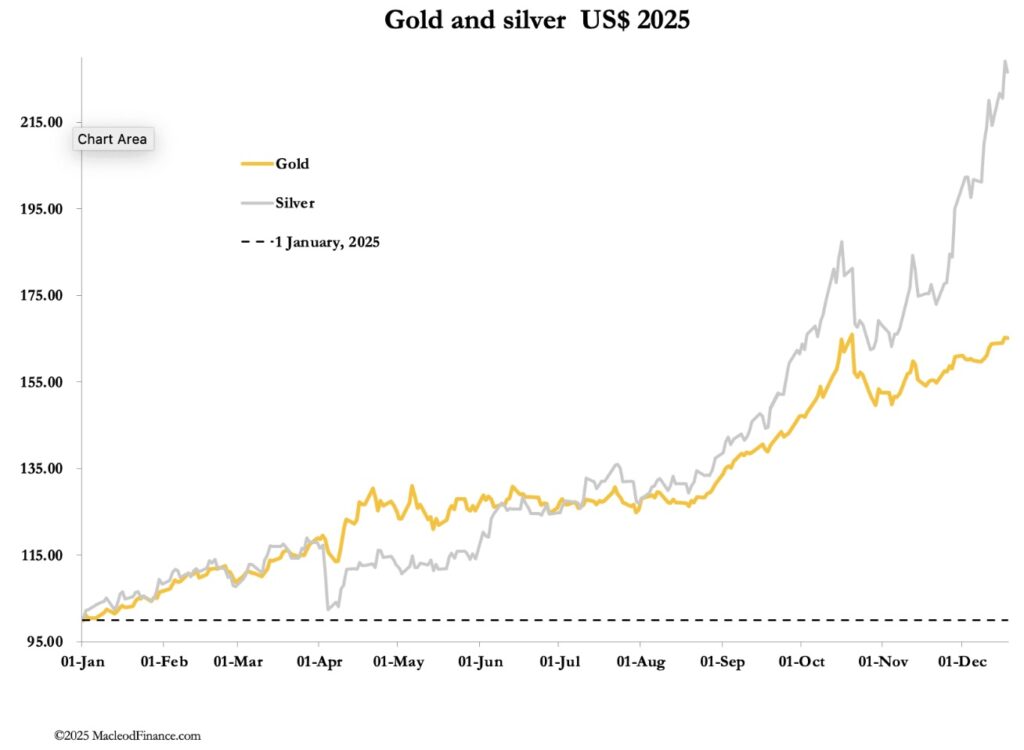

Today the price of silver and gold hit all-time highs. Take a look at what is propelling prices to record levels.

Gold and silver march higher…

December 19 (King World News) – Alasdair Macleod: Soaring silver’s upwards march is set to continue, given the ongoing systemic squeeze. Furthermore, gold threatens to make new highs, exacerbating a silver pricing crisis.

The background to a developing market liquidity crisis in derivatives is signalled by higher precious metal prices. It is a combination of liberation from long-term price suppression (silver, platinum, palladium, copper) and a rapidly deteriorating inflation outlook being signalled by gold.

Central bankers have a history of mismanagement of their currencies, so their current guidance that inflation is a receding problem could not be more wrong.

Gold and silver continued to rise this week but at a more moderate pace. In European trade this morning, gold was $4331, up $31 from last Friday, and silver at $66.05 is up $4.10 on the week. Volumes were moderate on Comex, but open interest in silver barely changed, while it increased by about 30,000 contracts in gold on preliminary figures.

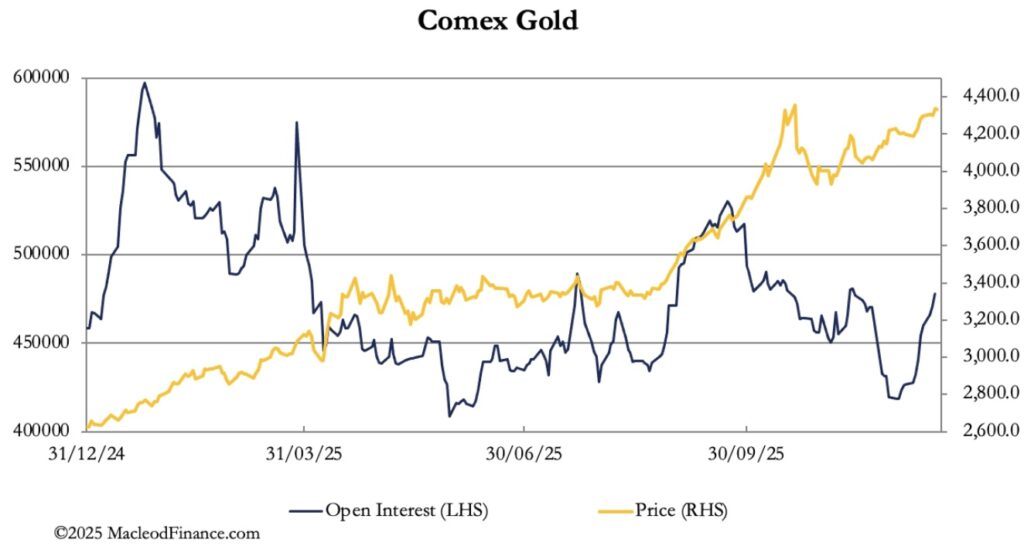

The next chart shows gold’s open interest relative to the price:

The level of open interest tells us that whatever chartists might say, gold is far from overbought. Yes, there has been a recent increase in speculative interest, perhaps reflecting dying hopes of a more prolonged and deeper correction after the all-time highs in late-October. But the principal price driver is a realisation in the bullion banks that the outlook is for higher prices and that they must not be short.

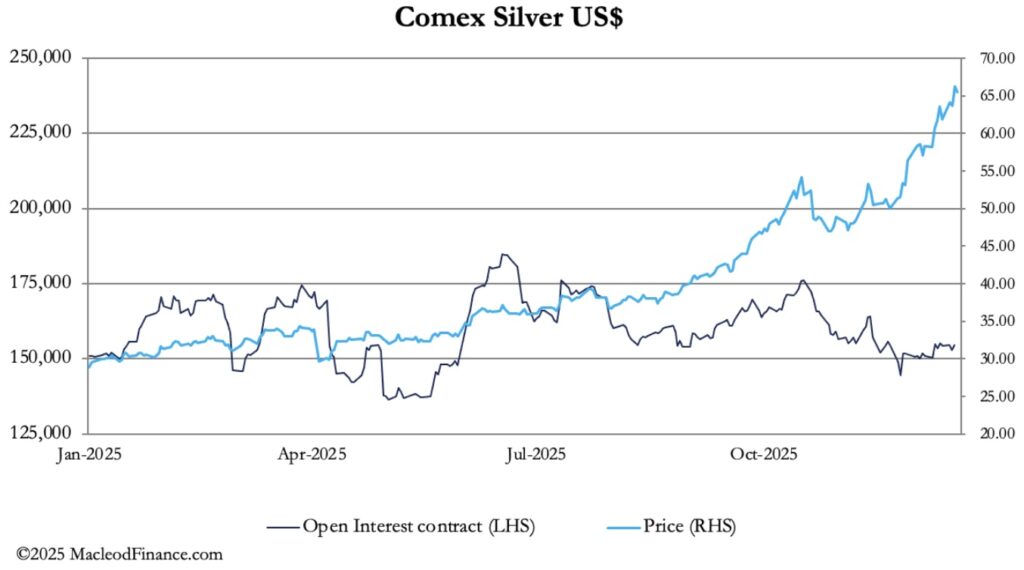

While there is some physical liquidity in gold it is not the case with silver, which is our next chart:

Despite the price soaring higher and even hitting an all-time high of $66.85 on Wednesday and trading at over $68 in Shanghai, Comex open interest remains subdued. In other words, there is very little speculative demand generated by persistent moves into all-time highs. Open interest began declining in mid-June when the price was $36. Why speculators are missing out on silver’s obvious price momentum is a mystery, even when it is obvious that there is no physical liquidity anywhere.

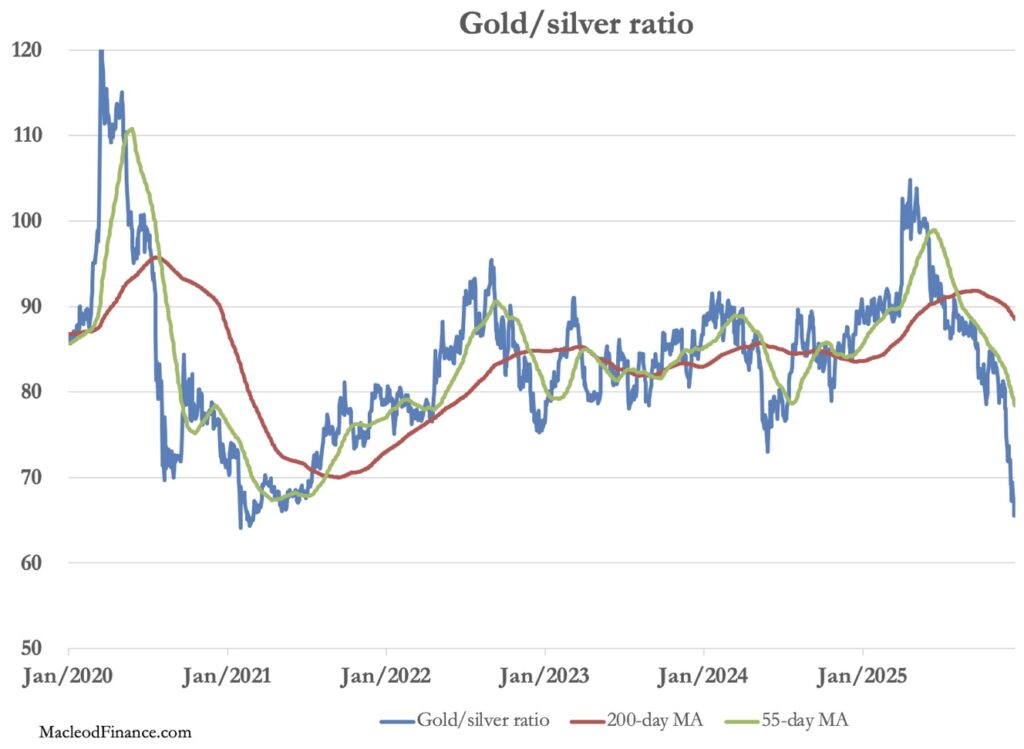

Effectively, silver is bid only, meaning that there is no price available to buyers. The shorts are simply refusing to sell and have reached their credit limits. The consequence for the gold silver ratio has been dramatic:

Will it break down through the low at 64 in January 2021? The answer is almost certainly yes. Lease rates in London are running at 7%, and Comex is close to backwardation. And with China restricting physical silver exports in the new year with a new licencing scheme, this short squeeze is far from over.

Anecdotal reports of long queues of retail buyers in places like Singapore tell us that Asian savers are putting an additional squeeze on industrial demand worldwide. And there is a noticeable trend for silver prices to rise during Asian trading hours relative to European and American times.

Turning to gold, it appears to be a more orderly market with prices now rising along with open interest on Comex. Increasingly, momentum traders appear to be buying into the rising trend and appear increasingly confident of new highs in the coming weeks. It will continue to be important for bullion banks to maintain level books, short on Comex and long in London. ETF demand is also likely to pick up. These are the factors leading to gold prices rising in a more orderly fashion perhaps than in scarce silver.

At least, that’s the theory and a conventional explanation. But the reality is less to do with whether gold is in a bull market, and more to do with declining purchasing powers for currencies. The major central banks, with the possible exception of the Bank of Japan are telling us that inflation will be a diminishing problem in 2026, citing prospects of economic recession which must be avoided at all costs. But these are the “experts” which experience tells us are always getting it wrong.

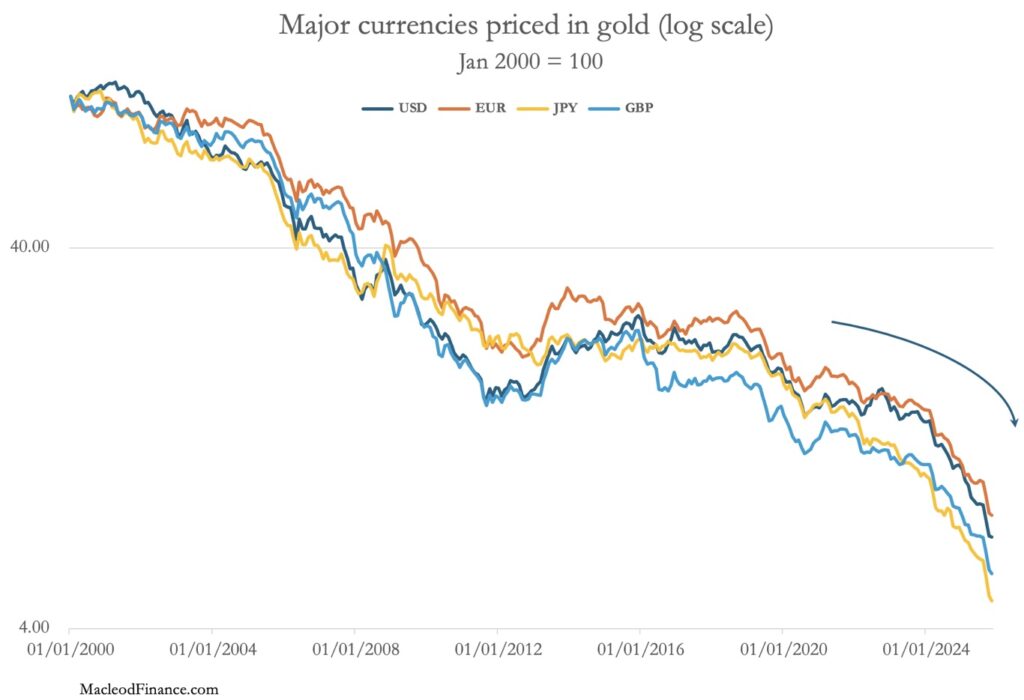

It is hardly surprising, when the Fed’s FOMC and the BoE’s MPC almost never cite money supply as a major factor determining prices on a six-to-nine-month view. Gold, which is real money while fiat currencies depend on their value mainly on faith tells a different story:

The collapse in purchasing power for these major currencies since the turn of the century has been alarming. It’s not just the dollar. Over 25 years the worst performing currency is the Japanese yen, ¥100 yen in 2000 now worth only ¥4.70. This is followed by sterling, £100 now worth only £5.60, $100 becomes $6.95, and €100 becomes €7.95.

Worryingly, the downward trend for all these currencies is accelerating, pointing to an imminent crisis. It is the background for a very difficult 2026, with current inflation forecasts wildly optimistic. Do not be surprised to see inflation close out 2026 significantly higher than the post-covid inflation spike, which no central banker expected.

But then so long as these currencies’ central bankers believe that gold is a pet rock and just an historical oddity, then we shouldn’t be surprised that they always get inflation prospects wrong. To listen to Alasdair Macleod discuss the soaring price of silver as well as the action in gold and the mining stocks CLICK HERE OR ON THE MAGE BELOW.

ALSO JUST RELEASED!

Look At This Year End Price Target For Silver CLICK HERE.

Look At This Shocking Inflation Over The Last 5 Years CLICK HERE.

Look At This Jaw-Dropping Setup For Silver & Gold CLICK HERE.

Silver Futures Hit $67 All-Time High As Gold Closes In On Record High CLICK HERE.

This Will Send Gold & Silver Mining Stocks Screaming Higher CLICK HERE.

This Sums Up The Situation In The Silver Market Beautifully CLICK HERE.

ECONOMY IMPLODING: More Than A Million Layoffs In America CLICK HERE.

This Is All That Needs To Be Said About The Recent Gold & Silver Trading Action CLICK HERE.

This Is Why The Price Of Silver Is Poised To Skyrocket CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.