Sprott says with the gold market trading above $2,500, this is exciting…

Gold Above $2,500

August 22 (King World News) – Paul Wong, Market Strategist at Sprott Asset Management: Since Friday of last week, gold has been breaking above the technical/psychological $2,500 level. As I mentioned to my colleagues, this appears to be another buying leg that is not explained by the usual market variables (currencies, yields, curves, spreads, CFTC & ETF, etc.). This week’s calculations indicate this is continuing. My best guess remains central banks or sovereigns, but it is unlikely China. In January, I wrote that the good news was gold would do very well in 2024, but the bad news was that we might not know precisely why, beyond “central banks and sovereigns”, and we would lack high-frequency data to track/confirm this development. YTD, gold is up 21.86% as of August 20, 2024.

Gold’s Bullish Cup and Handle Pattern

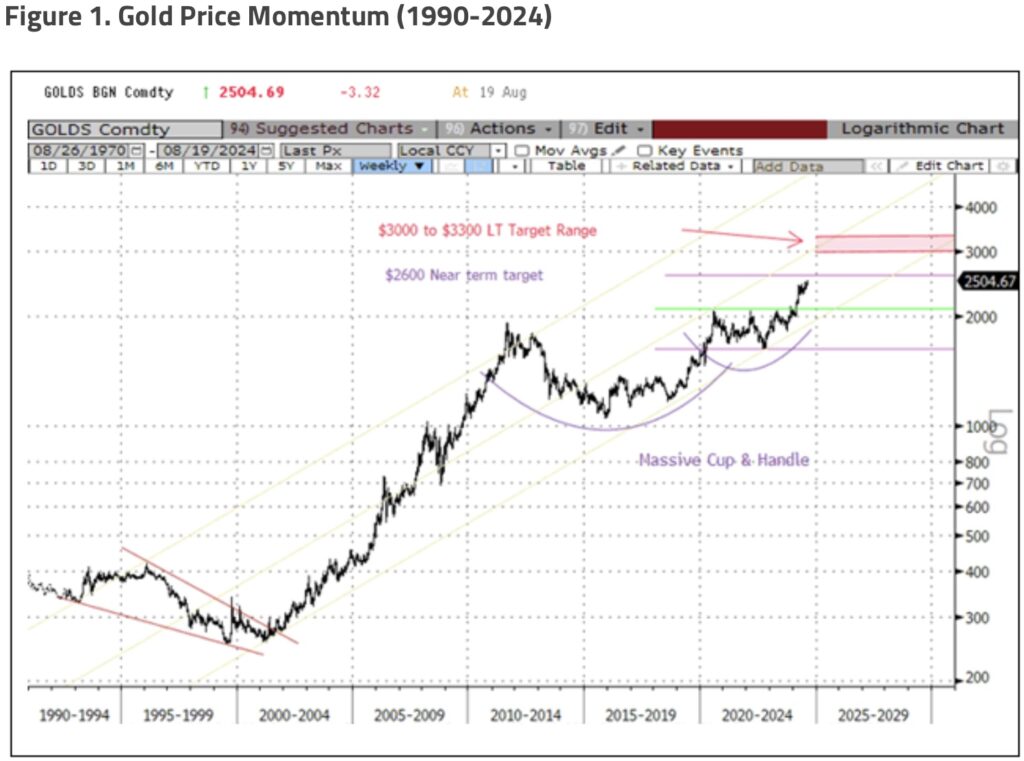

At the start of the year, gold bullion had one of the most bullish high conviction charts I have seen in a long time, with clear bullish patterns in the broad and micro pattern structures. Figure 1 highlights the main macro pattern: the cup and handle chart (purple lines). This chart stretches back 30 years in its development. The 1990s was a long, protracted bear market driven mainly by a significant U.S. dollar (USD) bull market and relentless central bank selling of gold…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

The 2000s’ spectacular gold run was driven by a major USD bear market and the debt expansion wave to bail out the housing bust and financial crisis (2008-2010). For the past 12 years, gold has developed a cup and handle pattern (a close cousin to the head and shoulders reversal pattern). The green line marks the breakout resistance level, and the upper purple line marks the $2,600 target level.

We are approaching the $2,600 with a lot of momentum. My best guess is that gold might hit the $2,600 level and consolidate for a bit before potentially advancing to the $3,000-3,300 range (shape and pace to be determined). The $3,000/3,300 range is based on where Fibonacci projection targets are clustering.

A Surge in Call Options on Gold Futures

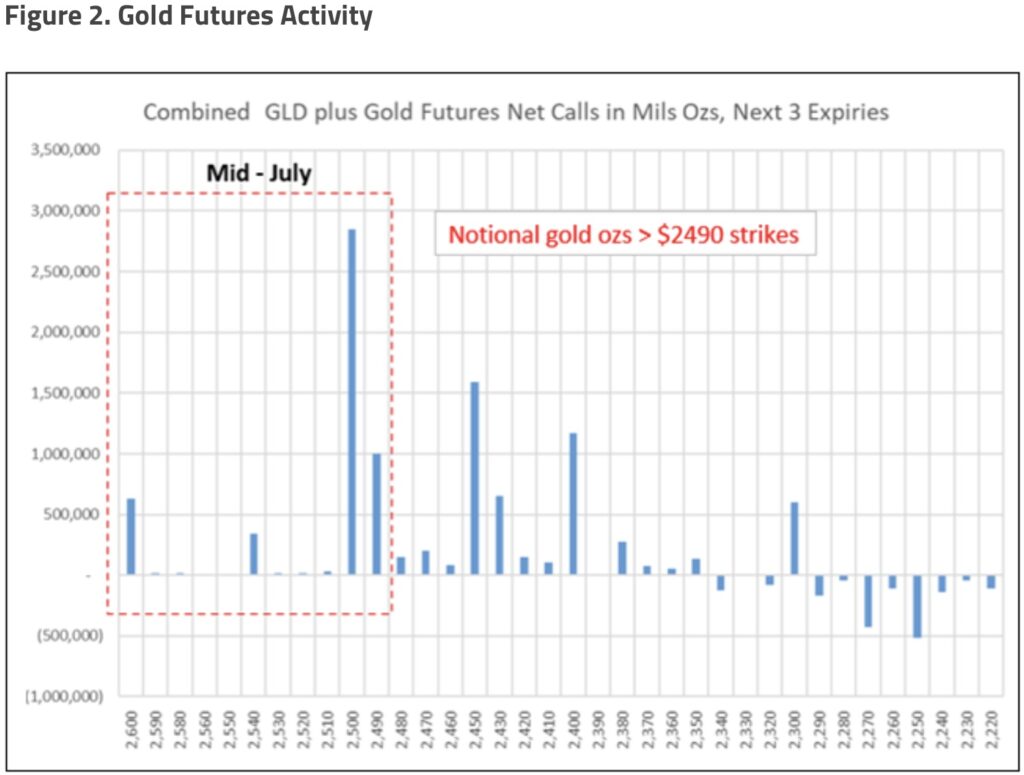

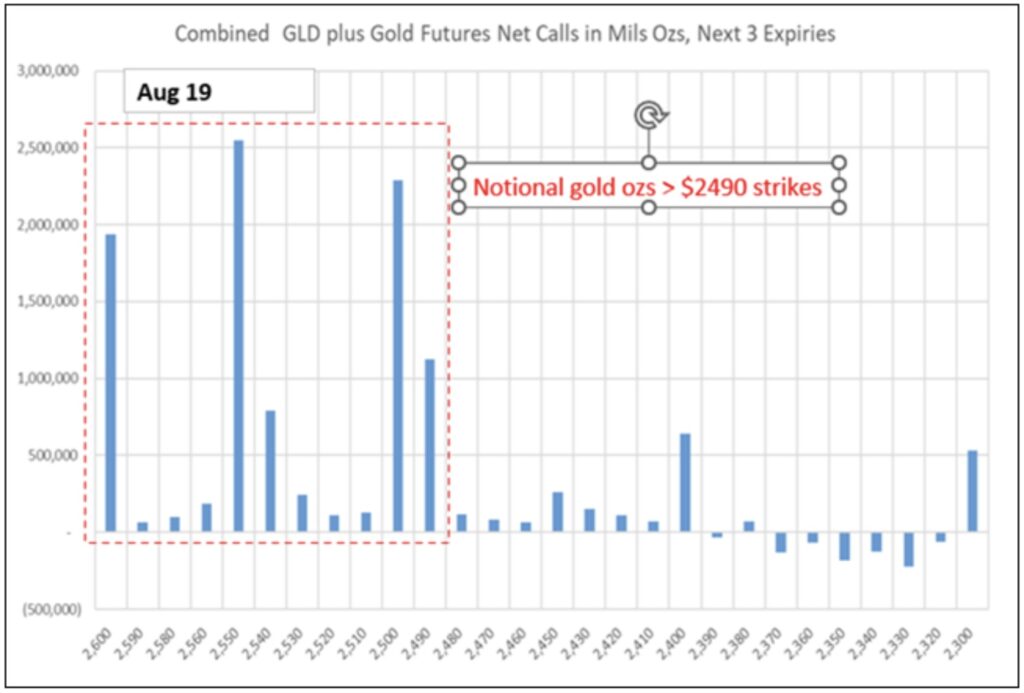

This year, I have noted the call wall plot of gold futures and GLD (SPDR® Gold Shares ETF). Figure 2 highlights the surge in call options with +$2,490 strikes since mid-July. There has been approximately a doubling of notional ounces with a +$2,490 strike from ~4.8 million ounces in mid-July to ~10 million ounces today (thus far). Gold-related calls have also notably rolled up and out (higher strikes and longer-dated = bullish). Last Friday’s (August 16) surge to the $2,500 level was likely due in part to option expiration effects.

Bottomline: Similar to past bullish runs, options activity has joined the fray and shown that they can significantly impact the gold price. If actual trading liquidity in gold becomes challenged, entry via options markets will have greater appeal.

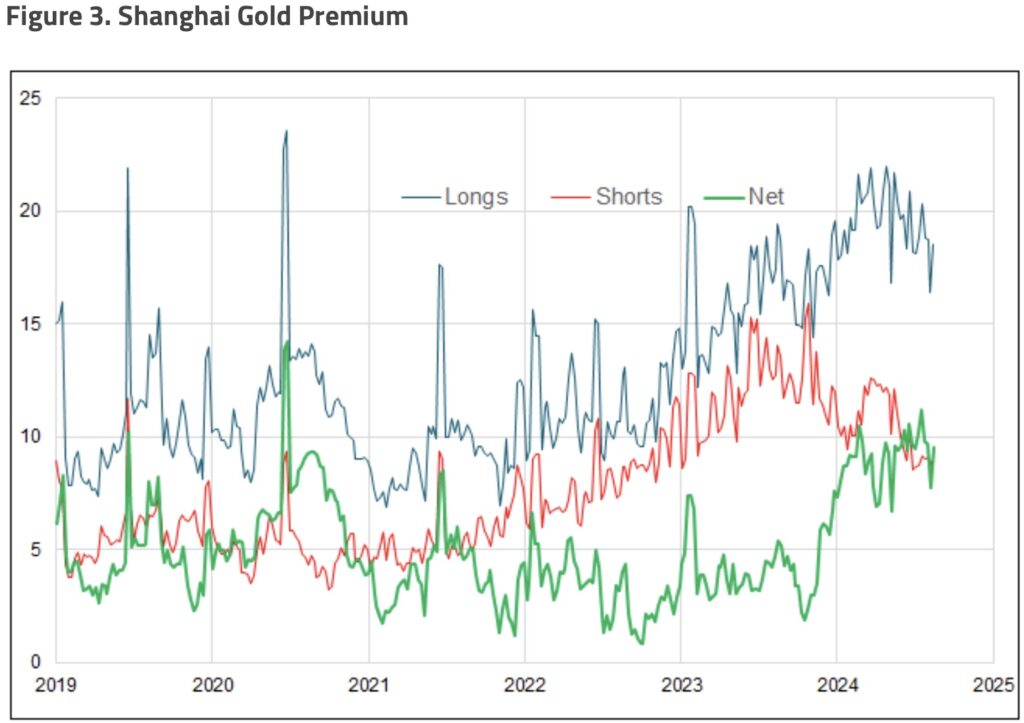

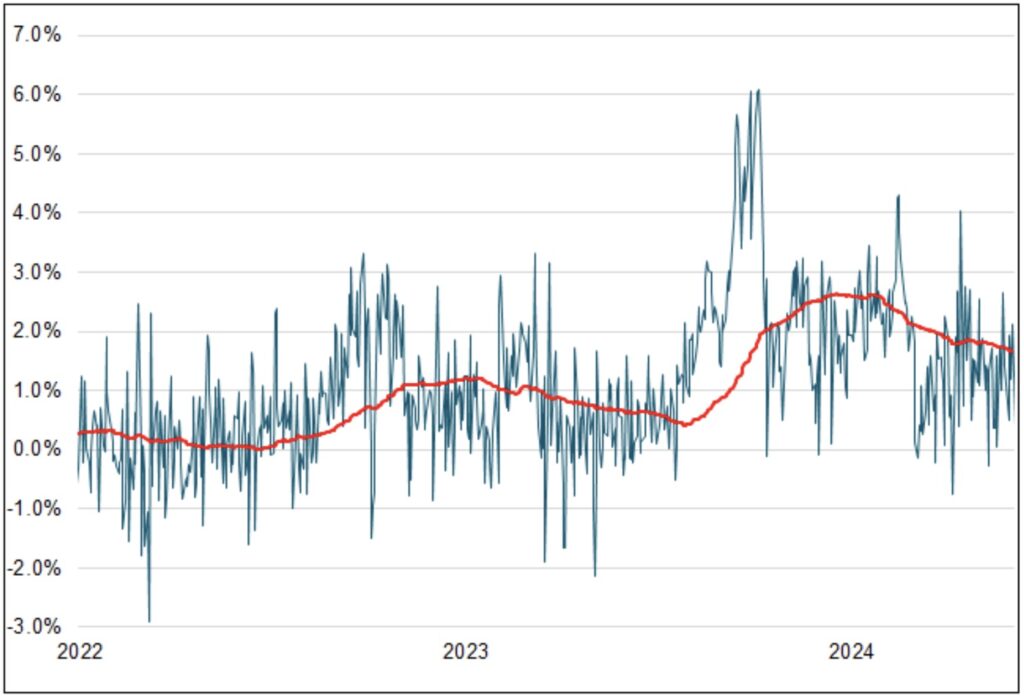

The recent price surge also does not appear to be driven by China. Figure 3 shows the Shanghai Gold Futures (longs, shorts, net) and the Shanghai Gold Premium, which were negative during gold’s latest run. While China has been far away the largest net buyer of gold since mid-2022, according to World Gold Council data, China accounted for about 25% of actual central bank buying. Many central banks are buying, creating multiple bid layers.

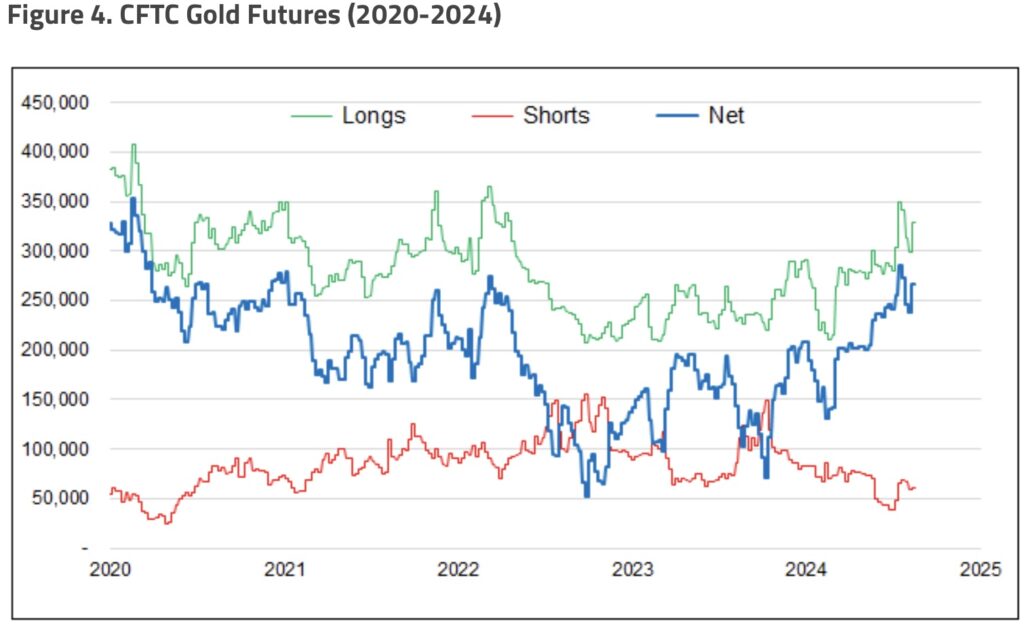

The last chart is a CFTC update. It appears that the degrossing and deleveraging have not only ended but have reversed to accumulation. Gold held in ETFs remains flattish to slightly higher. This potential source of weakness lasted two weeks. CFTC positioning relative to the past decade remains far from the upper levels.

Bottom Line

Gold Is Likely to Move Higher

We believe gold will likely go higher, with signs that the supply of “free-floating available gold held inventory” is drying up quickly (i.e., significant size sellers are nearly gone).

Egon von Greyerz

To listen to the powerful audio interview with Egon von Greyerz where he issues a dire warning for people in the US and around the world as well as discussing what people need to do to avoid having their money trapped and possibly confiscated and much more CLICK HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss his prediction for where the price of silver is headed,$3,000 gold and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.