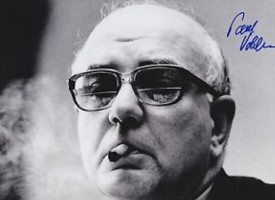

As we approach the end of the first week of trading trading in June, today the top trends forecaster in the world, Gerald Celente, discussed the gold bull run, the World Bank, the Fed, China, Morgan Stanley, the global economy and more.

The Gold Bull Run

June 6 (King World News) – Gerald Celente: “Back in 2005, when gold was $421 per ounce, we alerted Trends Journal subscribers to get ready to ride the “Golden Bull: Once gold breaks past the magic $500 per ounce mark… it will push gold beyond the 1980’s high of $885 per ounce.”

On target, gold had a steady rise, peaking at $1,917 per ounce in 2011. Subsequently, when prices slumped to the mid $1,000 per ounce range in 2015, we had accurately forecast that prices bottomed out and that the next “Gold Bull Run” would begin when gold breaks above $1,450 per ounce…

BONUS INTERVIEW:

Mag Silver Co-Founder says this company may have just found the

source of Arizona Mining’s massive $1.3 billion Taylor

Deposit CLICK HERE OR BELOW:

Considering weakening economic fundamentals and how central banks will address them — from Australia cutting interest rates to new lows, to China inventing money pumping schemes to artificially inflate falling equities and its sagging economies with cheap money — that breakout point is on the near horizon.

GLOBAL RECESSION

In the U.S., despite relatively strong economic data, bond markets are signaling a sharp slowdown. With the 10-year Treasury down well below yields on the three-month Treasury, the inverted yield curve has preceded both interest rate cuts and recession.

Indeed, in our 27 March Trend Alert we warned, “Fed Can’t Wait: Must Move Now.” With negative economic data rolling in from nations across the globe, on 30 May, U.S. Federal Reserve Vice Chairman Richard Clarida said the Fed was “very attuned” to those indicators and that it would consider “accommodative” monetary policy.

On 3 June, James Bullard, head of the St. Louis Fed, citing a global economic slowdown, low inflation and trade war risks, said lower interest rates might be “warranted soon.”

The next day Federal Reserve Chairman Jerome Powell signaled the Fed would cut rates if economic conditions worsened.

And worsening they are. U.S. manufacturing output has fallen for three of the last four months, reflecting the demand for products is weakening. On the employment front, ADP reported that only 27,000 new jobs were created in May, the fewest since March 2010.

This week Morgan Stanley warned of a “litany of downside risks we see for markets.” Indeed, Stock ETFs shed a record $20 billion in May. Fearing deteriorating economic conditions, U.S. junk bonds suffered $6.5 billion in outflows.

On the Emerging Markets front, for five consecutive weeks, investors have been pulling funds from EM stocks, totaling $7.8 billion in outflows.

WEAK NUMBERS

The eurozone’s Purchasing Managers Index hit a two-month low in May, dropping to 47.7. Below 50 indicates contraction.

In China, manufacturing productivity fell to a 10-year low, driving its PMI down to 49.4 from 50.1.

From Brazil to South Africa, nations are slumping in recession. The World Bank warned of “a deepening slowdown in global trade, and sluggish investment in emerging and developing economies.”

TREND FORECAST:

In an effort to artificially stimulate equities and economies with monetary methadone, nations will in effect devalue their currencies, thus pushing investors to seek safe-haven assets such as gold.

As we have long noted, gold must first pierce the $1,385 an ounce mark to hit the $1,450 break out point, which will then spike gold prices above their 2011 highs.

Don’t forget to read Art Cashin’s remarkable piece titled A Day The World Will Never Forget by CLICKING HERE.

***Also just released: WTF? Citi: Gold “Coiling” For Explosive Move Higher, Possibly $1,700+ CLICK HERE TO READ.

© 2019 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.