The flight continues as the situation worsens.

The Flight Continues

June 1 (King World News) – Gerald Celente: During the 12 months ending 31 July, 2021, the largest U.S. cities lost residents at a faster pace than small and medium-size cities, census bureau data shows.

In the nine cities with populations of at least one million people, the number of residents dropped by 1.9 percent.

Phoenix and San Antonio were the only two cities in the category where residents grew in number.

New York City, the country’s largest city, lost 3.5 percent of its people, roughly 305,000. Los Angeles, in second place for size, was down 1 percent, or about 41,000. Chicago, the third biggest, lost about 45,000 people, or 1.6 percent.

San Francisco’s residents numbered 55,000 fewer at the end of the period, a loss of 6.3 percent.

Chicago and San Francisco’s populations now hover near 2010 levels, the census bureau noted.

Twenty-eight cities ranging in population from 500,000 to 1 million lost 0.7 percent of their people.

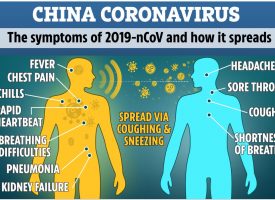

The 2020 COVID War and its remote work model sent families out of commuting distance to downtown offices in search of cheaper housing with more space…

Billionaire Eric Sprott bought a 20% stake in a mining company

that is preparing to announce a massive silver resource

to find out which one click here or on the image below

The new figures show that the trend continued well into 2021, with Millennials in their prime child-producing years looking for family-friendly areas with better schools.

The population shift is a measure of the ways in which the COVID War prompted many Americans to analyze and reshuffle their priorities, The Wall Street Journal said, “in ways that made city living no longer worth its drawbacks, including higher taxes and elevated crime.”

TREND FORECAST:

As we said in “Fleeing From Urban Counties Speeds Up” (3 May 2022), the migration away from urban centers further confirms our trend forecast made two years ago in “Real Estate Dead? Time to Buy?” ( 20 Apr 2020) that the commercial real estate business in urban centers is undergoing a long-term decline.

Remote work as the new normal has spread skilled workers farther from the traditional business hotbeds, particularly on the coasts, and will create new centers of tech, financial, and innovative gravity around the country, reducing the coasts’ cultural influence and giving more to what have been second-tier metro areas in the heartland.

As more people work remotely, commercial real estate prices, especially office buildings, will fall further. In turn, businesses and transportation systems that relied on commuters will economically suffer and jobs in those sectors will disappear permanently.

Therefore, the shift to working at home will redefine economic ecosystems, both in exurban areas and in urban centers.

Exurban counties will add retail and service businesses, enriching the quality of life, adding jobs, and attracting more residents. Local planning commissions will need to be aware of the trend and take steps to ensure that exurbs do not become appendages of sprawling suburbs.

Urban centers face the opposite problem.

Commuters coming downtown to work buy lunch, gifts, clothes, gadgets, and other items; as workers stay home and more move out of commuting range, downtown stores and restaurants are losing their traditional customer base and gas stations along commuter routes will see business plummet.

At the same time, owners of commercial real estate, and especially commercial office space, face a reckoning.

Many will slash rents to lure a shrinking base of tenants, forcing them to demand property tax concessions from cities that will struggle even more to maintain police, fire, and public works infrastructures.

As city services decline, so will the quality of life; more people will leave, creating a downward spiral.

Therefore, to keep residents, businesses, and buoy property tax revenues, cities in decline can become laboratories for innovation in everything from marketing their brand identities to negotiating with businesses over taxes to the ways in which essential services are provided.

JUST RELEASED: CAUTION: This May Not Be A Bear Market Rally After All CLICK HERE.

JUST RELEASED: BUCKLE UP: This Monster Is Going To Be Highly Disruptive For Global Markets CLICK HERE.

JUST RELEASED: Greyerz – We Are Witnessing The Bursting Of A $3 Quadrillion Global Bubble CLICK HERE.

JUST RELEASED: Most People Don’t Have A Clue How Bad Things Are CLICK HERE.

***To listen to Gerald Celente discuss what to expect next for the gold and silver markets as well as what surprises to expect for the rest of 2022 CLICK HERE OR ON THE IMAGE BELOW.

© 2022 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.