Silver futures have now surged above the $80 level, plus this major bull market is about to kickoff!

Silver Bull Market Just Getting Started

January 6 (King World News) – Graddhy out of Sweden: SGR [Silver vs Gold Ratio] now has a massive, historical breakout in the making, above a 15-year (..!) purple expanding falling wedge.

Plus, now starting the climb up the right side of the red 45-year rounded bottom/arc.

King World News note: Silver Has Just Begun An Explosive Phase Of Outperformance vs Gold. The Best Is Yet To Come For Silver!

This chart told us that silver was about to move big.

Been saying for years that SGR, which is the reverse GSR [Gold vs Silver Ratio], has a cleaner pattern than GSR. Said recently that the “The chart is now ready.”. And we now finally have the huge breakout in the making.

Take in that it is a breakout from a 15-year (..!) expanding falling wedge. Usually a very bullish pattern.

And, do note that this massive breakout is a starting move for this chart below, and not an ending move. We will still have small and big pullbacks though of course.

It is vital to follow the right people.

Venezuela

Peter Boockvar: Quite the extraordinary weekend and it wasn’t just in Venezuela, what is going in Iran too is highly noteworthy. It’s always a good day when a despot goes down but I’ll leave the geopolitics/legalities to others. I did think this piece from my friend Tracy Shuchart laid out the real reasons why we did what we did with Maduro and it wasn’t because of drugs and maybe something other than oil.

Crude Oil Making A Major Bottom

With respect to oil, we know that Venezuela has the world’s largest reserve base of about 300 billion barrels but there is one thing to have it and another to lift it out of the ground. I’m sure you read about all the stats over the weekend and I will lay out what I read too here. Off a current production level of about 960k barrels per day (could dip from here before it reaccelerates upon the placement of a stable government), it could take between 3-5 years and about $10 billion of investment per year to bring production back to about 2mm barrels and possibly up to 10 years to get Venezuelan production back to 3mm barrels, where Venezuela was pre Hugo Chavez.

With global crude demand rising by about 1mm barrels per day, the world will grow into any increase in Venezuelan oil production and in the context of a world that currently produces about 105 million barrels per day, an increase in Venezuelan oil production over the coming 10 years shouldn’t have that much of an impact on global supply and demand, though we’ll of course take more supply.

Also to think about, Venezuela is a member of OPEC+ and OPEC+ can of course tweak overall production quotas to manage what comes from Venezuela in the coming years. OPEC+ over the weekend said they will keep quota levels unchanged for Q1 and said it’s too early to compute what could change with Venezuela. As OPEC+ production levels have not kept pace with the recent quota increases, it appears that Saudi Arabia and the UAE are really the only two members with spare capacity currently anyway.

US refiners rely heavily on heavy, sour crude and will benefit from buying that which Venezuela produces in the coming years but which takes a higher breakeven cost relative to some light, sweet basins around the world. US refiners currently get most of this type from Canada.

Bottom Line

Bottom line, the Venezuela news does not change my view point that in the coming few years, the price of oil is dirt cheap and we remain long oil and natural gas stocks. What happens past the next few years, we’ll reaccess then.

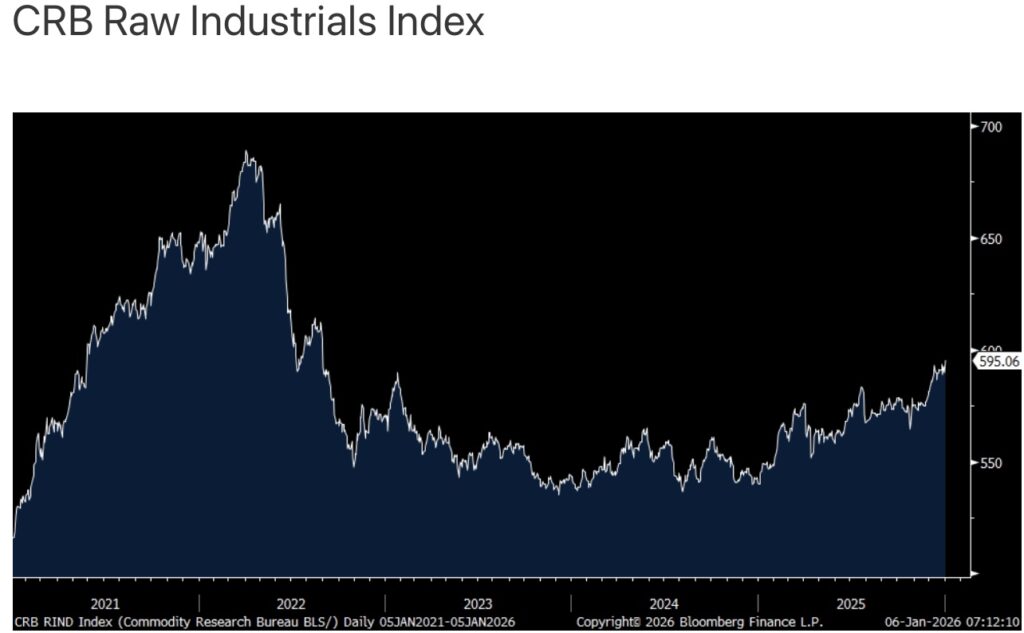

With respect to industrial raw material prices, the CRB raw industrials index yesterday was up 1% to the highest level since August 2022 helped by another record high in copper. Copper that goes into just about everything made, especially the electronics in our hands, the data centers being built and the grids that need to power them.

JUST RELEASED!

To listen to Alasdair Macleod discuss what to expect for gold, silver and the miners in 2026 CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED!

This Man Predicted Silver Will Soar Above $100 In A Matter Of Months CLICK HERE.

It’s Not Just Gold & Silver Skyrocketing, The Stock Market Is Going To Crash CLICK HERE.

Silver Sparkles & Gold Shined In 2025 But Look At What’s Ahead In 2026 CLICK HERE.

Silver, And What Stood Out To Me The Past Two Weeks CLICK HERE.

Here Is The Remarkable Big Picture Setup For Gold As We Head Into 2026 CLICK HERE.

CNBC Antics About The Silver Market CLICK HERE.

Turnaround Tuesday As Silver & Gold Soar, But Take A Look At This… CLICK HERE.

Black Monday For Gold, Silver & Platinum Markets. Here Is Where Things Stand CLICK HERE.

Costa – Here Is The Big Picture After Silver & Gold Prices Tumble CLICK HERE.

Tavi Costa – What A Week As Silver Explodes To The Upside! CLICK HERE.

Historic Silver Short Squeeze Sends Price Soaring Over 7% On Friday! CLICK HERE.

An Astonishing Christmas Prediction From Legend Richard Russell CLICK HERE.

EXPECT WAR: Early Days For Gold & Silver Bull, Especially The Miners CLICK HERE.

Hansen – This Is What Is Really Happening With Gold Market CLICK HERE.

$15,000 TARGET: Volatile Gold & Silver Trading But Look At What Is Coiled To Skyrocket CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2026 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.