Here is a stunning chart of the housing bubble, plus weak economy has less people renting U-Hauls.

June 3 (King World News) – Peter Boockvar: You want to reignite the talk of a July Fed rate cut? Maybe a 4% handle on Friday’s payroll unemployment rate will do it, especially as the March dot plot has a year end 2024 median unemployment rate estimate of 4%. The current estimate is 3.9% which happens to be the highest since January 2022.

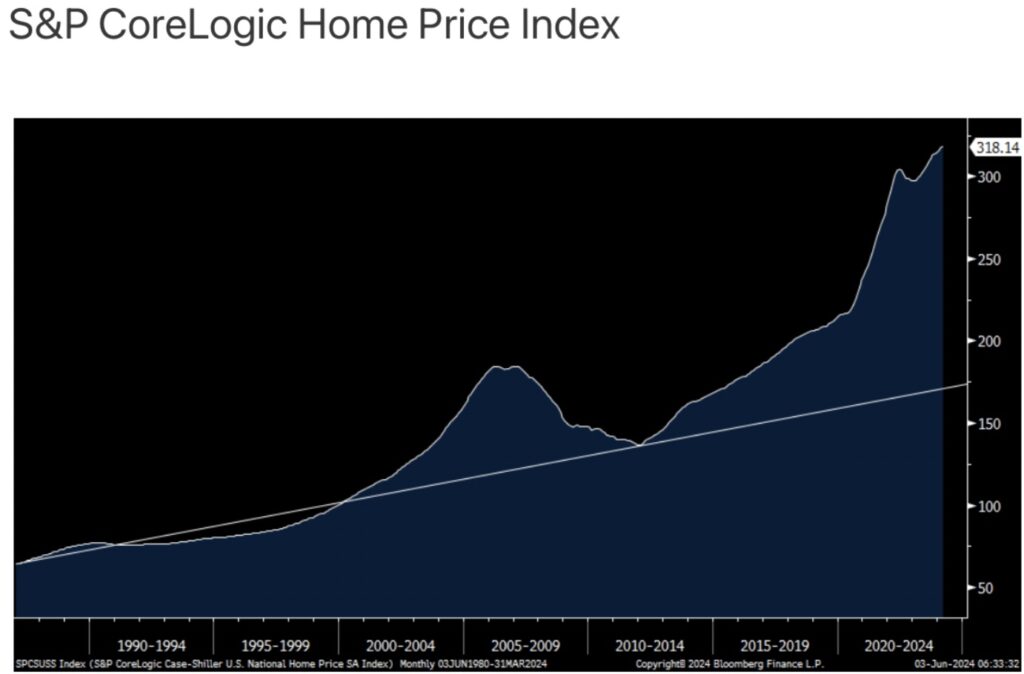

Housing Bubble

Why are so many frustrated by the economy as seen in polls? It’s obviously inflation but in particular the high cost of housing, whether to buy or rent. I decided to look at the S&P CoreLogic Case Shiller index to see where it would be if it remained on trend since the beginning of the data in 1987. Just drawing a simple trend line has this index 85% above the trend line. It was 50% above in 2007 for reference and got back to it in 2012 when prices collapsed.

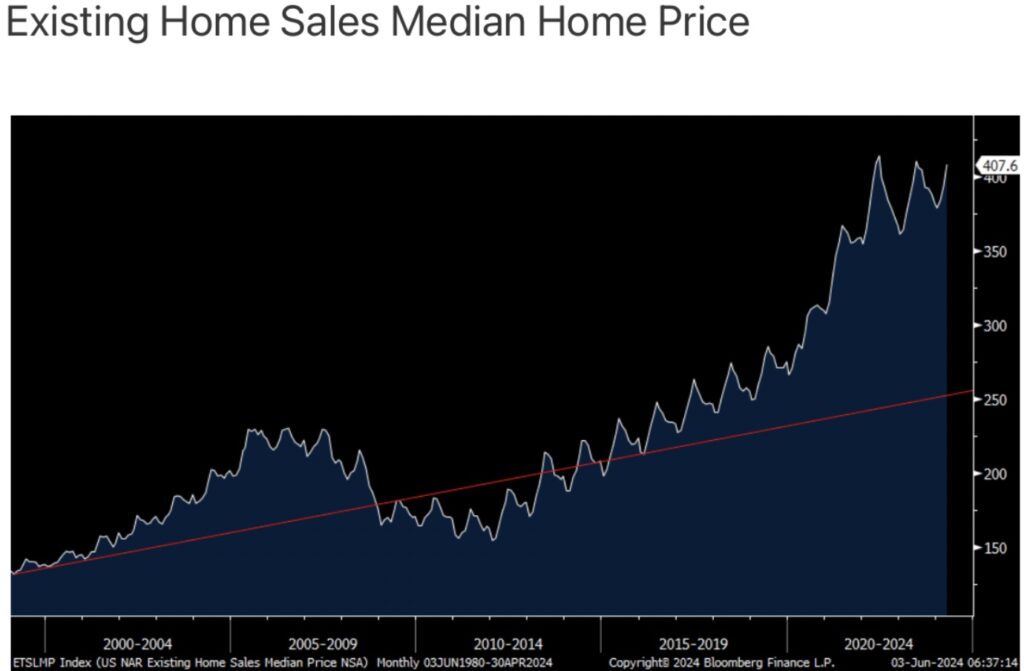

The 2nd chart is a trend line I drew for the median home price within the existing home sales data. It’s 63% above its trend line vs the 33% it was in 2007.

So when you hear your baby boomer relative tell you that ‘when I was your age I had a 12% mortgage rate’, the price paid then for a home was much cheaper relative to one’s income.

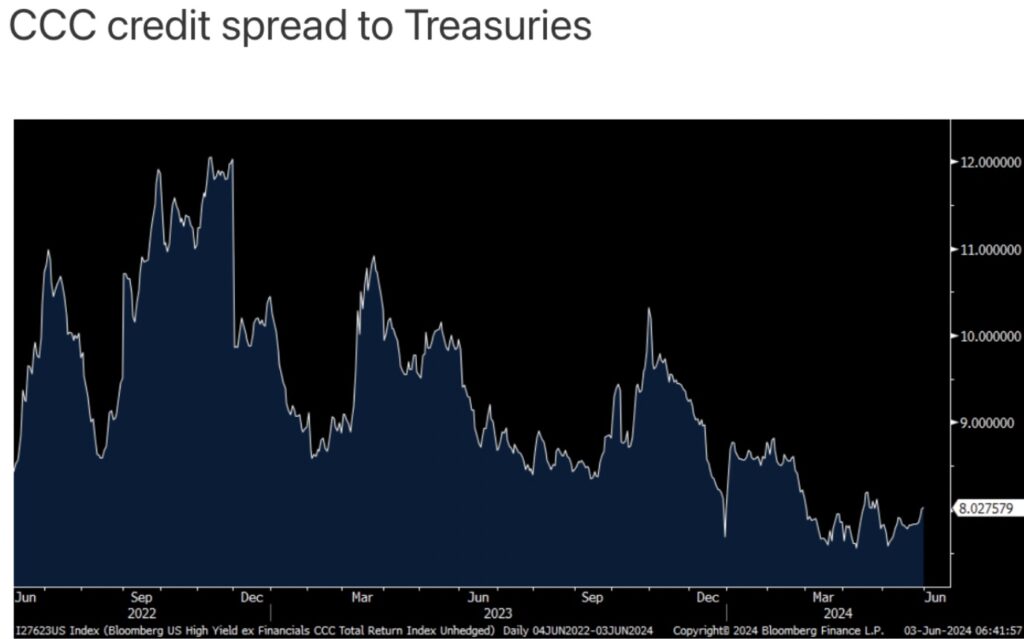

I haven’t mentioned it in a while but wanted to circle back to the CCC rating category of high yield and quietly the spread to Treasuries looks like it’s carving out a bottom at 803 bps, it’s the highest since late April. It still is VERY tight but something to keep our eye on. Putting aside spread and looking at the yield itself, it’s at 12.8%, expensive.

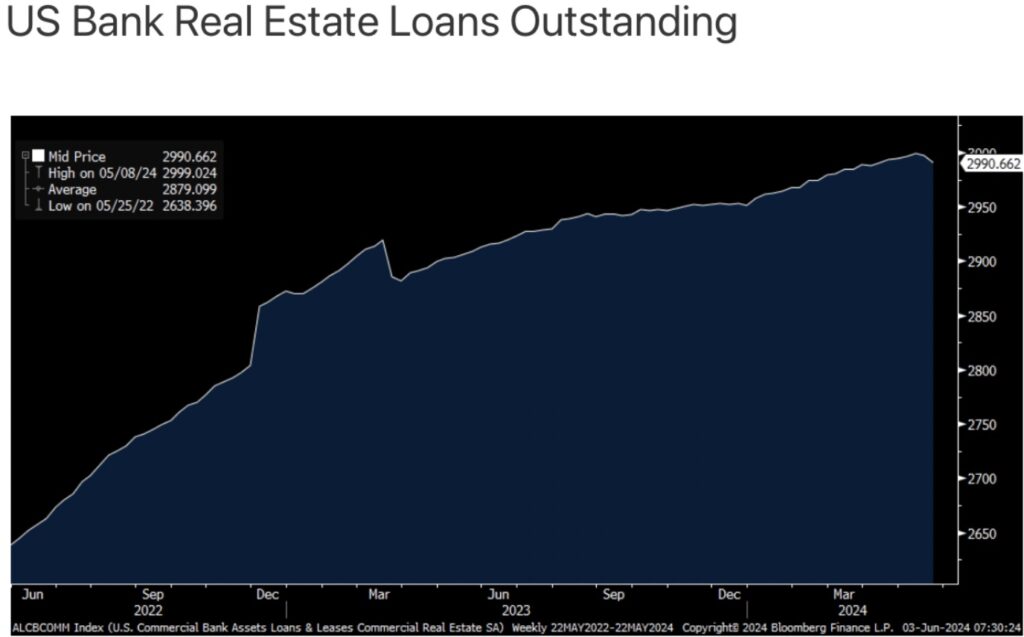

After a pretty steady rise over the last few years as loan commitments given prior to 2022 were likely satisfied, commercial real estate bank loans saw its biggest one week drop outstanding for the week ended 5/22 since March 2023, when SVB blew up, to $2.99 trillion. Something to watch.

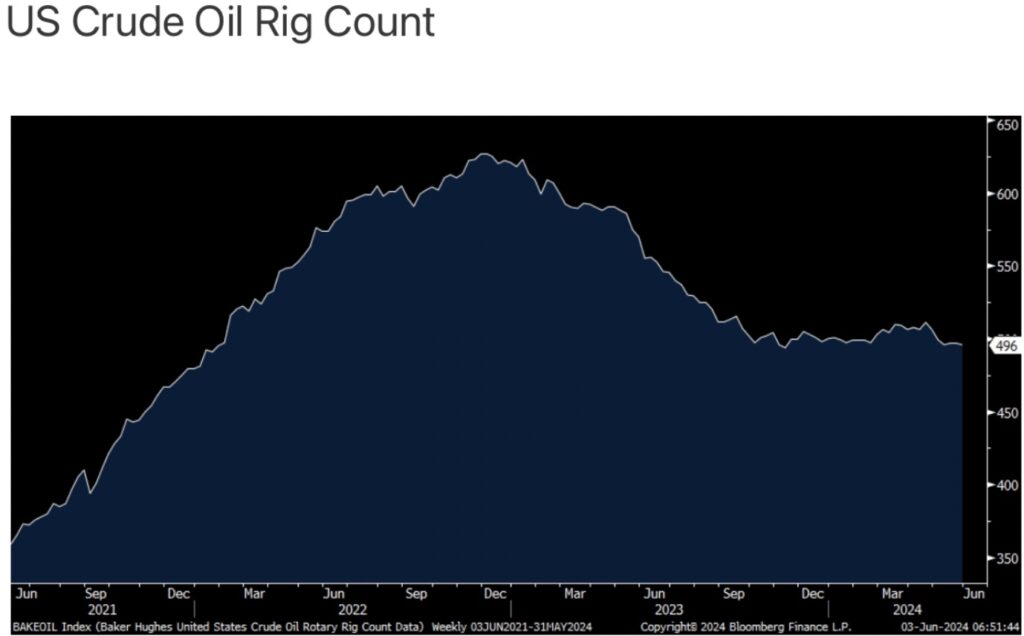

As OPEC is about to extend its production cuts well into 2025, the US crude oil rig count fell last week to match the least since November 2023. At 496, it is just 2 rigs from matching the lowest since January 2022.

The natural gas rig count is 1 rig off the lowest since October 2021. We remain bullish and long energy stocks, both oil and gas.

Weak Economy Has Less People Renting U-Hauls

An earnings conference call that I always find interesting but its never really given much broader attention is from U-Haul, the moving and storage company. They said this last week:

“So far consumers remain cautious in our experience…when I said I think the consumer is still pretty conservative, that really results in less miles per rental. People still move because moving is a need and it’s based on things like marriages, births, deaths, these things are inherently kind of smooth. They don’t have a lot of peaks and valleys and they steadily increase over time. But how far people move and therefore, how big the dollar amount of the transaction has something to do with just how they feel about life.

They think it’s great, I’m going to go on my big adventure and move to San Diego and start a new career. Well, great. That’ll be great for us. But when they get more conservative, they say, well, I’m going to move to another house in the neighborhood, keep the kids in the same school, keep my present job. So that just shortens the move and to a large extent, we have to recover costs based on mileage incurred because our costs very much vary with mileage incurred.

So I don’t see a big shift. I thought we would pick up a little bit quicker than we have. And I’m still expecting we’re going to see this shift. We’re not running behind this year, but we’re running I think a little bit behind historical trends or at least how I have anticipated they would play out and we’ll see the housing turnover or whatever it’s called has some modest effect on it, but I think how people feel about the economy and this whole life situation has a greater effect than residential new home sales.”

Meanwhile In China

With the China PMI read, “Businesses grew more optimistic, with the corresponding indicator indicating slightly from the previous month. Surveyed companies had high expectations for improvements in domestic and foreign demand in the following year.” On pricing, “Input costs rose at the fastest pace in 7 months, though the increase was modest. Some surveyed companies attributed higher input costs to the rising prices of industrial metals, plastics and crude oil. Sales prices continued to decline amid intense market competition. However, factory gate prices for intermediate goods ticked up.”

South Korea Strong Growth

In South Korea they said, “South Korea’s manufacturing sector appears to have caught a 2nd wind. After recovery efforts appeared to have plateaued recently, growth surged in May as stronger demand conditions, both domestically and abroad, drove production growth to its strongest in nearly three years.”

Eurozone Continues To Struggle

The May Eurozone manufacturing PMI was revised a touch to 47.3 vs the initial read of 47.4 but up from 45.7 in April and the best read since February 2023. The final figure for the UK was 51.2 vs 49.1 in the month before.

So the ECB on Thursday will cut rates just as their manufacturing sector is showing some signs of life and commodity prices are near the highest since August 2022.

Celente Predicted Gold & Silver Breakouts

Gerald Celente discusses the historic gold and silver breakouts as well as where the prices of gold and silver are headed and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

Swaps All-Time Record Short Gold

Alasdair Macleod discusses the swaps short position in the gold market reaching an all-time record. Macleod also discusses the remarkable developments in the silver market and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.