Here is a look at what is happening around the world.

Contrarian Ideas

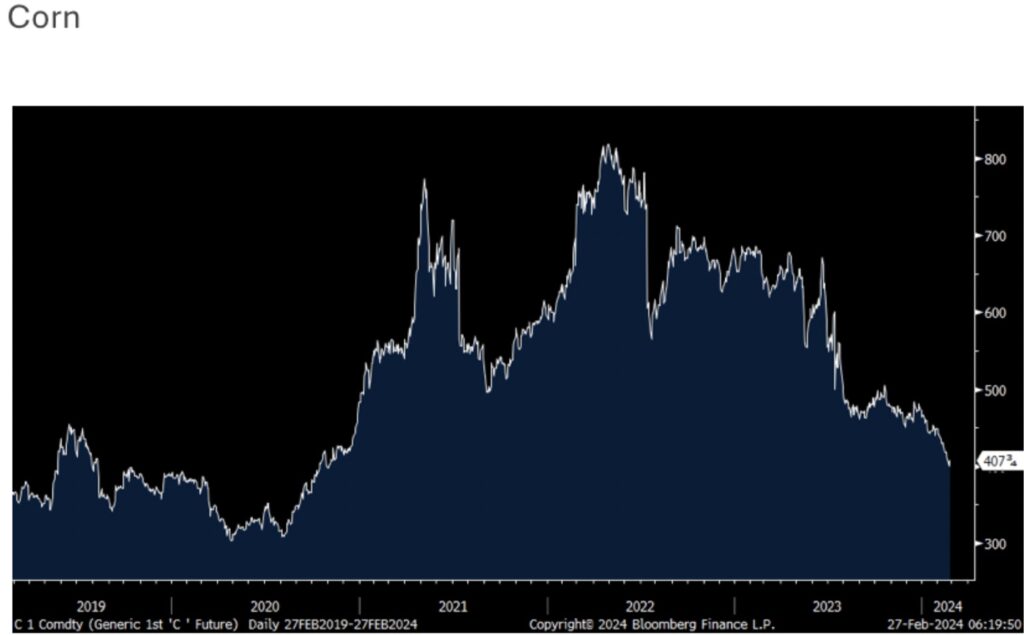

February 27 (King World News) – Peter Boockvar: I have another contrarian idea for you (previously this year it has been Hong Kong stocks and cannabis) and that is in the ag space, specifically corn and soybeans. While the price of cocoa is at a record high, corn closed last week at the lowest level since November 2020 at $4 per bushel.

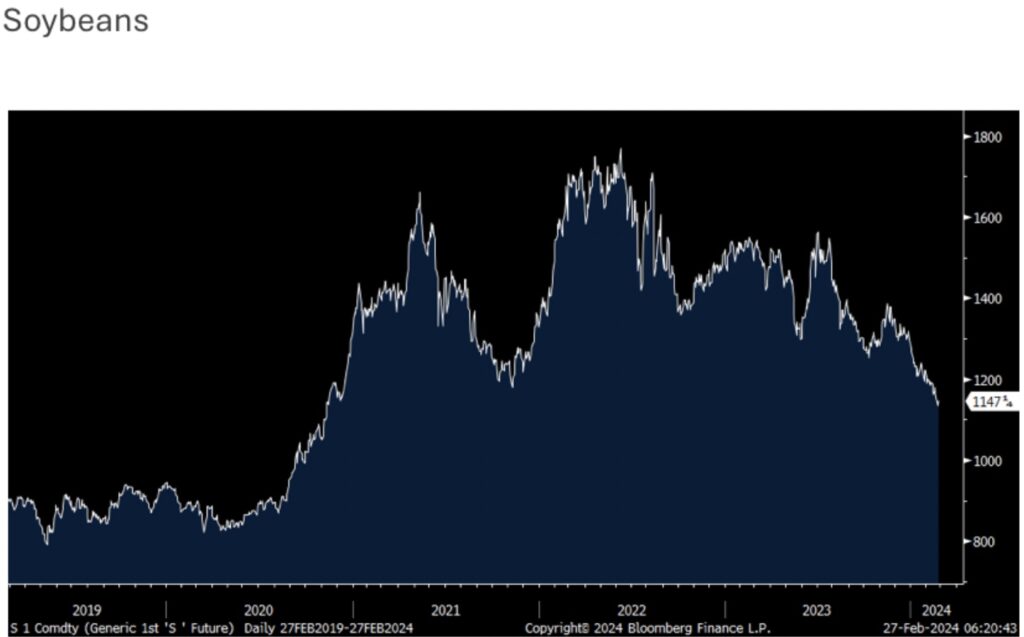

Soybeans the same at around $11.50 per bushel.

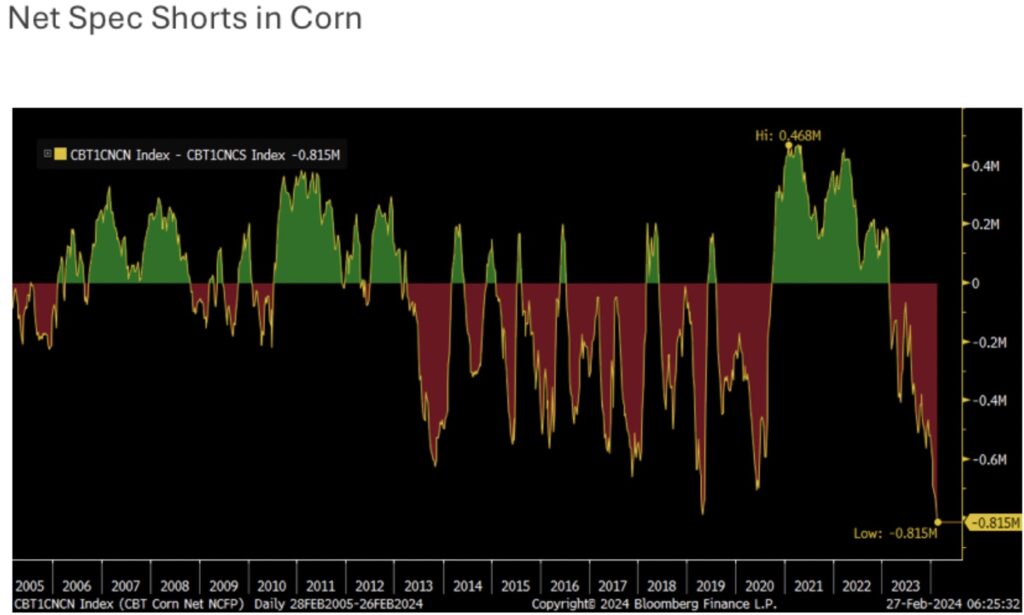

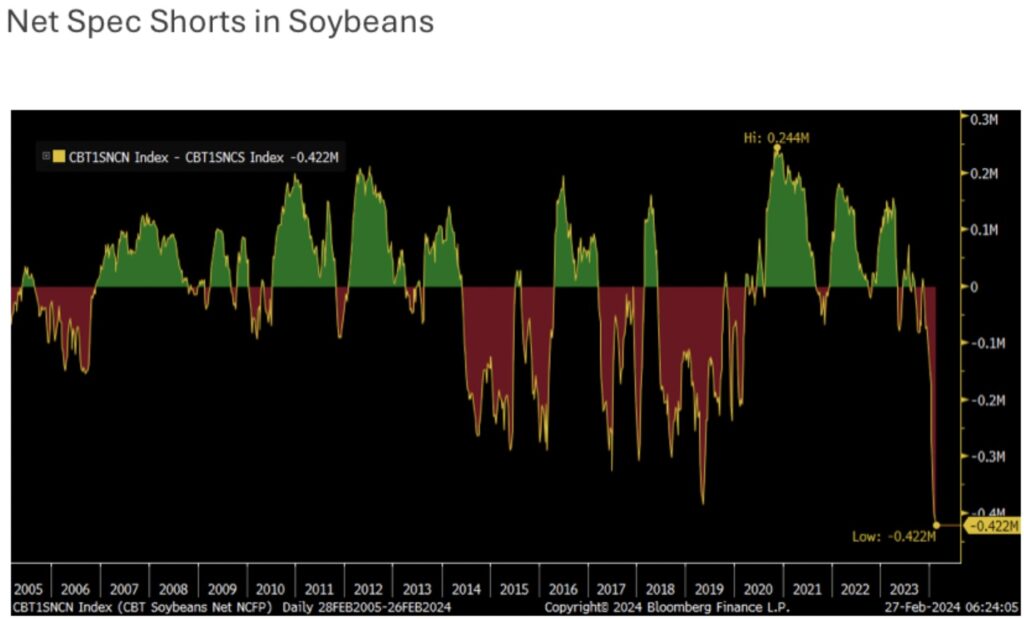

I’m calling the bottom because I saw the CFTC data yesterday and speculative net shorts for each are now at record highs. When extreme positioning takes place for non-commercial traders, it’s time to look at the other side.

We had been long the fertilizer stocks until right after Russia invaded Ukraine and they were spiking along with crop prices. I’ve been waiting to get back in since and we just did on this major pullback. This is a highly correlated way to play the rise in row crop pricing, if it were to occur, and if corn and soybean prices rally, fertilizer prices should as well.

When you hear a Fed member say that policy is ‘restrictive’ it’s important to ask back, ‘restricting what exactly?’ I saw a Bloomberg News story yesterday that said “Blue chip companies have sold at least $153 billion of bonds in the US in February, setting a record for the month…The sales topped the prior record for February of $150.9 billion, set last year, according to data compiled by Bloomberg News. The record comes on the heels of the busiest week in nearly two years, driven in part by a deluge of bonds sold to fund mergers and acquisitions. And dealers say more bond sales are on the way.”

Now easier financial conditions have certainly greased the wheels for this but it needed to take place anyway as there is about $800 billion of corporate debt coming due this year and more than $1 trillion in 2025. While refi’s and new issuance are getting done, the interest rate being paid is most likely higher than on the debt coming due. And, the economics of private equity deals are certainly less attractive with the current higher cost of capital, even with tight credit spreads…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Consumer News

Getting to some company conference and earnings comments, this first one from SoFi Technologies at the USS conference was interesting:

“And then lending, we are taking a more conservative approach in 2024 where revenue is going to be about 92% to 95% of 2023 revenue. Our personal loans originations will be flat to down, student loan refinancing will grow modestly in home loans, will grow correlated with rates, but in ’25 and ’26, once we get more visibility into the macro and hopefully rates stabilize a bit will be beyond a Presidential election, we would expect to see an acceleration in growth in lending.”

From Domino’s:

“The increase in US Q4 same store sales was driven by transaction growth from our new loyalty program…Shifting to international, same store sales, excluding FX impact, increased .1%. The deceleration from the 3rd quarter is being driven primarily by pressures in Europe and geopolitical tensions in the Middle East.”

On pricing and more on international, “In the US, we are planning for a modest price increase in the low single digits. This is inclusive of California where we’re expecting to take pricing above that to offset the wage impacts from AB 1228. We expect our international comps to remain soft in the first half of the year due to a continuation of the trends we saw in the fourth quarter, but expect them to accelerate to our 3% or more long term guidance in the back half of the year.”

Also on inflation, “We are estimating the rate of inflation across the system, inclusive of California, will be in the mid single digits, and this has been primarily driven by minimum wage increases.”

Cava had a good quarter and I’ll go thru their earnings call later. They saw traffic growth of more than 10%.

In Lowe’s earnings release they referred to “the continued pullback in DIY spending.”

From Macy’s, who reported a decline in comps:

“The Macy’s nameplate saw strength in beauty, particularly fragrances and prestige cosmetics, and its Backstage off-price business while women’s shoes saw continued softness along with relatively weaker performance in cold weather apparel and accessories.”

“The Bloomingdale’s nameplate saw strength in beauty, women’s contemporary sportswear and the Bloomingdale’s the Outlets business, while men’s and designer handbags continued to be soft.”

Of note, “Net credit card revenue declined 26% from 2022 to $195 million. As expected, the decline was driven by the impact of higher net credit losses in the portfolio.”

Overseas

Overseas, the big story was the higher than expected CPI print in Japan for January, though down from December’s pace. The core/core CPI increase was 3.5%, two tenths more than expected and vs 3.7% in the month before. Just ex food, the so called core rate there, was up exactly by 2%, one tenth above the estimate. In response, the 10 yr yield was up almost 1 bp to just under .70% while the 10 yr inflation breakeven was higher by 3.5 bps to 1.25%, the highest close this month.

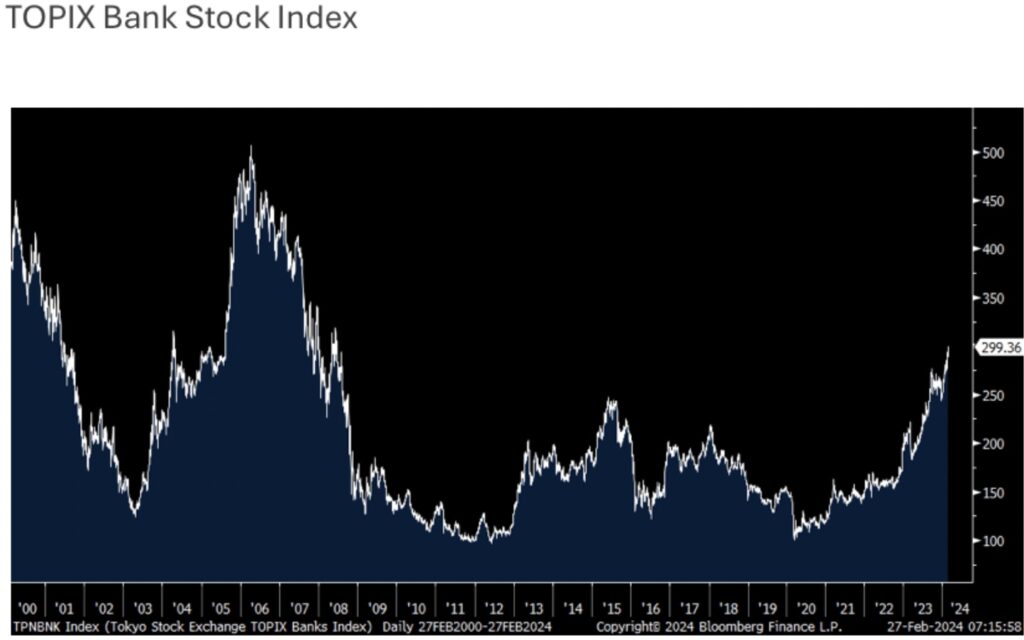

The yen is also higher. The Nikkei was little changed but the TOPIX bank stock index rallied 1.7% to the highest level since 2008, though still down about 80% from its 1989 peak. We still like the Japanese banks and are long Sumitomo Mitsui Financial.

Bottom Line

Bottom Line

Bottom line, there is no good reason to still have a negative rate policy and I expect the BoJ to raise rates by 10 bps to zero next month.

French consumer confidence fell by 2 pts m/o/m in February to 89 and while above the 2022 low of 80, it was 105 in February 2020. German consumer confidence rose a touch but at -29 still is near the lowest level in a year. We know the German economy is currently challenged.

To listen to Alasdair Macleod discuss what is happening behind the scenes in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.