Look at what just hit the highest level since 2007.

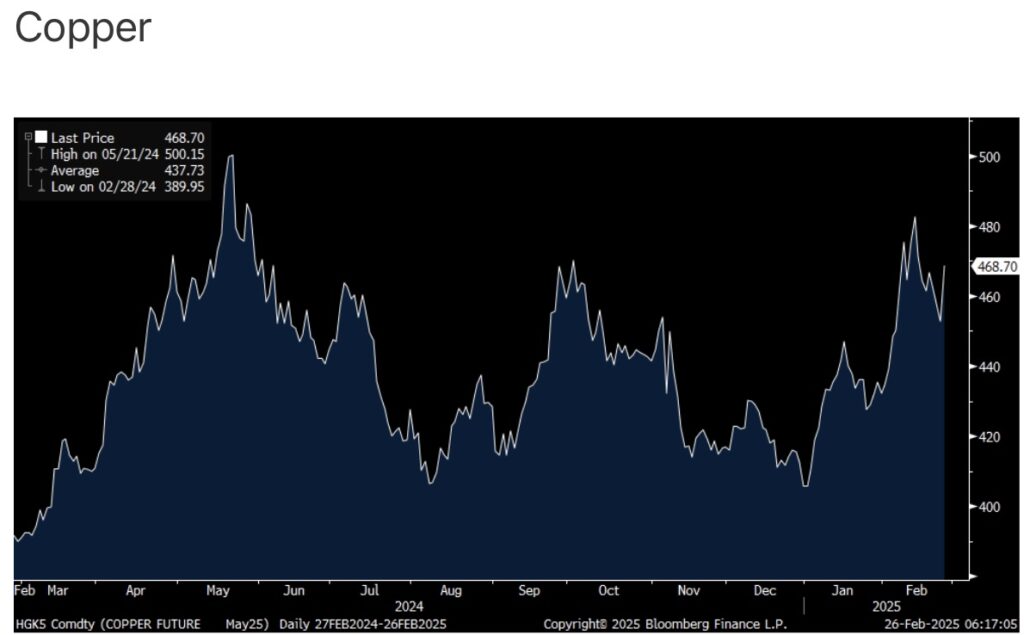

February 27 (King World News) – Peter Boockvar: Let’s start again with the possible impact of tariffs. Copper is jumping by 3.5% after it was said yesterday that the Commerce Department was going to look into putting tariffs on imported copper in order to defend US production.

Highest Since 2007!

New home sales in January totaled 657k, below the estimate of 680k but December was revised up by 36k to 734k. This is a volatile month to month so best to smooth it out. The 3 month average is now 690k vs the 6 month average of 685k and which compares with the 2024 average of 686k. For further perspective, the average in 2019 was 685k.

Months’ supply rose to 9.0 from 8.0 in December and 8.6 in November. Interestingly, the absolute number of new homes on the market now total 495k, the most since December 2007.

King World News note: Number of US Homes For Sale Hits Highest Level Since 2007!

The median home price, highly influenced by mix, rose 3.7% y/o/y and 7.5% m/o/m.

In January, where these contracts were signed, the average 30 yr mortgage rate averaged 7.02% vs 6.82% in December and vs 6.88% right now so we’ll hope to see a home purchase lift in February, though we it hasn’t been reflected in weekly mortgage applications this month which are down by 8% month to date vs January 31st.

Bottom line, the housing market needs more supply but the expensive homes combined with high mortgage rates make it tough to absorb (especially from that first time buyer who doesn’t have an expensive home to sell as an offset) when new homes come on market from the builders and why the bigger builders are still discounting and buying down mortgages. The smaller builders though don’t have this flexibility and why the bigger ones will keep taking market share.

Is US Treasury Rally A Bad Omen?

… we’ve seen a really nice rally in US Treasuries across the curve and we all speculate why. I attribute it to a few things. While the economic data hasn’t really changed much, the imbalance is still obvious with all of the strength coming from upper income spenders, AI spend and everything related to the government. Softness has been seen elsewhere. But now we have the likelihood that government spending is likely to slow in its trajectory and tariffs too will negatively impact economic growth.

Inflation expectations haven’t fallen nearly as much as the drop in nominal yields as seen in the breakevens which points to more growth concerns than the belief that inflation will fall much from here. Maybe the tariff influence separating the two.

I also want to point to the shakiness in the Mag 7 trade that I think is coming to an end as I’ve said many times now. As the whole world has piled into these stocks, and I literally mean the entire world, this is a really big deal if I’m right because if it leads to an eventual market correction, that upper income spending pillar will get shaky legs. Hopefully, the investing dollars will just find other things to buy instead of dragging everything lower. That said, upper income savers will continue to benefit from interest income with interest rates staying high for a while still.

Amazing Interview!

To listen to one of the most powerful and shocking interviews of 2025 CLICKING HERE OR ON THE IMAGE BELOW.

Just Released!

To listen to Alasdair Macleod discuss Fort Knox and the (missing) US gold hoard and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.