On the heels of silver futures hitting $39.91 during Wednesday’s trading, Sprott says we may be setting up for a short squeeze in the silver market.

Silver 2nd Half Of 2025

July 24 (King World News) – Maria Smirnova, Chief Investment Officer at Sprott: Silver outlook for 2025.

Key Takeaways

- Silver Bull Market Gathers Strength: Silver has surged nearly 25% year-to-date in 2025, breaking past $35/oz, driven by structural deficits, industrial growth and renewed investor interest.

- Persistent Market Deficits: Global silver supply has not kept pace with demand for seven consecutive years. The cumulative shortfall has intensified upward price pressure.

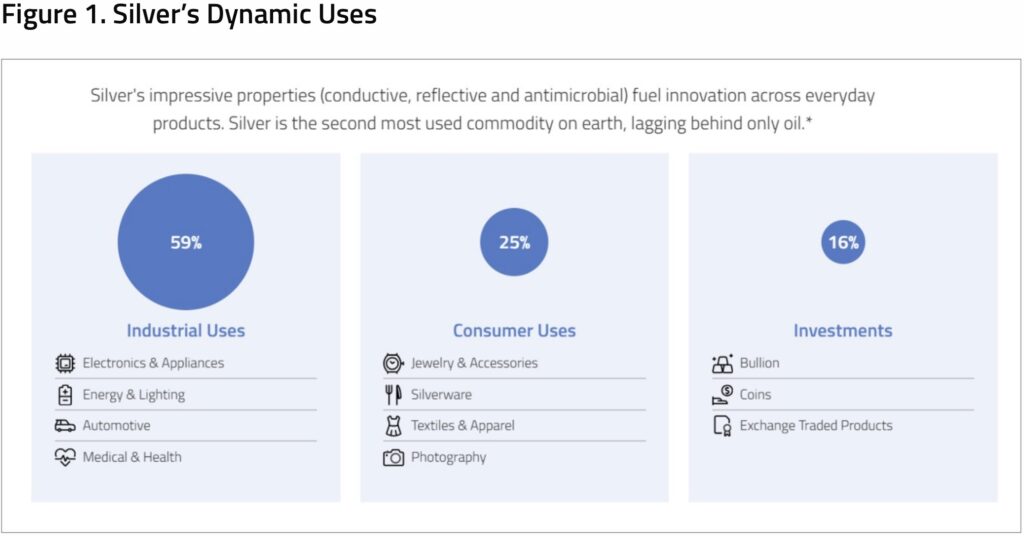

- Industrial Demand Remains a Key Driver: Industrial demand accounts for 59% of usage for silver, which is essential to solar panels, EVs and consumer electronics.

- Potential for a “Silver Squeeze”: Freely traded silver inventories have been heavily diminished, and silver may be poised for sharp upside on even modest demand spikes.

Silver Breaks Through in the First Half

Silver bullion broke through the significant $35 per ounce resistance level early last month, reaching its highest price in a decade. Silver stood at approximately $38 at this writing, climbing closer to its most recent high of $48 in 2011 (and its all-time high of $49 posted in 1980).

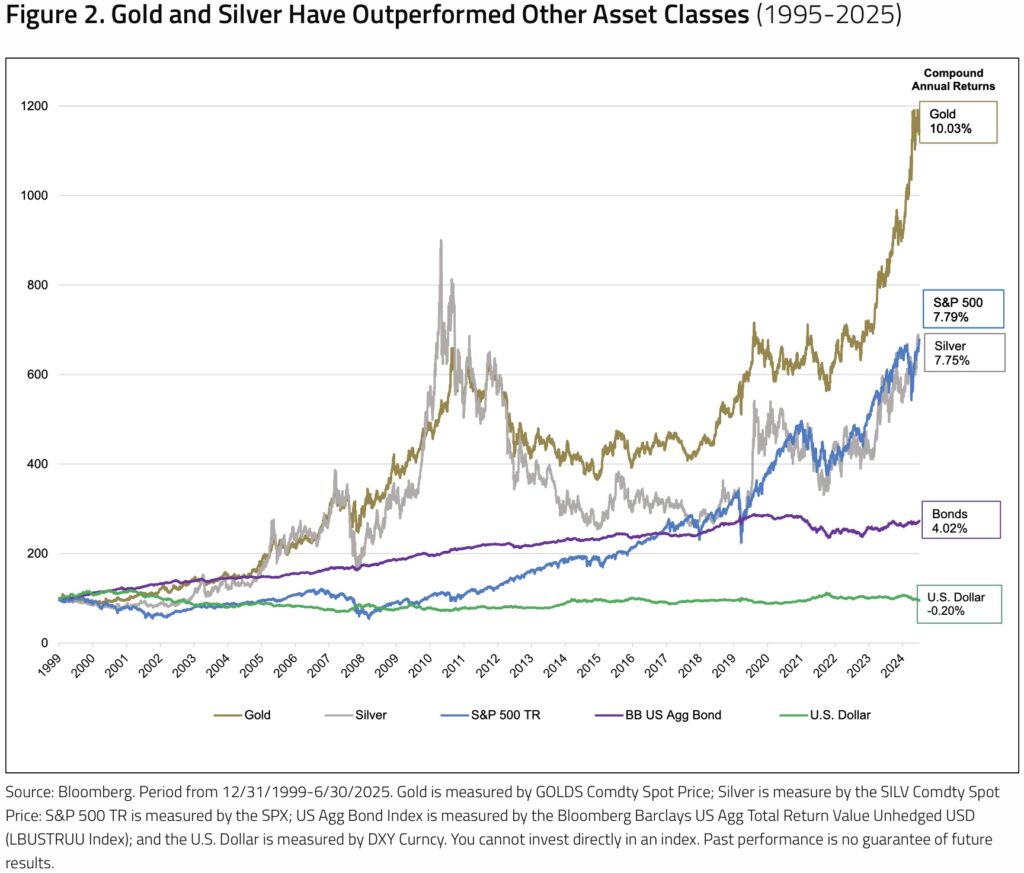

Along with gold, silver has been posting impressive gains. For the first six months of 2025, silver bullion gained 24.94%, following its 21.46% in 2024. We believe the catalysts for this silver bull market are a structural supply deficit, growing industrial demand and renewed investor interest, particularly among Asian and North American retail buyers of exchange traded products, coins and bars.

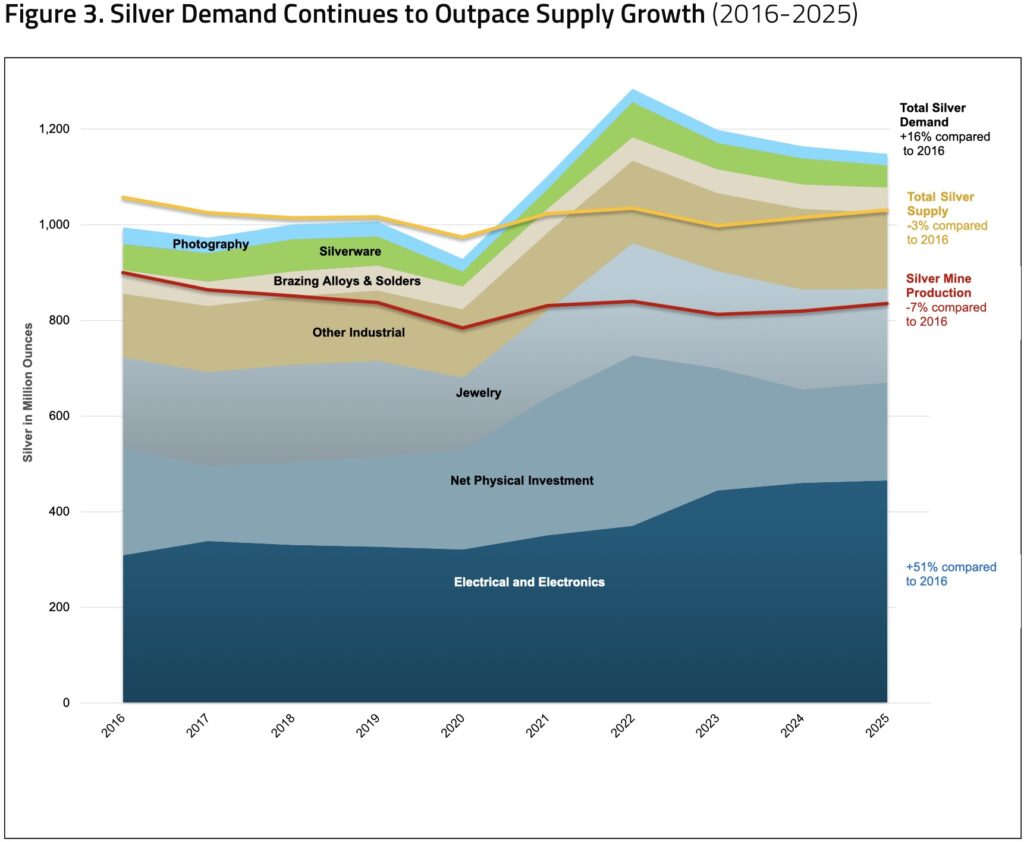

For the seventh consecutive year in 2025, the global silver market is likely to remain in deficit, putting upward pressure on prices. Supply is not keeping up with demand for silver. In fact, silver mine supply, as shown in Figure 3, has declined by 7% since 2016. Silver is crucial to the technology needed to meet rising global electricity demand, including solar power, EVs and electronics.

At the same time, silver is regaining prominence as a trusted safe-haven asset in today’s environment of increased geopolitical tensions, inflationary pressures and financial market instability. Historically, silver has served as a store of value in periods of crisis, much like gold, but with the added benefit of being significantly more affordable and accessible for retail investors. For example, India is the world’s largest importer of silver, and Indian buyers purchased record levels of both physical silver and silver ETFs in the first half of 2025.

Silver Supply and Demand Imbalance Persists

Silver has been in a structural deficit since 2021. The cumulative shortfall for 2021-2025 totals almost 800 million ounces (25,000t). As shown in Figure 3, the electrical and electronics sector has been the biggest demand driver for silver usage, increasing 51% since 2016. This is not surprising given that silver is the most electrically conductive metal.

The electrical and electronics sector includes solar photovoltaics (PV); consumer electronics (phones, tablets, wearables, AI-related devices); automotive electronics (EVs, sensors, wiring); and power grid components and 5G networks. Solar PV-specific demand alone accounted for 17% of total silver demand in 2024, compared to 5.6% in 2015, growing at an annualized rate of 12.6%. The greatest push is coming from China, which increased its solar capacity by 45% in 2024. But despite record global solar installations, PV-specific demand remained relatively flat in 2024 due to aggressive “thrifting” by manufacturers as technological advances helped them reduce the amount of silver needed per panel.

Investment demand for silver will continue to be the wild card for the silver market balance. The rise of silver ETPs continues to impact silver demand significantly, as many silver ETPs are backed by actual silver stored in vaults, rendering it unavailable for industrial users. In the first half of 2025, global silver-backed ETPs experienced significant net inflows, reaching 95 million ounces. According to the Silver Institute, since 2019, more than 1.1 billion ounces (market balance plus ETPs) have been drawn from “available mobile inventory.”

Silver Squeeze Setup?

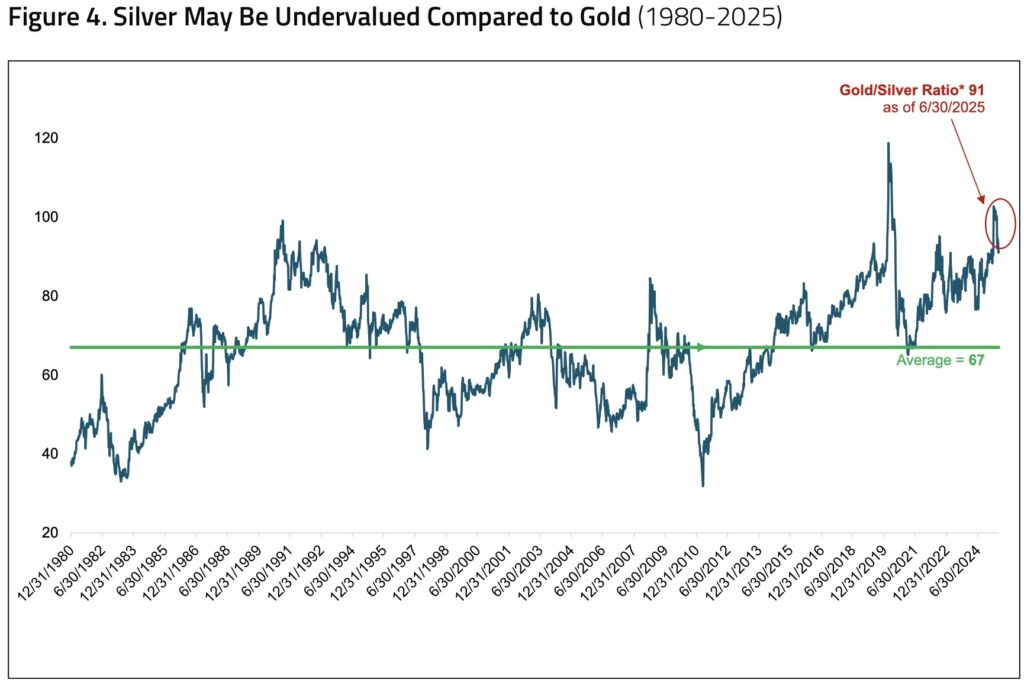

Silver remains undervalued relative to gold, opening it to significant upside potential. On average, gold has historically been priced at 67x the price of silver. With the current ratio at 91, silver is selling at a strong discount to gold (see Figure 4). Further, silver is mined at only 7:1 compared to gold.

In contrast to gold, silver is primarily influenced by retail investment demand, while gold is controlled by central banks and sovereign entities. The available inventory of freely traded silver has been heavily diminished, making the metal more sensitive to incremental buying. Small increases in demand could now lead to disproportionately large increases in price. With less silver available for open-market trading, investor positioning has become a more decisive force in price movements.

The current situation may be setting the stage for a possible “silver squeeze”: a situation when demand for physical silver surges suddenly, overwhelming available supply of freely traded or deliverable silver, and causing a sharp spike in silver prices.

Looking Ahead

Silver and gold have historically rallied during periods of fiat currency debasement, inflation, falling interest rates, economic recoveries and rising geopolitical risks. We are in a similar period now.

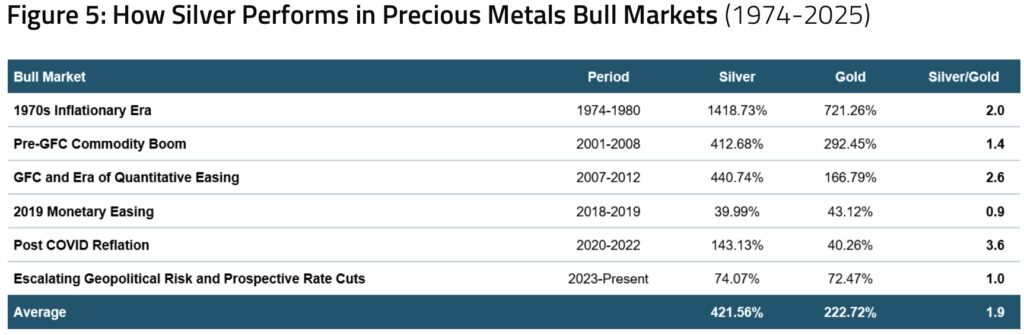

Unlike fiat currencies, gold and silver cannot be printed at will and are more likely to retain their value over time. In past precious metals bull markets, silver’s rally has been ~2x as large as gold, on average. This past outperformance is due in part to silver’s smaller market size and higher volatility, which amplifies price movements, and silver’s dual role as both a monetary and industrial metal, which adds extra demand. In the past, silver’s lower price relative to gold has attracted more retail investors and speculative capital, leading to sharper upside momentum.

With supply deficits deepening and demand intensifying across both industrial and investment channels, silver’s bull market appears well supported. We believe silver offers an attractive opportunity for investors seeking exposure to a hard asset with both growth and defensive qualities.

US May Begin Stockpiling Silver As Strategic Reserve

To continue listening to Nomi Prins discuss why this would make the price of silver skyrocket as well as her thoughts on gold, uranium, and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

JUST RELEASED!

To listen to Alasdair Macleod discuss what to expect next in the gold, silver and mining share markets and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.