The silver markets saw the highest weekly close in more than 11 years on Friday, but take a look at this…

Let me add one final thought about the increasing geopolitical tensions that have been ramping up recently. Gold is not rising because of wars or rumors of wars. Gold is rising because of the constant debasement of fiat money, which is how politicians and governments have stolen from the people since the beginning of time. It is theft through inflation. It is insidious, and it is the sole reason why the price of gold is headed many thousands of dollars higher. — James Turk

Silver Highest Weekly Close In 11 Years

April 14 (King World News) – James Turk: Friday’s big swing in precious metals prices may have left some heads spinning, Eric. But what happened is exactly the kind of volatility I said to expect in our interview last weekend.

I’d like to focus on this volatility, particularly in silver. It is a much thinner market than gold because its aboveground stock of physical metal is tiny compared to that of gold. This fact becomes increasingly significant as demand for physical metal becomes more important than the paper markets, which recurs from time to time and is a new and growing development now underway.

We see it clearly in gold because its price is rising while the paper ETFs are declining in size, which the promoters of those ETFs said wasn’t supposed to happen. But we also see it in silver with flows of Comex futures contracts exchanging to London over-the-counter transactions. What’s more, the uptrend in the silver price is giving us a loud and clear message. But let’s focus on Friday for a moment.

Silver had been climbing all week, and Friday began in Asian trading just like the rest of the week. Demand for physical metal was strong, so the silver price climbed throughout the day until London closed and the Comex took over.

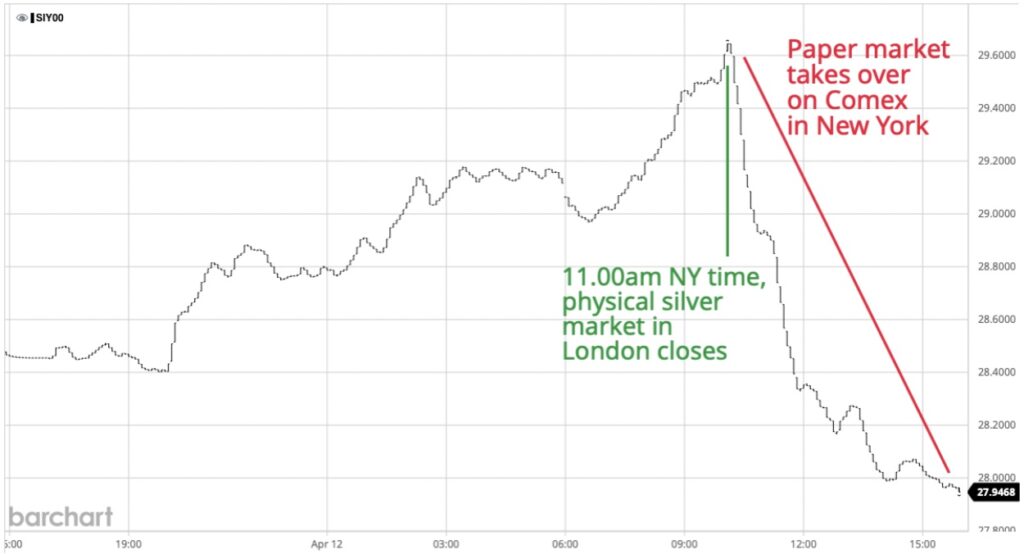

This chart then shows what happened next.

After Markets Closed In Europe & Asia The Silver Takedown Was Done In The Paper Casino That Is Comex

Admittedly silver is short-term overbought. It’s been that way for days. Using the Comex May contract, silver ended slightly up on Friday, and its price has now risen twelve consecutive days, an extremely rare occurrence. So the shorts and price manipulators saw the short-term overbought condition as an opportunity to strike.

This chart clearly illustrates that silver – and this applies to gold too – have two markets. These are of course the physical market that deals in real metal, and the paper market that deals in promises to deliver metal at some future date.

The bottom line is that it is easy to sell a promise, but you need to own metal if you intend to sell the real thing. Because promises are easy to sell, the paper market can be easily manipulated, and Friday is a good example of that. The problem for the shorts is that they don’t have all the metal they promised to deliver.

Once London closed, the price manipulators began selling. They then piled on until the end of the day when they started buying back their shorts at $28, more or less stabilizing prices.

My long-term silver chart shows why $28 is important. In fact, its importance goes back much further than this chart. Silver’s $28.255 close on Friday is the first weekly spot close above $28 since March 29, 2013. It signals to me, Eric, that despite the attempt by the shorts and price manipulators to paint-the-tape on Friday, silver’s bull market has taken another step forward.

Silver’s Bull Market Just Took Another Big Step Forward Punching To The Upside Of The Massive Multi-Year Reverse Head & Shoulders Formation

We can see on this chart circled in green three previous attempts to break above $28 – which is the key resistance level, not $30. So the question becomes, what lies ahead?

We can’t predict the future of course, but we know silver is undervalued on a fundamental basis, demand for physical metal is strong, and its chart pattern and long-term uptrend are bullish. And I’m not even mentioning any of the uncertainty everyone faces today. So it’s reasonable to expect higher prices. It’s a bull market.

But will the shorts and price manipulators try another overt manipulation of the precious metals like they did on a Sunday night in 2013 by slamming the paper markets?

Anything is possible of course, but I don’t think they will try it, Eric. It would be foolhardy for them to do so. It would just add to their problem of having more promises to deliver physical metal than they own.

The physical market is gaining the upper hand over the paper market. The trustworthiness of those never ending promises to deliver metal in the future are becoming doubted. More and more people are demanding physical metal, both gold and silver.

Let me add one final thought about the increasing geopolitical tensions that have been ramping up recently. Gold is not rising because of wars or rumors of wars. Gold is rising because of the constant debasement of fiat money, which is how politicians and governments have stolen from the people since the beginning of time. It is theft through inflation. It is insidious, and it is the sole reason why the price of gold is headed many thousands of dollars higher.

Billionaire Pierre Lassonde Predicts $19,000 Gold!

To listen to billionaire Pierre Lassonde discuss the wild trading in the gold market, what his predictions are for gold, the mining stocks, and much more CLICK HERE OR ON THE IMAGE BELOW.

Jim Sinclair’s Prediction Coming True

To listen to this timely audio interview with Alasdair Macleod discussing Jim Sinclair’s prediction coming true and the wild trading in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.