Today Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, communicated to King World News that a major market is about to break and it will fuel gold’s rise a new all-time highs.

Another Gold Bull Catalyst

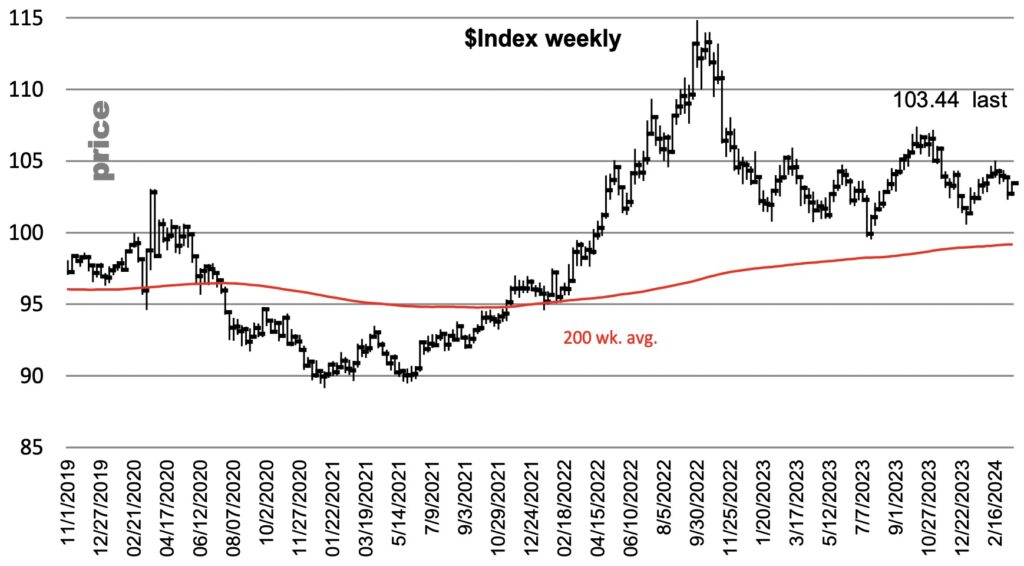

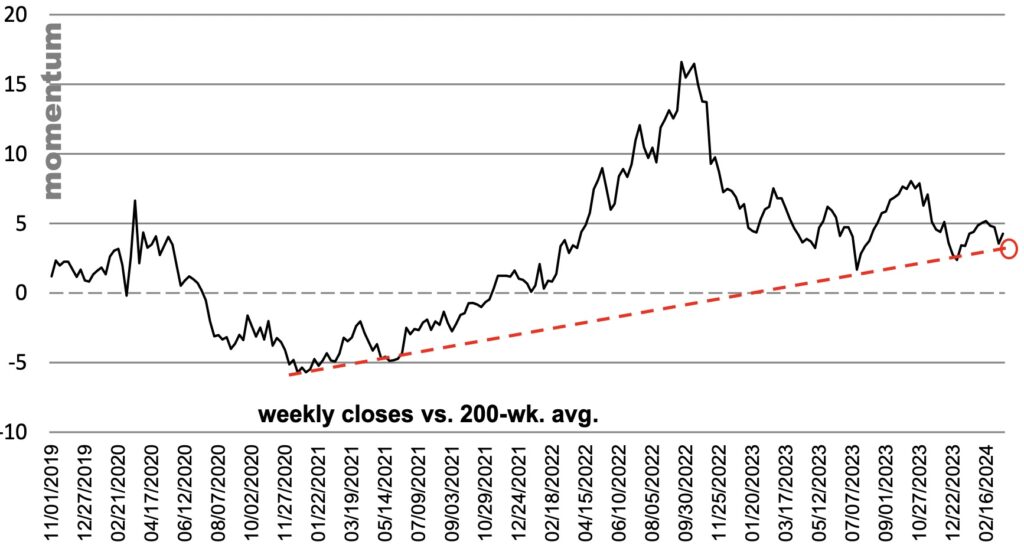

March 18 (King World News) – Michael Oliver, Founder of MSA Research: Dollar Index: long-term momentum. Here we’re using the 200-week oscillator, similar to a 4-year moving average, very long term.

There are other, lesser technical factors that have slipped into negative status, especially following that rally late last year that faked out many into thinking upside was “on again.”

If you try to plot a multi-point uptrend from the lows on the price chart back in early 2021, you can’t find a viable one.

But on momentum we find a credible one. And the recent drop once again used it for support.

There has been a “clustered” use of that line since last summer, which is usually not a good sign, as it indicates an inability to lift off. All it can do is grope the line. You do not want to drop now and close a week below the price lows seen two weeks ago (102.35). That would make momentum crack its structure. Because that trendline on momentum and the 200-week avg. rise a bit every week, breakage of that red line on momentum gets easier every week.

WATCH 102.35 LEVEL:

US Dollar Index In Danger Of Breaking Down

The Great Lie About The US Dollar & Gold

And as we’ve reminded people several times before, the inverse correlation of gold to the Dollar Index is sometimes fairly clear, but also over great spans of time it’s quite “iffy.” Not even a good coin toss.

For example, if you only referenced the Dollar Index going back to its monthly close in December 2015 (when gold was making its bear low monthly close), the Dollar Index’s price was 98.63. Its current price is 4.9% above that level. So you’d think gold has been doing nothing since then too, and perhaps even declining, right? Gold is more than double its December 2015 monthly close. King World News note: The anti-gold propagandists still throw around the phrase “a strong US dollar will weaken the gold price.” What a bunch of bullshit. Gold is rising vs all garbage fiat money.

Michael Oliver continues: The Dollar Index, in broad strokes, was certainly not an investment-grade factor to have used in determining whether to have been long gold.

However, we do suspect/expect that if the Dollar cracks this structure (and there are also other long- term momentum triggers not far below the Dollar), due to the dynamics of the subsequent downside, the Dollar will likely provide some wind at gold’s back. To receive the special KWN discount to subscribe to Michael Oliver’s internationally acclaimed MSA Annual Research which is used by investors and professionals all over the world CLICK HERE.

Alasdair Macleod’s latest audio interview discussing the short squeeze in the silver market has just been released CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.