With continued propaganda about the demise of China, there is one problem with the bear case — the Chinese have a jaw-dropping $22 trillion in bank deposits. What this means for gold and China bears will surprise you.

Stephen Leeb: “A key premise of both Sun Tzu’s “The Art of War”, thought to be written in 514 B.C., and Donald Trump’s “Art of the Deal,” is that if you don’t know where you stand, you’re at a severe disadvantage. Unfortunately, this past week has suggested that Trump and his team need to fully understand where America stands with respect to some critical geopolitical issues. “Make America great again” was a slogan that resonated with a lot of voters. But it could prove disastrous if the incoming administration, in a severe misreading of where America stands today, conflates “great” with “dominant.”

Particularly disturbing was the suggestion by Rex Tillerson during confirmation hearings that the U.S. should seek to prevent China from access to disputed islands in the South China Sea. This comes on top of Trump’s ongoing comments about China and his nomination of Peter Navarro, known for his anti-China trade stands, as his trade advisor.

I’ve argued before that the U.S. began a long downward slide in the 1970s when Nixon abandoned the gold standard and leveraged our status as king of the hill into the ability to print money with abandonment. That has made us vulnerable in ways that are becoming increasingly evident. However, our position isn’t hopeless. And we could improve it through cooperation with China and yes, even deal making. But if instead we attempt to beat the Chinese, it will be a lose-lose situation…

IMPORTANT…

To find out which company is set to become one of the

highest grade producing gold mines on the planet

CLICK HERE OR BELOW:

China wants to prosper. If we can understand and appropriately respond to that distinction, America has a chance to be great again by accepting that it can prosper by being dominant in the West, without seeking dominance in the world at large.

It’s inevitable that fairly soon – possibly even by the end of the year – the renminbi will be a floating currency. Moreover, either on its own or as part of a basket of currencies, a floating renminbi will be at least partially backed by gold. In other words, China is on an inexorable course to exert an economic stranglehold on the East. The world will then likely have two reserve currencies, one for the East and one for the West.

If this seems like a crazy bet, consider China’s major strengths. First, its economy is massive. By some measures, such as purchasing power parity, China’s economy is larger than ours. More important, China is the world’s largest trader and thus a natural candidate to have the currency that denominates the trading of goods. China is also a major military power, not just in cyberspace but also in the physical arena. Before Tillerson commits to aggressively confronting China in the South China Sea, he should read up on the Chinese navy.

A recent article in the periodical National Interest did various simulations of a conventional naval battle between China and the U.S. for possession of the disputed islands China now occupies in the South China Seas. These are the kinds of simulations the armed forces do all the time. The author, defense expert, Kyle Mizokami, sums up the results:

“I was tempted to restart the entire scenario, but I quickly realized that no matter how many times I played it, the result was going to be the same…The worst part – the Chinese didn’t even have to use missiles to defeat the Americans.”

The Mizokami simulation homed in on one example of Chinese naval strength. In a broader analysis of China’s naval capacity, The Financial Times recently concluded: “The emergence of China as a maritime superpower is to challenge a U.S. command of the seas that has underwritten a crucial element of…the relative period of peace enjoyed in the West since the second world war.” While this sounds alarming, I don’t think China is seeking worldwide hegemony. Rather, it seeks hegemony in the East, where most of its trading occurs, in order to protect its economic interests.

Right now the only block to an Eastern reserve currency built around the renminbi and gold is that, unlike other major currencies, the renminbi is partially managed. Most analysts, to explain why the Chinese don’t simply bite the bullet and let their currency float, point to the steep decline in the country’s foreign exchange reserves since their peak near $4 trillion in mid-2014 to $3 trillion today. And they add that China’s financial markets are extremely fragile, and that a floating currency might force the country to spend massively to keep the currency from crashing.

China Bears Need To Look At The Big Picture

I have trouble with these arguments. First, China’s trade surplus since June 2014 has been more than $1.2 trillion. Because the trade surplus adds to its dollar holdings, this means that more than $2 trillion dollars would have been used according to support the currency or else it would have left the country. (China is known to have sold about $300 billion in Treasury debt, but that still leaves $2 trillion unaccounted for.)

This is especially mysterious in that it is very unlikely the country ever had on deposit beyond treasury bonds more than a $1 trillion in U.S. dollars. The bottom line is that the amount of money most analysts seem to think China must have spent to support its currency is way beyond reasonable. Much more likely is that China has been funding massive purchases of commodities and gold, both of which it deems far more valuable than dollars, even if these assets don’t count as foreign exchange reserves.

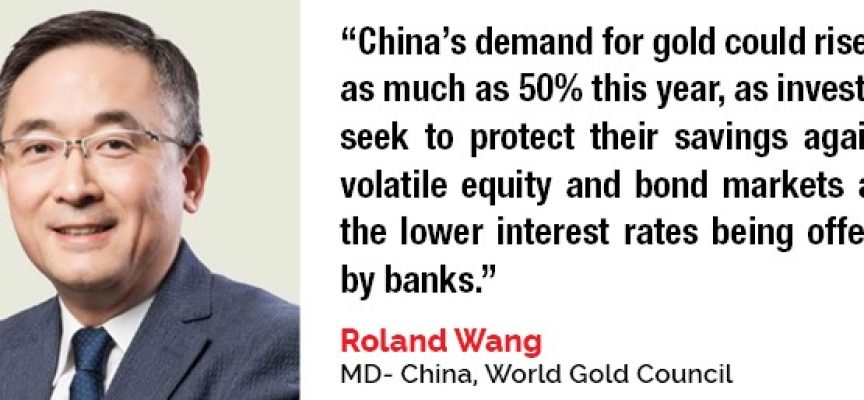

The Chinese Have A Jaw-Dropping $22 Trillion In Bank Deposits

As for its putatively fragile financial system, supposedly becoming ever more fragile because of rising bank debt, here, too, the conventional wisdom is out of touch with reality. By and large the vast majority of Chinese bank loans are funded by the public, whose deposits of $22 trillion are backed by the government. Moreover, according to the Banker, a trade publication for the worldwide banking industry, the major Chinese banks have the lowest loan/deposit ratios in the world. They are so low that even if non-performing assets were 10 times their reported value, they could theoretically be completely written off without threatening the solvency of the system.

Meanwhile, In The U.S.

Not so in America. Robert Litan, writing in the November-December 2016 issue of Foreign Affairs in an article titled “America’s Brewing Debt Crisis,” notes that the U.S. financial system has $22 trillion in uninsured financial liabilities including 50 percent of all bank deposits. While shadow banking is widely discussed in connection with risks in China, it actually makes up only a very tiny portion of China’s financial system. Shadow banking in the U.S., however, is about equal to our GDP. Where would you rather have your money?

Notably, in the same issue of Foreign Affairs, Gal Luft argues that America should engage China in terms of infrastructure investing in what could be a win-win situation.

So why hasn’t China already let its currency float? Probably because of fears that deposits will leave the banks and that the public could be spooked by renminbi volatility. That’s possible, of course, and no doubt something that concerns the ever-cautious long-term Chinese planners. Perhaps they want to see overall debt levels begin to fall, which I believe is likely this year.

But the key thing to keep squarely in your sights is that when – and it’s when, not if – China does let the renminbi float, there will be a connection to gold in some shape or form. So I think two things are near certain bets: One, there will be a lot of volatility in financial markets across the globe. And two, as the world separates itself into East and West, gold will be the one sure winner in both parts.”

***KWN has now released the fascinating audio interview with the top trends forecaster in the world, Gerald Celente, who discusses the big surprises ahead in 2017, gold, China, and much more, CLICK HERE OR ON THE IMAGE BELOW.

***ALSO JUST RELEASED: Gerald Celente – Even Trump Said This Grand Experiment Will End Badly CLICK HERE.

***KWN has also recently released the extraordinary audio interview with the man who advises the most prominent sovereign wealth funds, hedge funds, and institutional funds on the planet, Michael Belkin, and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

© 2017 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.