With oil surging nearly 3.5 percent, today a legend in the business sent King World News a powerful piece discussing ominous warnings from the IMF and billionaire Paul Singer that have dramatically increase fear levels.

From Art Cashin's notes: "Greece – Not Quite A Reassurance – The IMF head raised a few eyebrows with a new interview:

“A Greek exit is a possibility,” Lagarde told the German newspaper in an advance extract of an interview due to be published on Friday. She said such a scenario would not be “a walk in the park” for the Eurozone but would “probably not be an end to the euro,” she said.

Lagarde also said it is very unlikely that a deal between Greece and its creditors could happen in the coming days. “It is very unlikely that we will reach a comprehensive solution in the next few days,” Lagarde said. “[There] is a vast field to plow,” she added.

The IMF chief noted that after positive signs from Athens about 10 days ago, talks have stalled during the past week and warned that no loans will be disbursed if there is no reform agreement in place. “We have rules. We have principles. There cannot be a half evaluation. This evaluation cannot be rushed.”

With this in mind, the paper argued it is practically impossible to have a disbursement of the rest of the funds by the end of June because this would require an agreement between Athens and all the institutions.

Another Strong Caution – Another large hedge fund manager has come out to call the sovereign bond markets around the globe a massive short target. Here's a taste courtesy of CNBC:

Billionaire investor Paul Singer says he has spotted the next big thing to bet against: bonds.

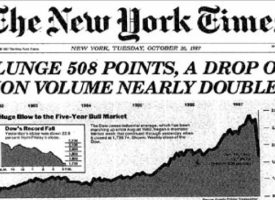

"Today, six and a half years after the collapse of Lehman, there is a Bigger Short cooking. That Bigger Short is long-term claims on paper money, i.e., bonds," Singer wrote in a letter to investors of his hedge fund firm Elliott Management obtained by CNBC.com.

"Bigger Short" is a play on "The Big Short," the book by Michael Lewis describing how a tiny group of investors made huge sums of money for their contrarian bets against mortgage-backed securities before the collapse of the housing market in 2007 and 2008.

"Central bankers have chosen, and doubled down on, a palliative (super-easy money and QE), which is unprecedented and extreme, and whose ultimate effects are unknowable," Singer wrote of governments stimulating markets, in part through the purchase of bonds.

Consensus – Could be a rumormongers delight as a potential Greek deadline looms next week. Monetary base is not growing so market is doing its own tightening ahead of the Fed. Big rebalance due on the bell, as previously noted. Stick with the drill – stay wary, alert and very, very nimble.

***ALSO JUST RELEASED: Former U.S. Treasury Official Dr. Paul Craig Roberts Warns Black Swans Will Engulf The World: "It's A Perfect Storm" CLICK HERE.

© 2015 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.

The audio interviews with Gerald Celente, Eric Sprott, Robert Arnott, David Stockman, Chris Powell, Andrew Maguire, Rick Rule, Bill Fleckenstein, John Mauldin, Michael Pento, Egon von Greyerz, Dr. Paul Craig Roberts, James Turk, Dr. Philippa Malmgren, Marc Faber, Felix Zulauf, John Embry and Rick Santelli are available now and you can listen to them by CLICKING HERE.