Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, communicated to King World News as gold futures broke above $2,990.

March 3 (King World News) – Michael Oliver, Founder of MSA Research: Oh, gosh! Another top! Based on annual momentum (our buy was in February 2016 on an investment-grade level, price then $1140+), there hasn’t been enough negative action at any point in gold to alter that long-term technical view. Therefore, we’re still bulls on gold. And at the current price there aren’t any nearby levels at all on long-term momentum that are triggers which would indicate it’s over. Long-term momentum is positive and solidly so.

In the past, via our work, it has required very clear annual momentum structure for us to call a major top or bottom (a few months off the 2011 peak and several months off the 2015 low). After our 2011 bear call, we dismissed the subsequent rallies as counter-trend. Same for the counter-trend drops after the 2015 lows. Yes, intermediate and short-term swings come and go, but from an investor’s perspective they were and are noise. The sort of declines that could derail a major trend capture—if at every flinch in the market you also flinched. Because the issue then becomes when or if did you get back on board?

Gold Futures Reverse Back Up To $2992

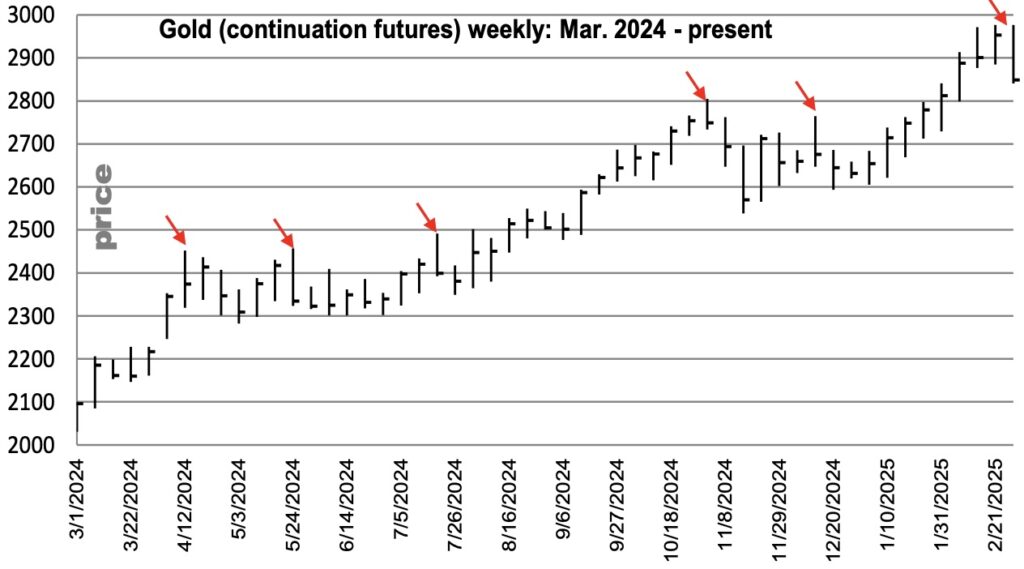

So on the chart above we show gold’s weekly action since last March when long-term momentum said the corrective/pause phase was over (a phase from mid 2020 to early 2024 that did not alter the long-term momentum trend, but just stalled it). MSA’s resumption signal occurred for gold, silver, and the miners in March 2024, where this chart begins.

Top Callers Fail…Again

Arrows note the shin-kicks on the way up since. The size of those gold drops were, in order: 6.7%, 6.1%, 4.7%, 9.3%, 6%, and so far this one is a 4.3% drop to last week’s low. Yet at each of these “events” we heard screams of doubt and arguments for running and hiding. As we hear many now.

BTFD!

Consider the alternative approach: what about the investor who simply added to his position on every 5% drop in gold?—blindly! That investor not only did better than the already long/fully invested gold bull, but that investor acted totally opposite the ever doubters. Selloffs were entry points or add-on opportunities.

And for silver, given its wildness both downside and upside, consider how well the investor did that bought into/added at every 10% drop over the past year, instead of running at every drop. You must subscribe to Michael Oliver’s MSA Annual Service to get this special 6 page report as well as his stock picks which have dramatically outperformed the XAU. MSA also lists individual mining stocks in their reports that significantly outperform the HUI Gold Mining Index. To receive the special KWN discount to subscribe to Michael Oliver’s internationally acclaimed MSA Annual Research and gain access to their research and stock picks CLICK HERE.

Gold & Silver Takedown

To listen to James Turk discuss the takedown in the gold and silver markets and what to expect next CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.