At the the end of another wild week of trading, look at what is happening in the war in the gold and silver markets.

The Fed Signals Its Pivot

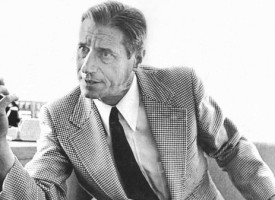

December 15 (King World News) – Alasdair Macleod: In his press conference following the FOMC meeting at which the Fed Funds Rate was left unchanged, Chairman Powell spoke about the slowing of economic activity due to restrictive territory for interest rates. This unexpected commentary caused precious metals to rally strongly, taking gold back above $2000, and silver above $24.

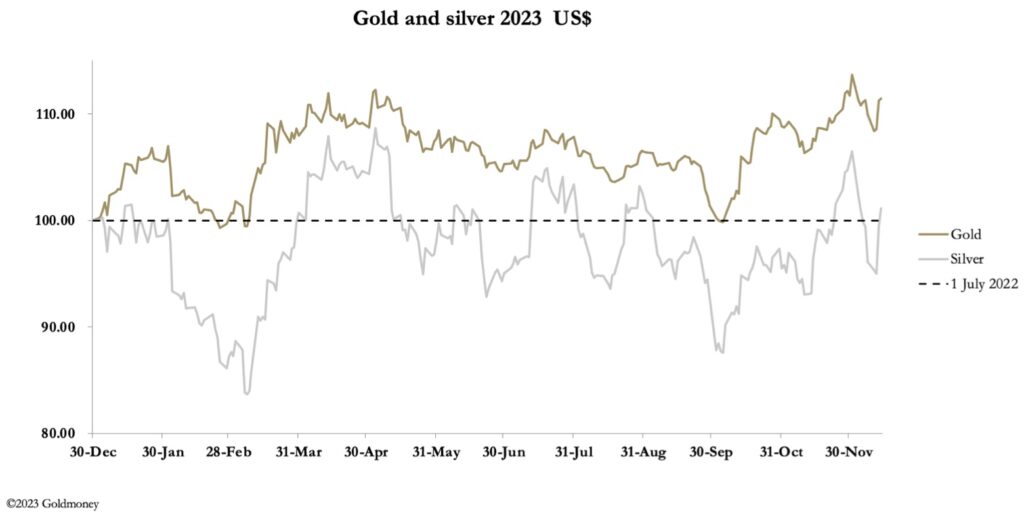

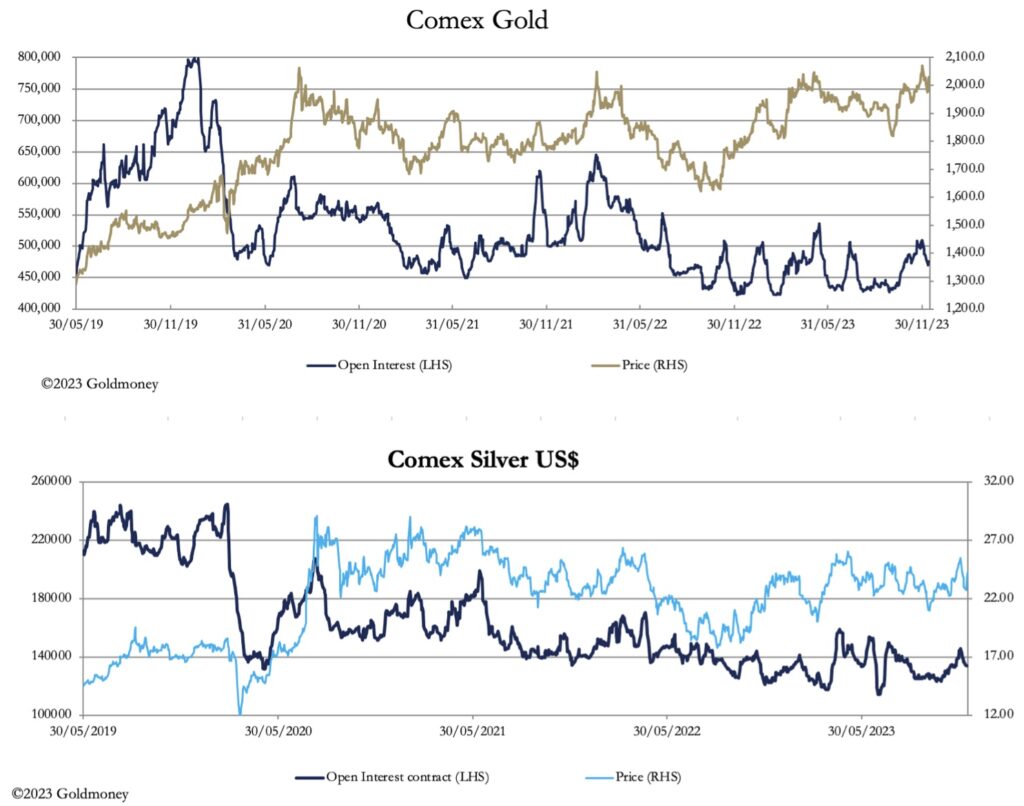

In European trade this morning, gold was at $2042, up $38 since last Friday’s close, and silver was $24.22, up $1.24 over the same time frame. Volume in both Comex contracts was moderate, picking up after the FOMC statement. Comex deliveries continued apace, with 279,000 ounces of gold (8.7 tonnes) and 6,390,000 ounces of silver (198.7 tonnes) this month so far. Open interest in both contracts is moderate, as our next charts show.

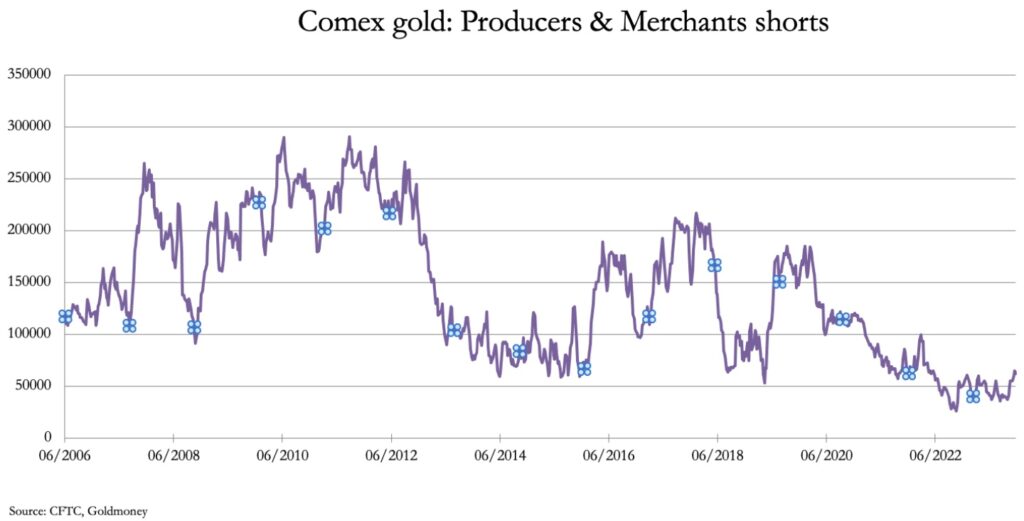

In gold, the Commitment of Traders figures show that mines are still not bothering to hedge, which is up next.

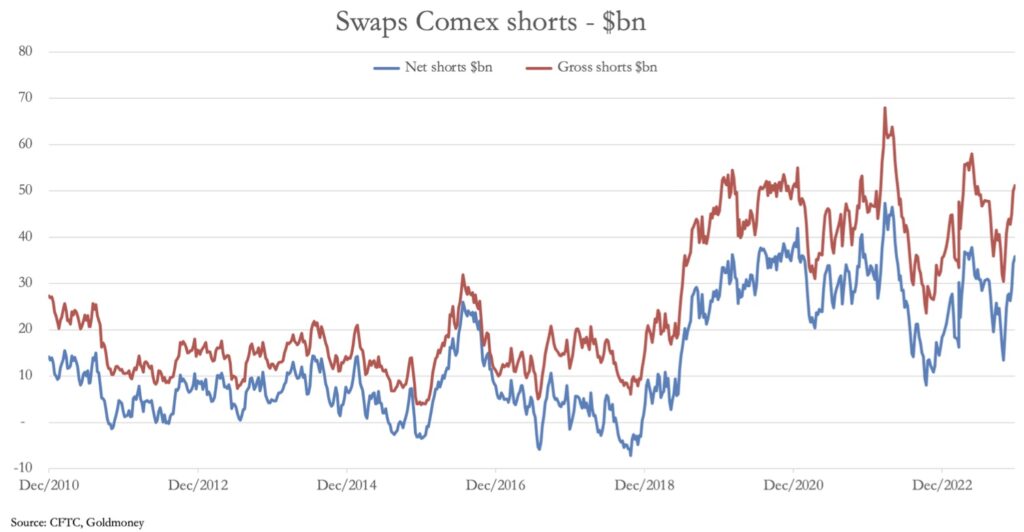

This is significant, because it throws the burden of the short side onto the Swaps, which is mostly comprised of bullion bank trading desks. Despite the moderate level of open interest, it explains the heavy financial commitment in the next chart.

The short side is shared between 29 parties, making the average short position $1.78bn, doubtlessly uncomfortable for some of them.

With the dovish noises coming from Powell, bond yields have fallen significantly, with the 10-year US Treasury note yield a whole one per cent below its October high. This is next.

Not surprisingly, the dollar’s trade weighted index has fallen as well.

The pace of this decline is unusual and there is a risk it becomes self-feeding. The fall in the dollar’s TWI matches the rise in the Japanese yen. This matters because interest rate arbitrageurs borrow yen through the swap market and sell them for dollars. The dollars are invested in Treasury Bills. Leveraging the position has been an extraordinary money-spinner for hedge funds and banks doing this trade. But that’s before reckoning on the 5% currency loss that has materialised since 1 November. Leveraged five or ten times, the losses become stupendous.

Add to that Japanese pension funds, insurance companies, and banks liquidating their foreign positions, and we can see that there is a panic developing likely to drive the yen higher and the dollar lower. The same goes for similar crosses between euros and dollars. It is not beyond the bounds of possibility that we are in the early stages of a substatitial dollar decline.

There is little doubt that privately central bankers have been expecting a crisis of this sort, evidenced by their aggressive accumulation of gold bullion. They monitor foreign exchange flows and positions. And their intelligence from the Bank for International Settlements and other channels is second to none.

For this reason, both investors and those concerned about global financial stability should take note. The recent dip below $2000 could turn out to be the last. Those who have not yet hedged out of dollars into gold are likely to chase rising gold and silver prices.

ALSO JUST RELEASED: Gold & Silver Continue To Surge As Dollar Weakens Again, But Look At This… CLICK HERE

ALSO JUST RELEASED: James Turk – Silver To Begin Its Surge Back To $50 All-Time High CLICK HERE

ALSO JUST RELEASED: Gold Soars Along With Mining Stocks As Fed Amits It Will Lower Rates In 2024 CLICK HERE

ALSO JUST RELEASED: Elon Musk And Alex Jones Debating Klaus Schwab And Bill Gates CLICK HERE

ALSO RELEASED: Ignore Gold & Silver Volatility Because The Whole Sector Is Ready To Skyrocket CLICK HERE

ALSO RELEASED: Look At What Just Collapsed To The Lowest Level Since 2012 CLICK HERE

ALSO RELEASED: The Shocking Truth About The Silver Market CLICK HERE

ALSO RELEASED: Bankruptcy Filings Are Skyrocketing CLICK HERE

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.