zero interest rates, those embers will soon come alive.

In the seventies, persistent monetary growth led to an average annual CPI increase at 7.1 percent. Then to cure inflation, rates skyrocketed with CPI averaging 5.6 percent in the eighties, 3 percent in the nineties and between 2000 and 2015, the average rate was 2.25%. During that forty year period debt skyrocketed, the monetary base exploded and we are awash in printed money which will ultimately feed the inflation beast, particularly when some $4 trillion of corporate debt comes due within the next four years.

So what happens now? First, the strong dollar as a result of quantitative easing is being blunted by the series of competitive devaluations. Devaluations are inflationary. Second, the inflationary headlines today are more severe than they were in 2008 in terms of leverage, frothy stock market valuations and sovereign debt loads. Third, a weaker dollar will help boost inflation. Gold is an effective hedge against inflation. Already there is real strength in gold in non-dollar terms. For example, gold in euros jumped during the Greek crises while gold in Brazilian reals, South African rands, Ukraine hryvnias and even renminbis have protected local wealth, acting as a safehaven against instability and inflation in those respective countries. Put another way, most currencies are declining against gold.

And the economy? It remains debt clogged, overextended and addicted to zero interest rates. No wonder Mr. Trump has tapped into a “mad as hell” anger. And why not? After injecting some $10 trillion into the global economy since the financial crisis, the world’s (ex-bankers) economies have remained weak where not even one percent rates are enough for investment.

China’s Devaluation, Good for Gold

More broadly, the dollar is the world’s currency. The US consumes more than it produces and the avalanche of dollars are looking for a home. Slow growth and a huge debt burden raises risks about the ultimate repayment of debt. So what happens when the trillions of dollars sitting in Japan’s or China’s reserves pour into the world’s payment system? When China devalued its currency, it also signaled their immense reserves would be put to work. Recently dollars were dumped in order to prop up the renminbi, joining Middle East players who dumped billions to fund their widening deficits. A lower US dollar is inflationary. Asian central banks and the Chinese public have been buying gold in a diversification move. China boosted its central bank holdings one percent in August, holding almost 1,700 tonnes, the world’s fifth largest hoard and overtaking Russia.

Risk has increased. Two thirds of the world’s asset are denominated in a fiat currency issued by a country that is blatantly debasing their debt and currency. China and America’s creditors are hedging their bets by looking for alternatives.

Gold is that useful alternative investment to the dollar and a rational solution to the excessive accumulation of dollars and risk. The combination of economic stagnation, too easy central bank policy and increased risk makes gold a better store of value. The major economies are sick. The US has a serious problem with too much debt and an overvalued dollar. The cure will be painful. Gold will be a good thing during this perilous adjustment.

Neither a Borrower or Lender Be

Gold hit a peak at $1,940 in 2011 and the consensus view is that peak will not be reached again, particularly with the absence of inflation. We do not share that view. We recall when gold recorded new highs after a “supposed” peak at $100 per ounce, then $400 per ounce and $850 per ounce. Each time, gold always surpassed its previous peak. It is not so different this time.

Ironically, Comex, the major futures market where billions of paper gold ounces are traded is not the market where the central banks purchase gold. Comex has become a casino where high frequency trading, spoofing and price rigging has become commonplace. The Swiss watchdog just launched a probe into possible collusion or manipulation of the precious metal trading by seven big bullion banks. In fact, there is growing evidence of a short squeeze developing with Comex’s available gold for delivery is overshadowed by demand on the order of 200 ounces for every one ounce held in the warehouses.

Gold was been in backwardation with the near month for delivery trading at a premium to gold for future delivery reflecting tightness in the physical market where there is less supply. Central banks buy physical gold with nineteen purchasing gold last year. Meantime, China’s Shanghai Gold Exchange has surpassed the trading on Comex where the shenanigans are banned, delivering over 64 tonnes in one week alone. Chinese investors are a big buyer of gold and withdrew almost 1,400 tonnes, up 150 percent in a year from Shanghai Exchange. Simply there’s too many paper ounces against too few physical ounces made less by the regular purchases of China, Russia and the Middle East. Gold players will learn that the shorts should “neither borrower or lender be.” ***KWN has now released the extraordinary audio interview with legendary Robert Arnott, where the he discusses the unprecedented chaos, turmoil and instability in the global financial system, what investors should be doing with their money to protect themselves from the turmoil in Western stock markets and much more, and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

***ALSO JUST RELEASED: An Important Reminder About Oktoberfest And Gold CLICK HERE.

***Within hours KWN will be releasing the powerful written interview with Dr. Paul Craig Roberts!

© 2015 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.

If you are interested in purchasing physical gold and silver for delivery you can call SQ Metals at (406)586-4842, or you can email them at tyler@safetrek.com or info@sqmetals.com