Russian buying has stunned the gold market and kept a strong bid for the Metal of Kings with the futures price continuing to hold well above $2,500.

Within hours King World News will be releasing a powerful audio interview with Nomi Prins, who has given speeches to the World Bank, IMF and Federal Reserve. Her predictions about where the price of gold is headed along with silver as well as many other stunning predictions will keep global listeners on the edge of their seats. Also, Alasdair Macleod’s latest audio has now been released (link below).

Russia steps up gold purchases

September 6 (King World News) – Alasdair Macleod: While the resilience of gold and silver prices puzzles western capital markets, the Asian hegemons take a different view, continuing to dump fiat for gold. Now Russia is investing her surplus oil revenue.

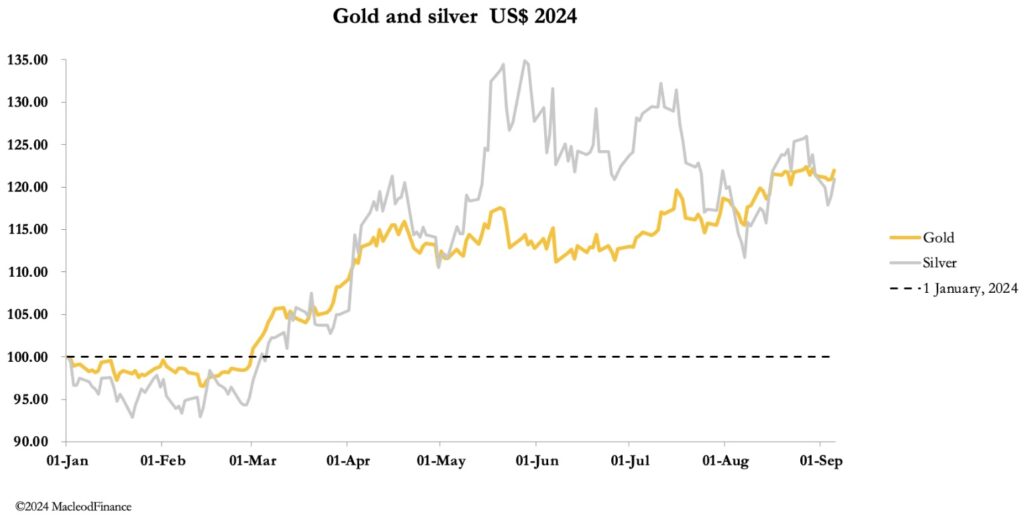

While gold and silver are yet to break into new high ground, the resilience of gold this week has been remarkable for its firm undertone, just under its all-time high. And silver is showing signs of bottoming out after a decent correction. In European trade this morning, gold was $2518, up $15 from last Friday. At $28.80, silver was down just 5 cents. Volumes in both Comex contracts were moderate.

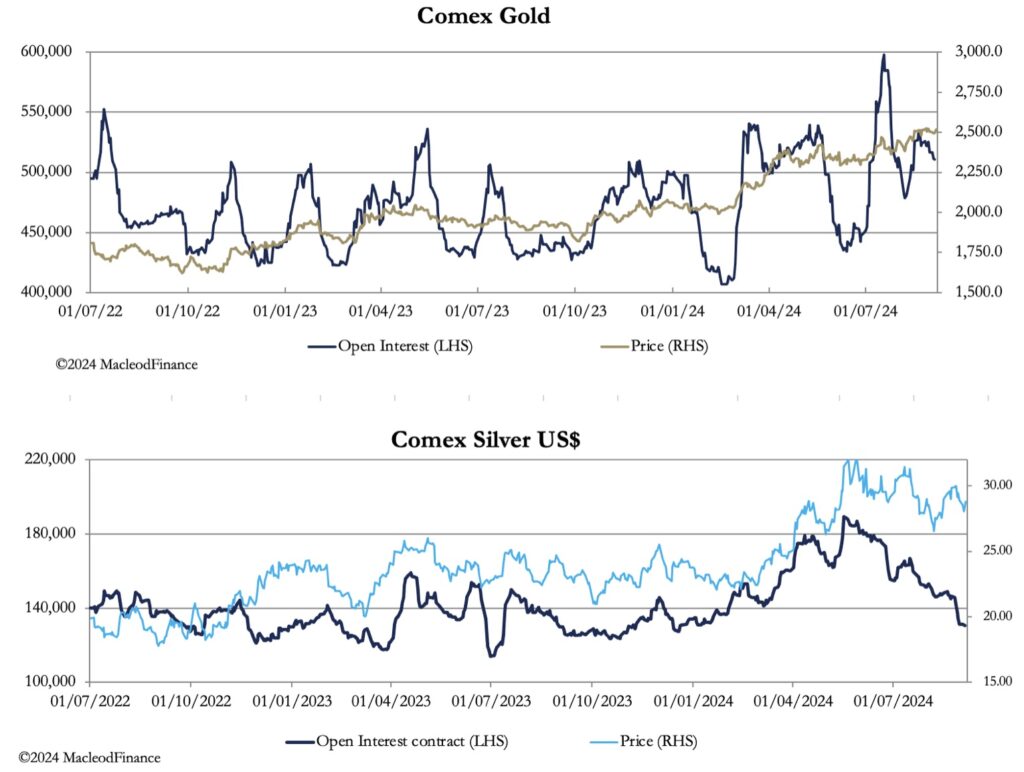

Comex Open Interest declined in gold to little more than its long-time average, a healthy development. In silver, Open Interest is considerably below the long-term average. These are our next charts.

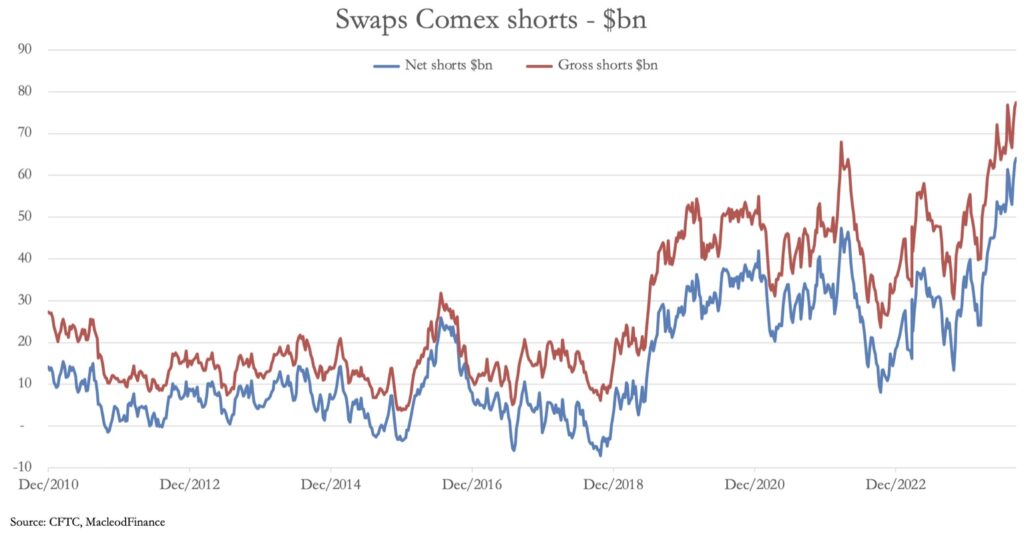

In both cases, when Open Interest declines, prices don’t decline much with it. Clearly, attempts by the shorts to reduce their liabilities are failing, as the next chart for the financial position of the Swap category in the gold contract demonstrates:

Despite the fall in Open Interest from a recent high of 598,013 contracts on 18 July, the Swaps (mostly bullion bank trading desks) have record gross and net liabilities, shouldered between 19 longs and 26 shorts. That’s a combined loss on the short side averaging $77.4 billion between 26 traders, averaging nearly $3bn each. This is why I think that a higher gold price could lead to one or more traders needing rescuing.

Asian and central bank demand continues apace, keeping London and Comex short of physical liquidity. Comex was never intended to be a delivery market, yet according to my records, since late November 2020 when stand-for-deliveries became a common occurrence having been rare, some 2,136 tonnes of gold have been stood for delivery, and 24,072 tonnes of silver. These are staggering figures, and do not include exchanges for physical, a significant but unknown portion of which were swapped for London forward contracts and then delivery taken.

The premium on gold in Shanghai today is minimal. But this is not where the big buyers in the form of banks operate, only buying in Shanghai when there is a discount. The banks back their gold account liabilities by buying physical gold in western markets, or by not withdrawing purchased bullion from the Shanghai Gold Exchange.

For Chinese banks and investors, the strength in the yuan has been keeping the gold price down, and lower yuan interest rates make gold even more attractive. The yuan’s chart (invested scale) is below:

It appears that Russia is adding to her gold holdings as well. According to the Russian news agency Interfax, Russia is increasing her purchases of gold to RUB 8.2bn daily, the equivalent of over 36,000 ounces financed by a surplus in oil revenues. This is a clear signal that Russia prefers holding gold to fiat currencies, a view echoed by China with respect to the dollar.

And lastly, an update on the technical chart, which has gold consolidating at the upper trend line of a bullish flag:

***To listen to Alasdair Macleod’s just released audio interview discussing the Russian gold buying along with other central banks and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.