Today Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, communicated to King World News the current setup in the gold market.

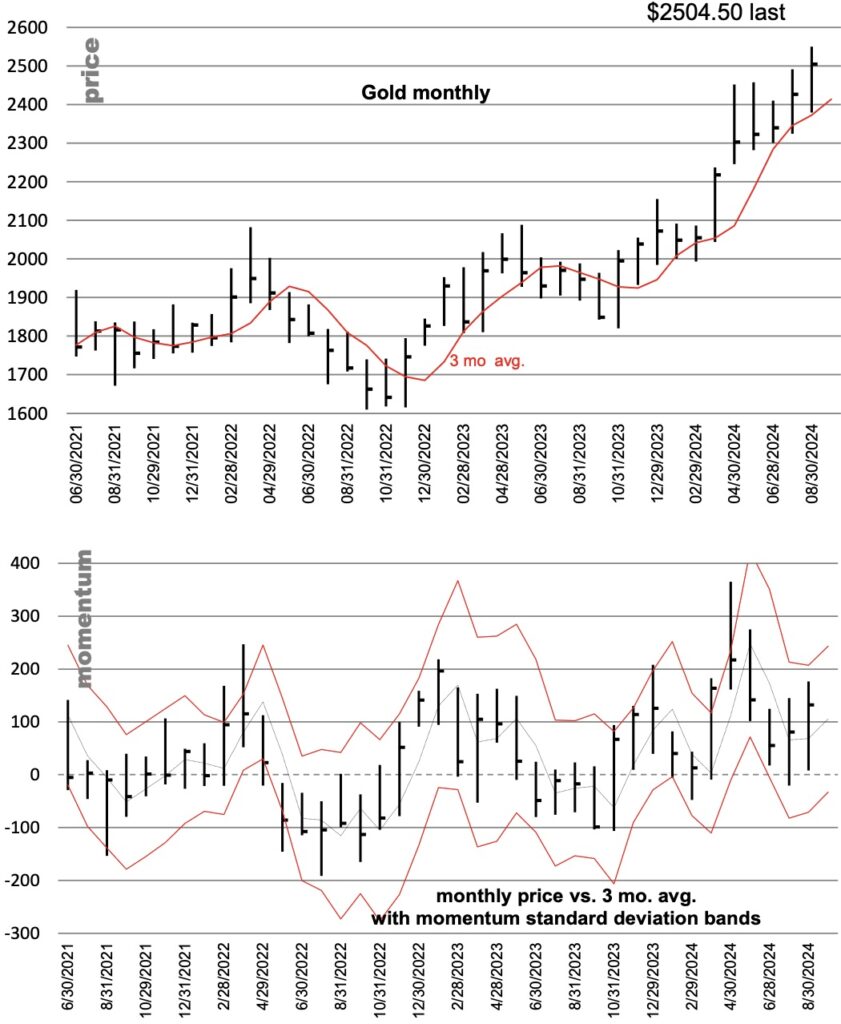

Gold: monthly momentum

September 4 (King World News) – Michael Oliver, Founder of MSA Research: Gold’s action vs. its long-term momentum metrics (such as the 36-mo. avg. oscillator, 100- wk. avg., 3-qtr. avg, etc.) broke out in March to the upside, out of clear range-bound action (shown in reports then and before). The subsequent $350 surge was followed within a month by price tagging $2450 in April and again in May.

Monthly momentum had then reached (for the time being) somewhat excessive levels (an overbought signal occurred on monthly momentum when the lower SD band rose above the zero line at the April close). That was to be expected—a corrective or “pause” process. It was primarily a pause in price while monthly momentum cooled off down to the zero line/3-mo. avg. What we wanted to see this past month was further evidence from various metrics (see the rest of the report) of an upturn out of corrective mode, and we got it. MSA lists individual mining stocks in their reports that they believe will significantly outperform the HUI Gold Mining Index. To receive the special KWN discount to subscribe to Michael Oliver’s internationally acclaimed MSA Annual Research and gain access to their stock picks CLICK HERE.

Gold & Silver

***To listen to Alasdair Macleod discuss the wild trading he expects to see in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.