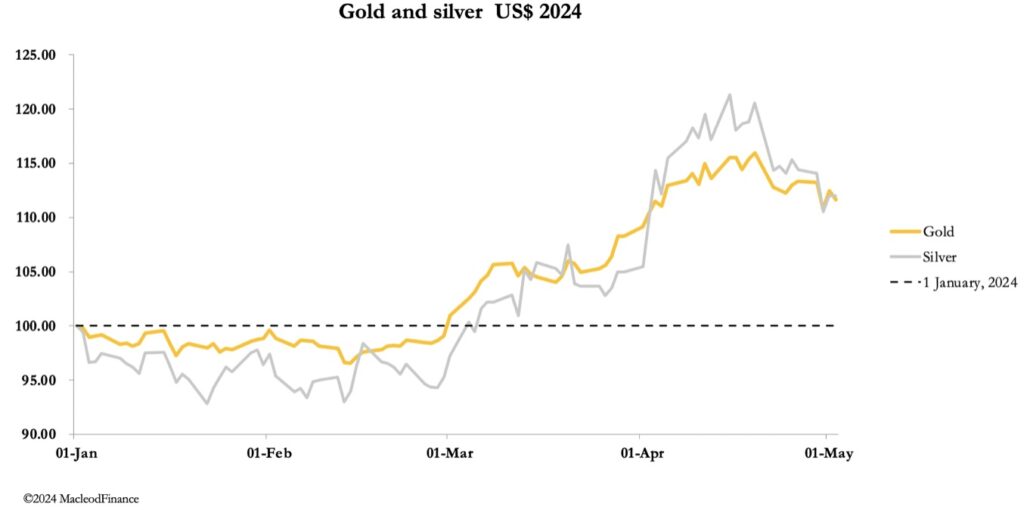

As the gold and silver market continue to consolidate their large gains, a massive short position in the silver market may prove risky. Take a look…

Gold & Silver Finding A Floor

May 3 (King World News) – Alasdair Macleod: Massive Comex silver deliveries: does this indicate a scramble for metal? And are the silver short positions spiralling out of control?

Gold and silver consolidated this week, with gold testing support at $2300 and silver at $26. In European trade this morning, gold was $2302, down $35, and silver $26.56, down 66 cents. Volumes on Comex in both metals declined as the consolidation has progressed.

The highlight of the week was the FOMC meeting and statement. As it turned out, there was little surprise, other than the pace of quantitative tightening which persuaded optimists that pressure on yields along the curve would be reduced. Consequently, yields ticked marginally lower, as the chart of the 10-year UST note shows:

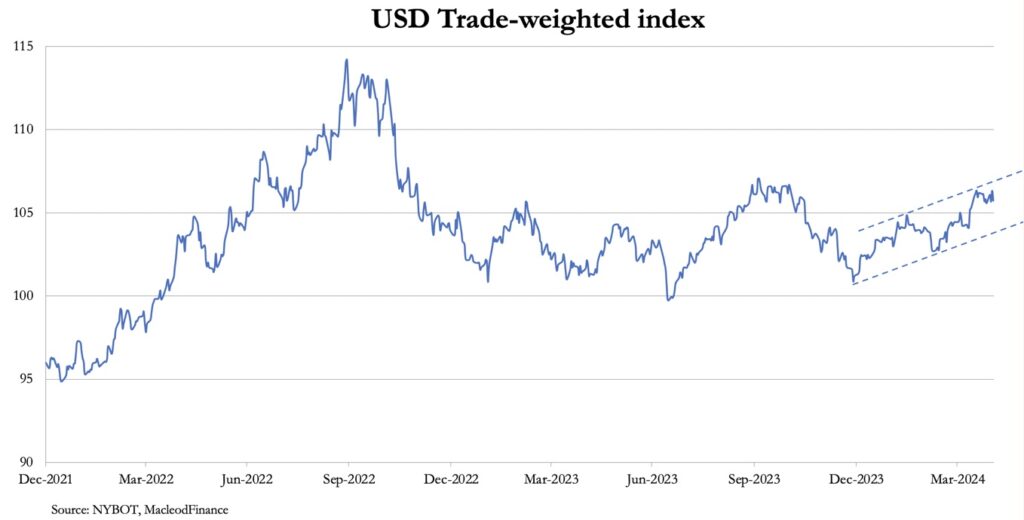

The golden cross on 7 March told us that the fall in yields from last October was over, and that instead of lower bond yields in time they were heading higher instead. This is consistent with the likely funding difficulties which the US Government faces with its $3+ trillion deficit. This problem is destabilising the entire fiat currency system, leading to a relatively strong dollar, whose trade weighted index is next.

As long as the $TWI is in a bull trend, it is bad news for other currencies, typified by the Japanese yen, which this week made a break for the downside as the yield on the 10-year JGB rose to over 0.9%. Clearly, the developing debt trap for the dollar is undermining the Bank of Japan’s monetary policy.

The determination of the Bank of Japan to sit on JGB yields only encourages the carry trade, whereby the expansion of yen bank credit feeds directly into US Treasuries. The consequences for the currency and bond yields are next:

Instability in fiat currencies is what’s driving them lower valued in gold. It is worth putting the relationship by pricing fiat currencies in gold instead of gold priced in fiat to emphasise that it is less of a question of gold rising, and more one of the dollar and other currencies falling. It is a situation which can rapidly drift into crisis.

There could be a crisis developing in silver. The next chart shows that the Swaps’ shorts are drifting out of control.

The net short position amounts to the paper equivalent of nearly 9,750 tonnes, or $8.2 billion spread between 17 traders. They are part of the same cohort which is short of $63bn in Comex paper gold.

Falling fiat currency values is putting the squeeze on the banking establishment. And it doesn’t help that longs are standing for delivery. In silver, a further 696 tonnes were stood for delivery, and in gold a further 7.6 tonnes in the first four days of this week.

How long will it be before a bullion bank defaults? We should start thinking this way. The problem in gold is bad enough, but with India scrambling for silver for its photovoltaic cell production, silver’s short position is becoming potentially explosive. When this consolidation phase ends, the next leg of rising prices could well develop into the mother of all bear squeezes — on the establishment! To listen to Alasdair Macleod discuss the wild things happening in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.