Here is the setup for gold and silver as we come to the end of 2024.

KWN has just released a “sneak peek” at Celente’s shocking top trends for 2025!

Also, Alasdair Macleod’s audio interview has just been released (LINK BELOW).

A Year In Review

December 28 (King World News) – Alasdair Macleod: Gold and silver performed well in 2024. But what are the prospects for 2025?

Gold rose and silver rose moderately in quiet trading during Christmas week. In early morning European trading today, spot gold was $2627, up $34 from last Friday’s close and silver at $29.70 was up 20 cents. Close examination of price timelines during the week showed a tendency for both metals to rise modestly during Asian trading hours, with a loss of direction in European and American hours. This suggests that Asians are still quietly accumulating physical bullion if it becomes available over the Christian holiday season.

One surprise is that option expiry for Comex January contracts passed with barely a ripple. The explanation surely is that the decline in prices during December conveniently made calls with strikes above $2600 for gold and $29.50 for silver worthless, benefiting establishment sellers. This pressure is now behind us and all else being equal we can reasonably expect prices to rebound in January.

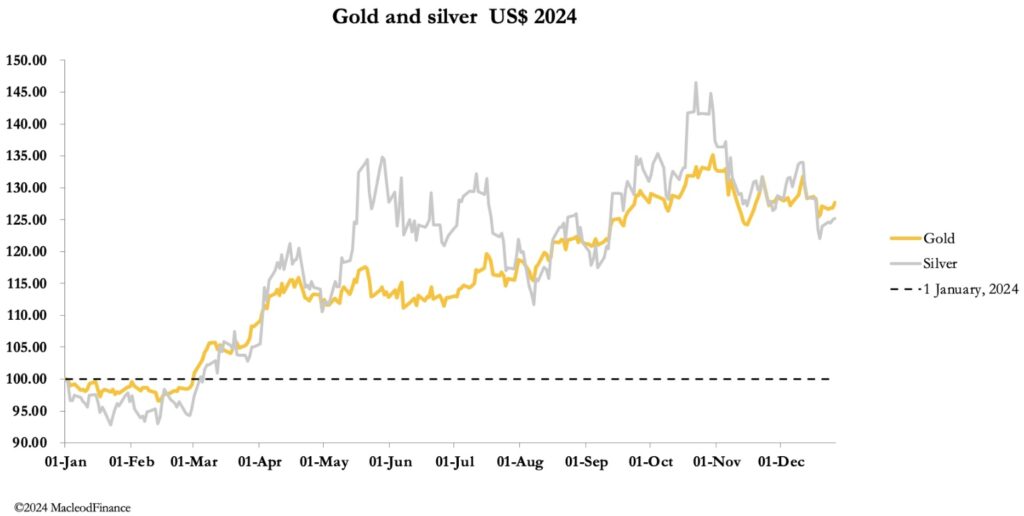

For the record, gold rose 26.5% and silver 25.25% since 1 January, which compares with the S&P 500 Index which rose 26.6%. These are the comparisons likely to be made by investment allocators, who will probably conclude dismissively that there was little advantage in increasing allocations towards precious metals. That could turn out to be complacent with respect to 2025…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

2024 saw record stand-for-deliveries in both metals. In gold, 485.5 tonnes were stood for delivery of which nearly 80 tonnes have been since Thanksgiving. In silver, these figures are 6,378 tonnes, and 1,410 tonnes respectively. They are enormous numbers and the acceleration of deliveries in the last month is simply staggering. Furthermore, this doesn’t include Exchange for Physical numbers which are far larger, some of which would have involved taking delivery in London and shipping physical metal on to Asia.

Withdrawals of gold by the public from the Shanghai Gold Exchange vaults in the first eleven months of 2024 totalled 1,333.7 tonnes, predominantly supplying the jewellery trade. This is almost 40% of expected global mine output over the same period. Crucially, this does not include gold accumulated by the state and its central bank. Nor does it include additional gold acquired by banks and institutions choosing not to take delivery from SGE vaults. Increases in this hidden total back gold accounts and other Chinese investment media.

Prospects for 2025

Establishment predictions for gold in 2024 proved wide of the mark. Here is a selection listed at Bullion By Post:

- ABN Amro – $2,000

- AG Thorson for FX Empire – Target of $3,000

- Natixis – $1,920 average

- UBS – $2,250

- BMI – $1,850

- Trading Economics – $2,016

- Commerzbank – $2,050

AG Thorston’s forecast was an outlier, but the others severely underestimated the outcome. For 2025, the establishment cohort appears to be predicting anything between $2,300 and $3,000. Will it underestimate outcomes again?

There is a vested interest in expecting prices not to rise significantly, given that bullion banks tend to trade with short books which they expect to recover on price dips. In the past, they have often been right in their expectations with gold bugs being excessively bullish. But these successful predictions were at times of greater currency stability. That is no longer the case, as 2024 demonstrated.

My experience of bullion bank traders and analysts is that they are clueless about money, credit, and economics. For them gold is a trading chip which is no longer a part of the monetary system. If they know the legal position of gold as money — and I’ve yet to meet an analyst who does — they would dismiss it as irrelevant.

Asians and most central banks take a different view, seeing increasing risk to the purchasing powers of western currencies. Rapidly industrialising Asian naLons are creating massive wealth. And the savers amongst them see physical gold and perhaps silver as a core element in their savings. That will surely continue and perhaps accelerate during 2025.

This view of gold differs fundamentally from that taken in western capital markets. Almost all involved see gold as an investment — something to buy if it is expected to rise and sell if it is likely to fall. Behind this attitude is an accounting for profits in dollars, euros, or pounds and not realising that their currencies are declining rather than gold rising.

I analyse money, credit, and economic prospects in other articles for my Substack followers, so I won’t repeat their conclusions here. Suffice to say, gold’s technical chart offers a strong possibility that gold will rise beyond $3,000, the highest of the establishment estimates noted above.

Gold appears to be finding support at the 55-day moving average, but a dip towards the 12- month can never be ruled out. However, the shortage of physical gold in western markets, continuing Asian demand, and an understanding that this is actually a measure of declining international confidence in the dollar all suggest that a significant dip is unlikely. And that it is only a matter of not much time before gold trades significantly higher.

Inverting the gold chart to reflect what’s happening to the dollar’s purchasing power makes this point.

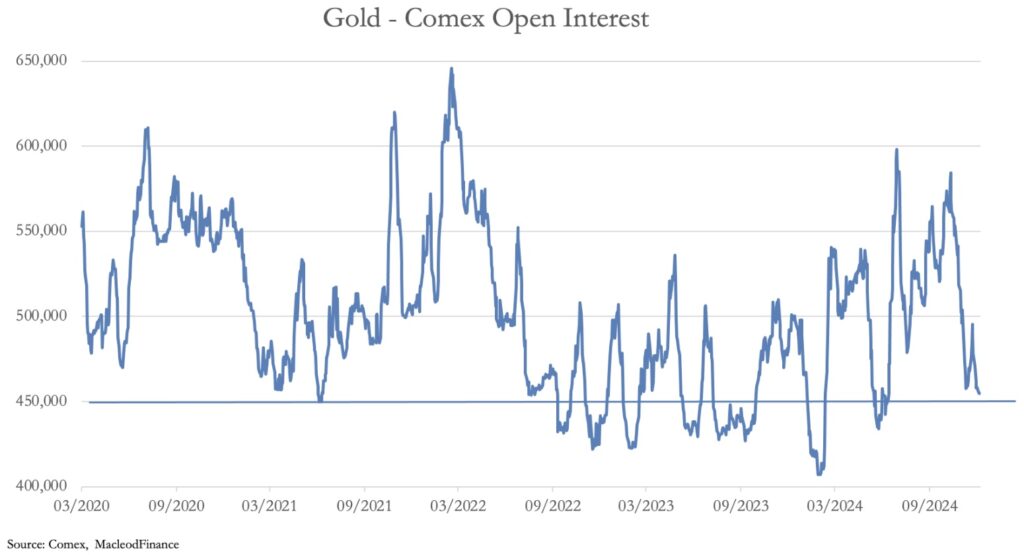

Furthermore, gold futures are now oversold, as Comex open interest demonstrates.

As a rough indication, open interest at or below 450,000 contracts tells us that on balance active traders are no longer bullish as a cohort, and that they have the headroom to buy up to 150,000 contracts before this contract becomes overbought. It confirms that the downside is limited, while the upside is potentially far greater.

I wish all my followers a happy and successful New Year. To listen to Alasdair Macleod discuss the big surprises to expect as we kickoff 2025 next week CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.