Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, just warned King World News that investors need to act quickly!

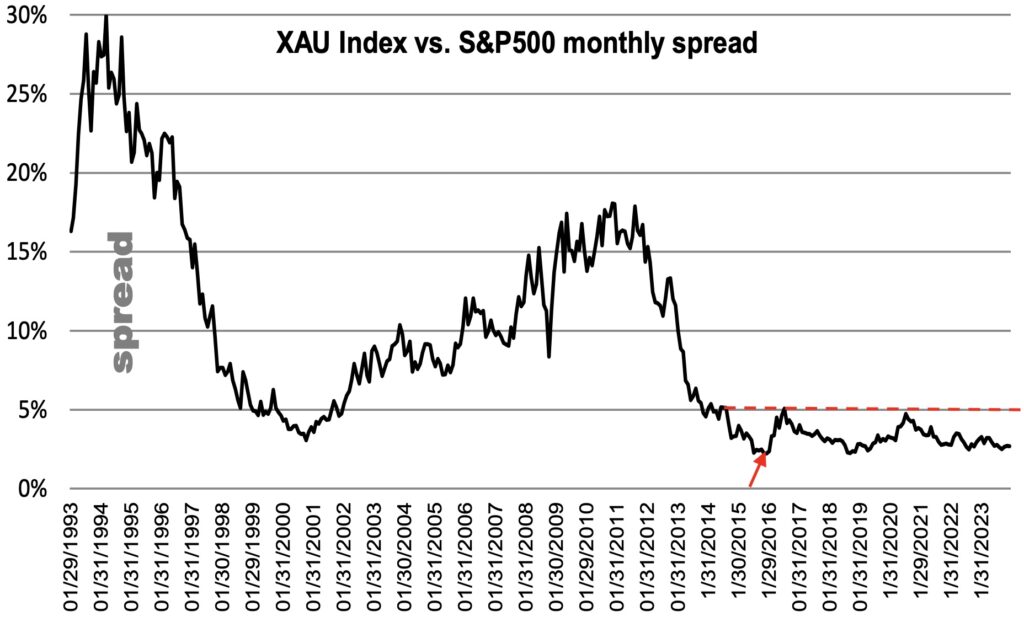

Relative performance of gold miners vs. the S&P 500

December 27 (King World News) – Michael Oliver, Founder of MSA Research: The XAU Index is the Philadelphia Gold and Silver (miners) Index.

Want to make your financial planner choke on his martini olive at the upcoming New Year’s party? Then tell him this.

In late 2015 gold and the miners produced their bear market price chart lows (red arrow). Also in late 2015 the miners’ relative performance (via the XAU Index) produced a relative performance/ spread chart low vs. the stock market. And that spread chart low was just a bit below the low performance readings had XAU produced in 2000 (when the stock market was topping and gold was starting its next bull trend). Also at that time in late 2015 and very early 2016 the S&P 500 was producing a corrective low. Both markets turned up from those points, and you know what? The XAU Index has beaten the S&P 500 since!

Yes! The low spread reading of XAU vs. the S&P 500 in December 2015 was 2.216% (meaning XAU’s price expressed as a percent of the S&P 500’s). Since that low the spread has twice reached up to the 5% level. Meaning from the bear low to its multi-year highs, XAU doubled its performance vs. the S&P 500 (the same as buying a stock at $2.216 and having it rally to $5).

Since the 2020 spread chart highs (the second rally high at that 5% level) XAU has oozed back down in relative performance. The current spread reading is 2.691%. That’s still a higher spread reading than the late 2015 low. Meaning even with the past few years of pullback in performance, the gold and silver miners are still outperforming the S&P 500 going back eight years to that pivotal time (pivotal both for price of both markets and for the spread).

Note: the S&P 500’s price at that December 2015 close (when the spread produced its lowest reading) was 2043.9. The S&P 500’s current price at 4754 is 132.5% above that December 2015 close. XAU’s price close on December 2015, eight years ago, was 45.30. XAU is now at 127.94. That’s a gain of 182.4% since the December 2015 XAU price close.

Obviously a level to be watched is that 5% level. The first peak was a few decimals above 5% during that initial post-bear-market surge by miners in mid-2016. The next relative performance peak was in the summer 2020 miners’ surge which saw relative performance peak a few decimals below 5%. Clear that horizontal structure on a monthly close and what you’ll be witnessing is a breakout above massive basing action by gold and silver miners vs. the U.S. stock market. The miners are only marginally beating the S&P now, when measured going back eight years, but will massively advance vs. the S&P 500 when that 5% level is cleared.

Investors Need To Act Quickly!

If you like to buy low and sell high (instead of chasing rallies that everyone else is chasing), then this relative performance chart says it’s time to wake up to what’s been going on here since 2015! And what’s probably next. To read the rest of this incredibly important and timely report, which has remarkable updates on gold, silver, and so much more (9 pages long!) you must be a subscriber. To receive the special KWN discount to subscribe to Michael Oliver’s internationally acclaimed MSA Annual Research which is used by serious investors and professionals all over the world CLICK HERE.

Top Trends For 2024

“THIS IS THE YEAR FOR GOLD!”

To listen to the top trends forecaster in the world discuss his top trends for 2024 and why this is going to be the year for gold CLICK HERE OR ON THE IMAGE BELOW.

JUST RELEASED! Big Money Entering The Gold Space!

To listen to Alasdair Macleod discuss big money entering the gold space as well as what to expect from gold, silver, and the mining stocks in 2024 CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.