Today Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, shared with King World News his thoughts on whether the gold mining stocks will have a significant correction here or not.

Gold Miners

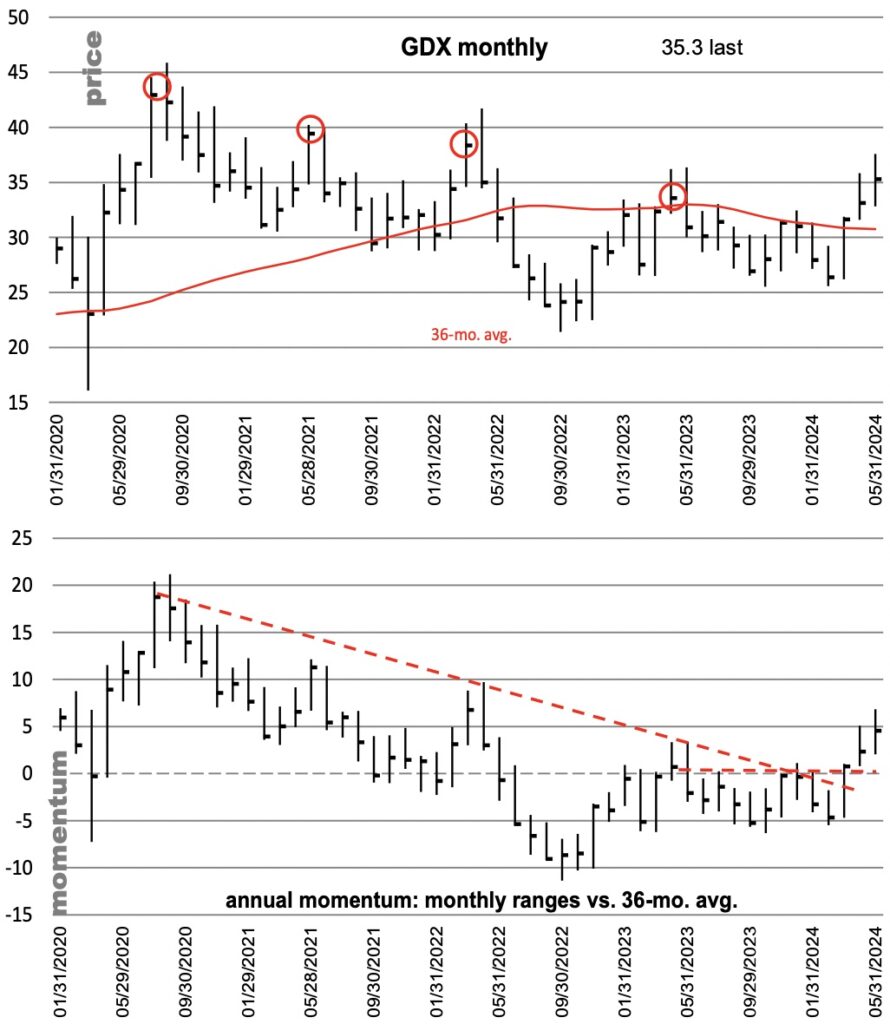

June 4 (King World News) – Michael Oliver, Founder of MSA Research: Annual momentum (price vs. the 36-mo. avg.) broke out at March’s close and even more in April. The price chart action in May, lagged by a few months to momentum, generated a monthly close above the prior descending pattern of lower monthly closes (as circled). Therefore, that negative trend pattern since 2020 has been broken via both metrics now. Even price chart watchers should finally begin to acknowledge that upside is underway.

Given this is a fresh trend shift, MSA doesn’t see any need for some sort of genuine corrective process to start now or soon.

It’s good to have two long-term metrics agree. In this case an average that few utilize—the 100- wk. avg. (like a 2-yr. avg.).

Will Mining Stocks See A Significant Correction Or Not

A massive three-year-wide basing action by momentum has been overcome, and only recently. Meaning this breakout is also very fresh and hasn’t even had its chance to run and perhaps get excessive at some point. The zero line (the average) is meaningless technically speaking. The breakout structure was defined by two horizontal peaks in 2022 and 2023. And if we treat the basing action as a momentum head- and-shoulder bottom pattern, then as a next swing objective it suggests reaching up to around the 65 to 70% area, meaning momentum will probably find resistance around that mid-2020 oscillator high (not some final target, just next meaningful resistance). The 100-wk. avg. is rising, and if we look out two months, reaching that 65 to 70% zone would mean price in the low to mid $50s. Something to consider. Maybe a place to pause?

We realize many price chart sellers will likely line up around the 2020 price high at $45. When GDX gets there, it will run them over. For now what we have are major momentum bases broken out above. Upside renewal of the primary trend is freshly underway.

Why should we expect meaningful correction here and now? We don’t. Others might.

Celente Predicted Gold & Silver Breakouts

Gerald Celente discusses the historic gold and silver breakouts as well as where the prices of gold and silver are headed and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

Swaps All-Time Record Short Gold

Alasdair Macleod discusses the swaps short position in the gold market reaching an all-time record. Macleod also discusses the remarkable developments in the silver market and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.