Today Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, shared with King World News his thoughts on why bank stocks are the sector to watch and why last time we saw this type of action gold and silver soared.

August 7 (King World News) – Michael Oliver, Founder of MSA Research: Over the past four weeks, many faithful believers in such ideas as “forever up” and “soft landing” were rudely jolted. For the stock market and T-bonds, the tectonic plates have finally shifted. But MSA still doesn’t see an initial major decline in U.S. stocks as a crash situation. Instead, we believe that support for the S&P 500 and NASDAQ 100 will probably begin around or not far below their 3-qtr. avgs. (4798 and 17,499, respectively). Other support-levels are their old price highs from late 2021/early 2022. For the S&P that’s just above 4800, and for NDX marginally below 16,800. On both indices there isn’t much difference between those support levels.

But their short-term technicals (i.e., daily and weekly) did reach oversold levels Monday. Yesterday you were seeing upside relief in that regard. We probably won’t see this week’s lows again until next week or later after some overdue cooling-off (there is a caveat to that specified below). Short-term momentum factors are vastly oversold and justify a counter-trend bounce or at least a few days of wheel spinning, which will calm investor panic. Investors may then start to realize that while things have shifted negative, it isn’t a crash dynamic. (As for any future such event, we expect it to only occur once the S&P breaks below its 3-yr. avg., which is at 4305 for 2024 and rising sharply every year.) That’s where the S&P tagged down to in late 2022 and again in early 2023, but without ever closing a month below that rising annual mean. It’s now set as a pending triple-bottom breakout structure on annual momentum. But don’t expect to see it in this initial downside wave.

Everyone has seen that despite the recent sharp recent drop that the Fed didn’t panic. No cut. At least not yet. Once triggered, the KBE charts shown below will cause panic at the all-wise Fed.

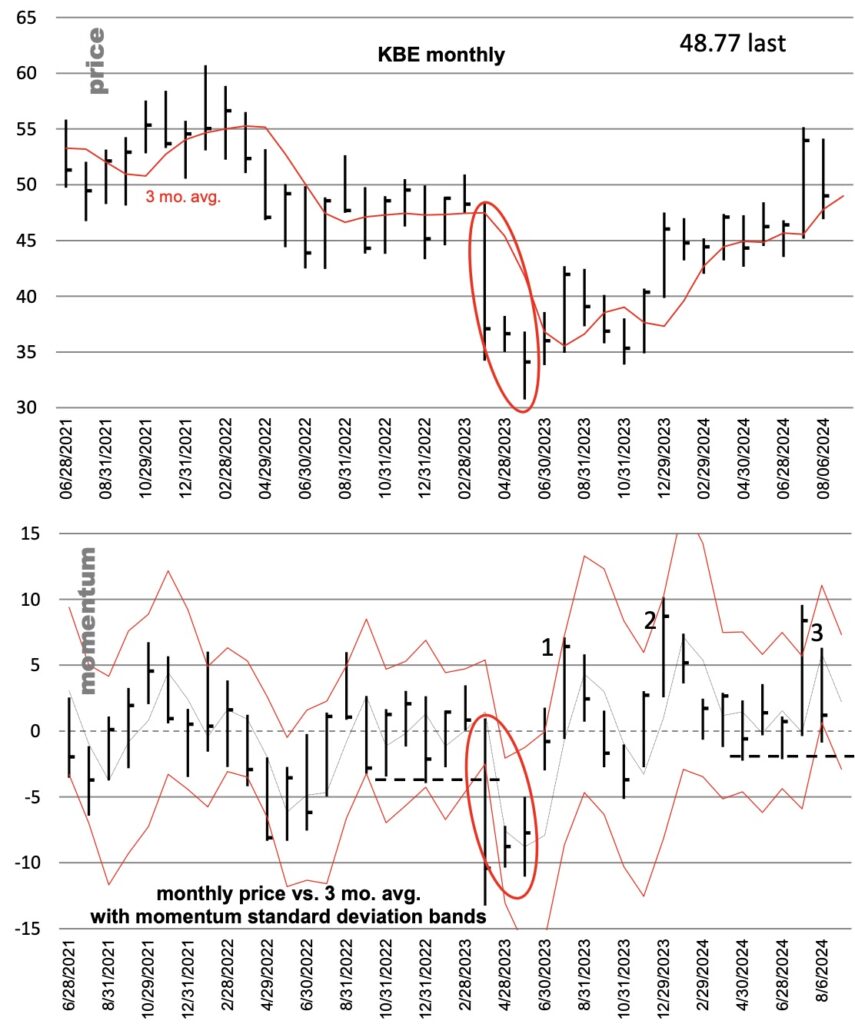

KBE (S&P Bank ETF): monthly momentum

In late January 2023 MSA issued reports giving an early warning of a banking sector collapse that was being set up. Sell triggers were hit in the first week of March based on our momentum factors. KBE then dropped 34% in price until a low the first week of May. That was of crash dimensions. That collapse phase is noted on price and momentum.

Gold & Silver Surged Strongly

(In those same weeks, gold rose from a low at $1815 to $2060; silver advanced from $19.83 to $26.45. During a crash-like event!) KBE’s current situation is that it’s trading just above very similar technical trigger levels that it had in March 2023. Above we show monthly momentum, but also a nearly identical situation exists on quarterly momentum…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Note, there have been three distinct upwaves of monthly momentum since May 2023. Three is usually all you get.

The July surge generated an overbought standard-deviation band (the lower SD band rose above the zero line at last month’s close). This month’s price drop then plummeted momentum very near to the prior six months’ oscillator lows, and it did so the first days of this month. That’s a double bottom there at two points below the zero line. Our strong view is that if action trades to –2 this month, it won’t hold! A triple-bottom breakout is pending. Two points under is 45.79. That’s 2.5% below yesterday’s low. KE’s quarterly momentum has an identical minefield just below, and it had better avoid trading to 45.595 anytime this quarter. So monthly and quarterly are linked trip-mines just below. Yes, banks also got a bounce today as it was short-term oversold.

No doubt price chartists just bought the top end of the price zone that existed from last December to June this year. Knee-jerk buying. Get price a point or so back below that ceiling (way before ever threatening those price around 44), and momentum factors will have signaled failure.

We argue that these KBE structures on monthly and quarterly could well generate a collapse in this sector. And you can bet heavily that if this sector—the banks—begin to implode, the Fed will go full panic and respond accordingly and not wait! And we suspect that if banks trigger the above levels, the S&P 500 and NDX will also resume and head for the likely next support zones as defined on page one. Reach trigger levels on KBE and any notions we might have of broader stock market pause goes out the window. No, not a crash for the broad market, but certainly joining a banking sector implosion. And likely in the midst of any such KBE drop there will Fed emergency cut reaction, not waiting for a literal KBE crash on their part. This is only one of many major reports issued each week by MSA Annual Research. To receive the special KWN discount to subscribe to Michael Oliver’s internationally acclaimed MSA Annual Research which is used by professionals and serious investors all over the world CLICK HERE.

Nomi Prins Says Gold Price Will Continue To Soar

***To listen to Nomi Prins discuss where the price of gold is headed, the wild trading that is unfolding in global markets as well as what to expect next CLICK HERE OR ON THE IMAGE BELOW.

JUST RELEASED!

To listen to Alasdair Macleod discuss the wild week of trading in global markets, gold, silver and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.