With stagflation engulfing world economies gold continues to shine with a powerful upside breakout as banking worries persist.

Gold

March 20 (King World News) – Graddhy out of Sweden: Last week gold priced in US dollars broke out, as expected. This week it already has follow-through, plus backtest starting. A beautiful, clean chart, exactly what we want to see.

What A Beautiful Golden Breakout

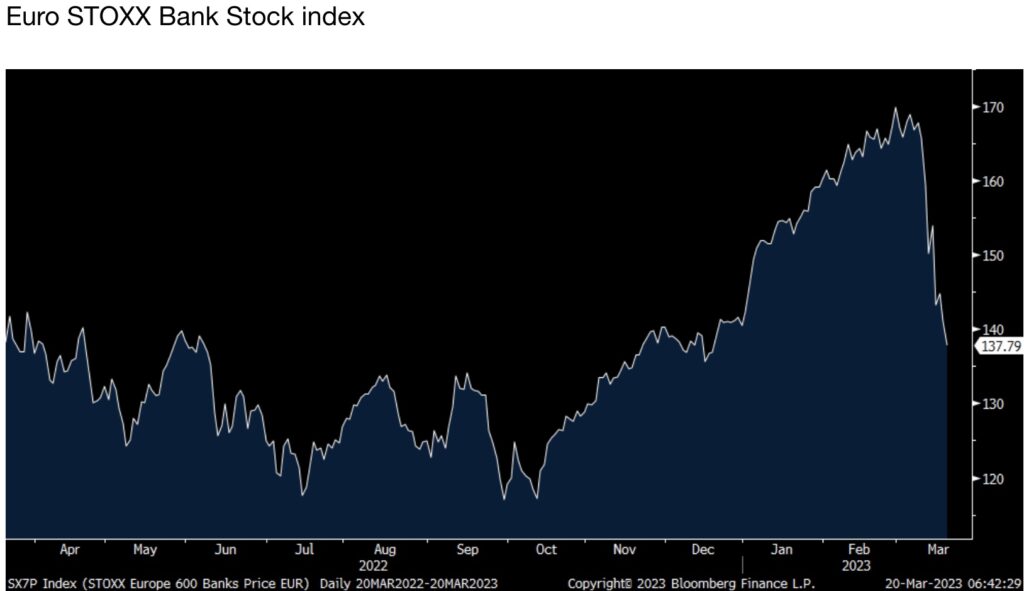

Euro Bank Stock Index Continues To Plummet

Peter Boockvar: UBS stock is down about 4% (well off its lows), we see CS stock at almost a zero though some value still there but notably was the complete zero the contingent convertible securities (lowest level of bank debt and CS had $17b worth of them) of CS are being assigned and are supposed to be senior to the equity. The Euro STOXX bank index is lower by 1.5% in response to the lowest level since December.

At least for the European banks I do believe that the ring fence around CS, which has been a melting ice cube for years as we know, will hold and not infect the viability of them. But, with 80% of lending to corporations in Europe done via the banks, you can be sure we’re going to see a notable drop in bank loans as we’re likely to see in the US where banks provide about 25% of corporate loans. Also, we’re going to see with some banks, both in Europe and the US, equity raises and shareholder dilution, as seen with First Republic here.

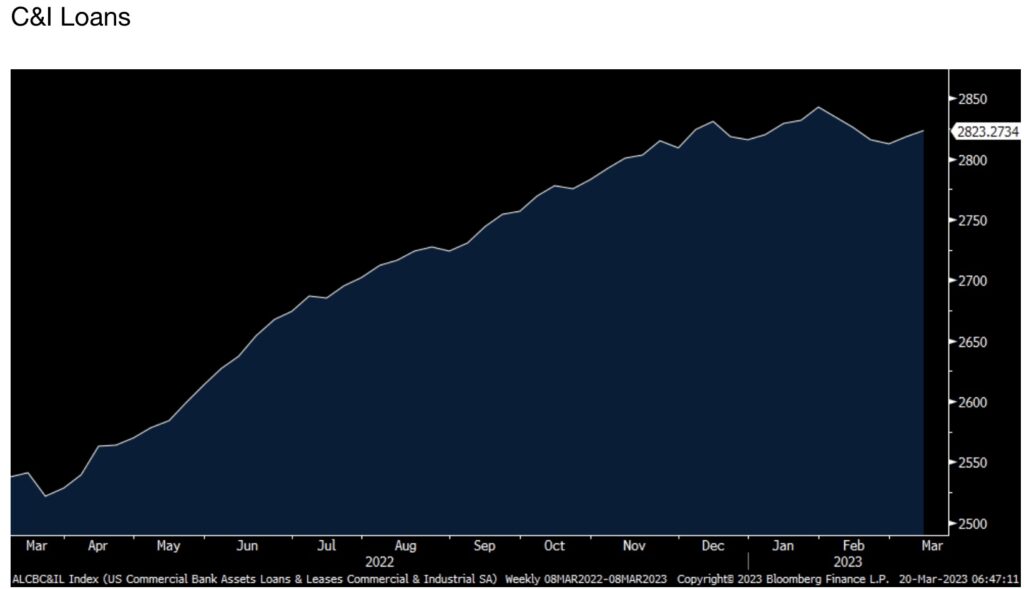

Speaking of US commercial and industrial loans, for the week ended March 8th, so the day before everything hit the fan for SVB, loans as seen in the chart below have been little changed this year as lending standards tighten.

FDIC Insured Deposits

While lawmakers in DC have started the conversation on how might the FDIC insured deposits limit will be raised, the sooner the better in making a decision but either way, expect C&I loans to shrink from here I believe. Of the about $17T of bank deposits, about half are insured. It’s easy for some to say (including notable hedge fund people on Twitter) ‘the government should insure all deposits!’ but we’re talking big numbers here and easier said than done.

ECB & Fed Rate Hikes

I’ll say this about the Fed this week, what ECB Governing Council member Francois Villeroy said today is why the Fed will most likely hike by 25 bps this week, though telegraph a pause thereafter. Villeroy said with regards to their rate hike, “It showed our confidence both in the solidity of French and European banks, and in our anti-inflation strategy. We will take decisions meeting-by-meeting depending on economic data, but we remain determined to beat inflation.” Unlike the Fed though, the ECB is still way behind with its deposit rate relative to inflation…

ALERT:

This company is about to start drilling what could be one of the largest gold discoveries in history! CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

On whether the Fed should follow the ECB in hiking, imagine for a second the scenario that it was the market that set the fed funds rate, we can at least dream, and not a bunch of people sitting around a large table in DC or on Zoom. Now markets get things wrong a lot but it quickly adjusts when they see the error of its ways. Firstly, the ‘market’ would have been tightening well before the Fed started to and you can be sure, the ‘market’ would NOT be raising rates this week.

Tech Troubles To Persist

We saw a nice rally in big cap tech last week as some think they are safe in this environment but I need to remind people that many customers of big cap tech are small and medium sized businesses, including VC funded companies. You can be sure less tech services and software are going to be needed at least for the next few quarters.

US Making A Big Mistake In Crude Oil

Remember when we heard that the Department of Energy would start refilling the SPR at $70 per barrel after ‘shorting’ oil at around $90? We’ll, now they are getting cute with oil now in the mid $60’s. Amos Hochstein, an administration energy official is not yet ready to cover their short. “Why don’t we take this one day at a time” he said last week on Bloomberg tv. It’s a big mistake with reserves at 40 yr lows.

Stagflation Continues

Taiwan said its February exports fell 18.3% y/o/y, a bit more than the expected drop of 17.5%. Exports to Hong Kong and Mainland fell a sharp 36% y/o/y and were down by 12.6% to the US and by 13% to Europe. Exports of electronic products were down by 22% y/o/y.

Germany said its February PPI fell .3% m/o/m, not as much as the estimate of down 1.4% while the y/o/y increase was still 15.8% vs 17.6% in January. Quite the stagflationary situation over there.

King World News note: Gold always shines during stagflation. Gold went up 25.5 times in the 1970s bull market during that brutal stagflation. Silver went up 38 times in price. Buy physical gold and silver on all dips.

ALSO JUST RELEASED: Greyerz – THIS IS IT! The Global Financial System Has Started To Collapse CLICK HERE.

ALSO JUST RELEASED: Gold Nears Record High As James Turk Warns US Dollar May Collapse In 2023 CLICK HERE.

ALSO JUST RELEASED: CHAOS ERUPTS: It’s Going To Get Much Worse As The Collapse Will Spread To Currencies And Gold Shines CLICK HERE.

***To listen to James Turk discuss the ongoing global collapse of the financial system and the underlying currencies as well as what people need to do right now to protect themselves CLICK HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod’s powerful and timely KWN audio interview where he discusses the ongoing collapse in the banking system as well as what this means for global currencies and other markets as well as why gold is set explode higher CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.