Look at what just collapsed to the lowest level in 24 years…

April 15 (King World News) – Peter Boockvar: In what is now very old news, both because of the onslaught of tariffs and also the weaker US dollar, March import prices were benign, falling one tenth m/o/m headline, unchanged ex petroleum and and up one tenth ex food and energy fuels. This is all about to change. Transitory? Not? One time step up in price? Or not because of the multi year shifting around of global supply chains and likely shortages of certain things until they do? We’ll soon see.

The April NY manufacturing index, the first April figure to be released, was -8.1, though up from -20 in March and better than the estimate of -13.5.

Prices paid rose 6 pts to 50.8, the highest since August 2022.

Prices received were up by 6.3 pts to 28.7, also the most since August 2022. New orders remained negative though backlogs rose back above zero. Employment was negative for a 5th month in the past 6.

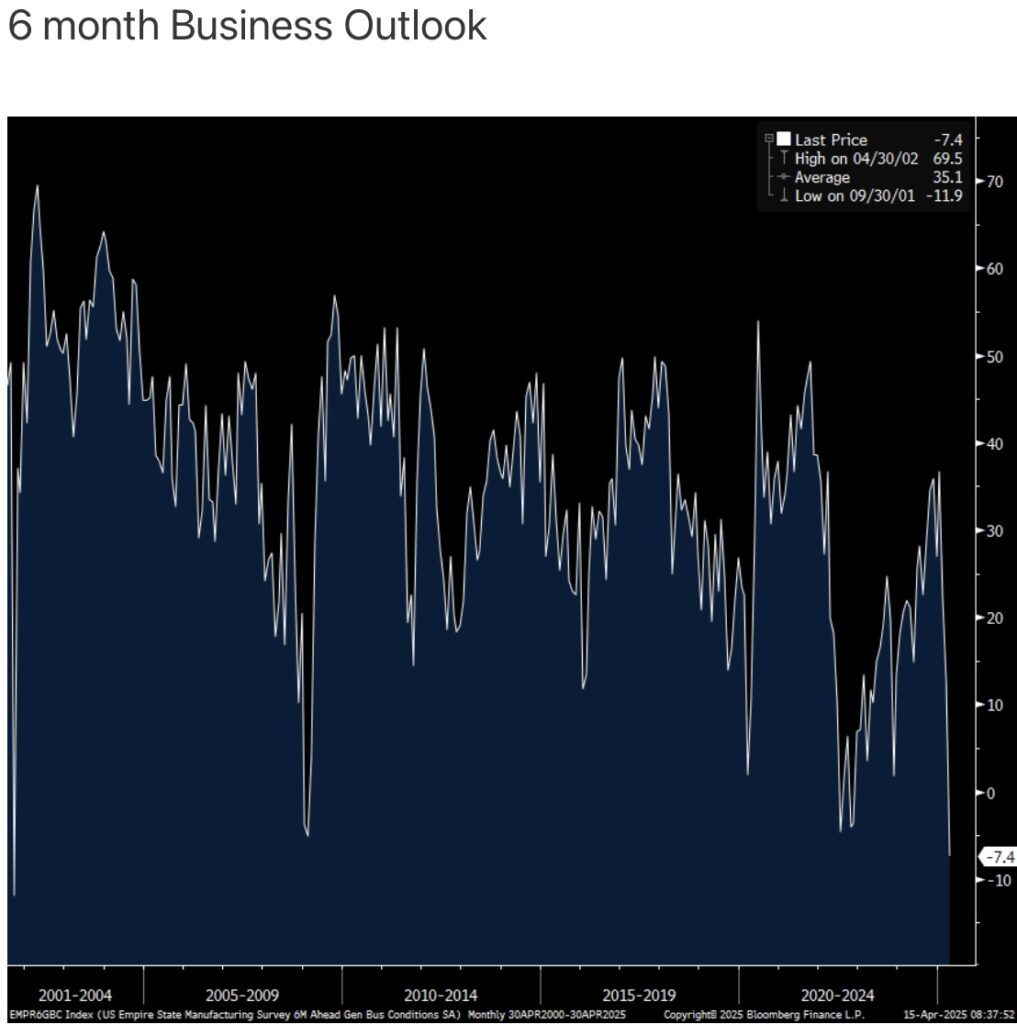

Of note, the 6 month business outlook fell to -7.4 from +12.7 and that is the weakest since 2001 and the 2nd lowest print in the history of this survey which runs about 25 years.

KING WORLD NEWS NOTE: German Business Outlook Collapses To Lowest Level in 24 Years!

Expectations for prices paid and those received both were higher at multi year highs. Capital spending plans weakened again for a 3rd straight month to just 1.6 vs the 6 month average of 10.3. Expectations for new orders went to -6.6 from +15.5 and the 6 month average of +20.9.

Bottom line, many manufacturers are flying blind right now, to state the obvious, especially if one is doing business with China, and/or anything with the auto industry and with anyone using steel and aluminum as in input. A 90 day pause on everything else is fine but what will come of the 90 days and we’re still left with a blanket 10% tariff on everything imported just because.

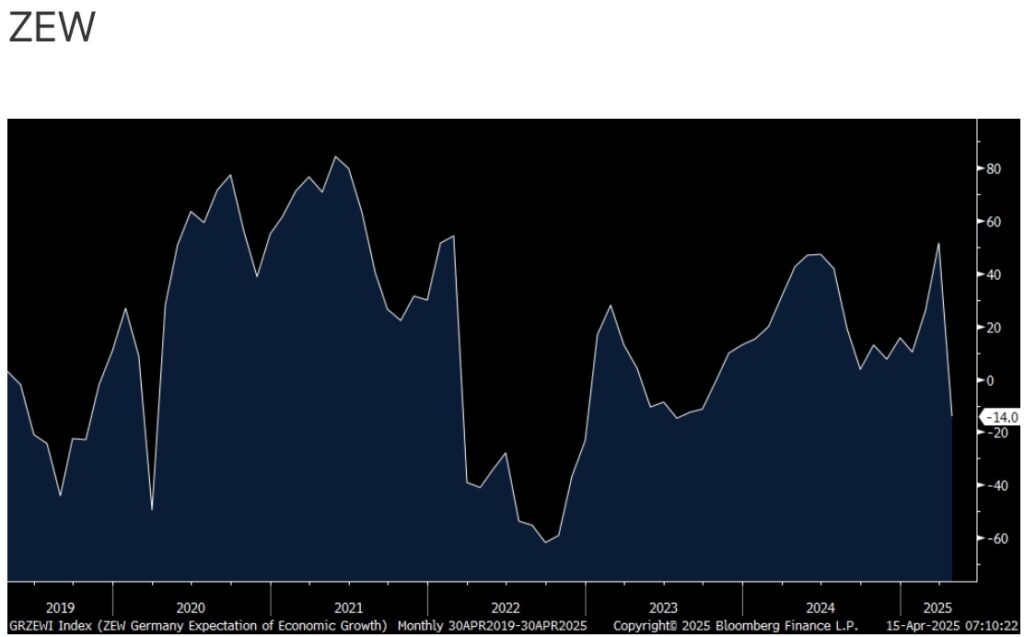

The tariff/trade war weighed on the German ZEW investor confidence index on the German economy. This plunged to -14 in April from +51.6 in March when everyone was excited about the new government and all the fiscal spend to come. The estimate was +10.

The Current Situation did improve though to -81.2 from -87.6 obviously still very negative. ZEW said, “The erratic changes in the US trade policy are weighing heavily on expectations in Germany, which have sharply declined. It is not only the consequences the announced reciprocal tariffs may have on global trade, but also the dynamics of their changes, that have massively increased global uncertainty. The economic expectations for Germany and the Eurozone reflect this development.”

Prins Just Issued Dire Warnings

To listen to Nomi Prins, who predicted the price of gold would surge well above $3,000, that the US dollar would see a mini-crash, and that global markets would be engulfed in chaos, discuss her latest dire warnings and predictions for global markets CLICK HERE OR ON THE IMAGE BELOW.

JUST RELEASED!

To listen to Alasdair Macleod discuss the wild trading in gold, silver, and global markets CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.