Look at how the real economy is collapsing.

April 30 (King World News) – Peter Boockvar: I mentioned the now 2 yr contraction in the Dallas manufacturing index, which followed continued softness from NY and a rebound in Philly and today the Chicago April manufacturing index just posted at 37.9 print, well below 50 and vs the estimate of 45. I don’t have the internals yet as the release is delayed to non-subscribers. Reconciling all of this, the ISM manufacturing index is expected to come in at exactly 50.

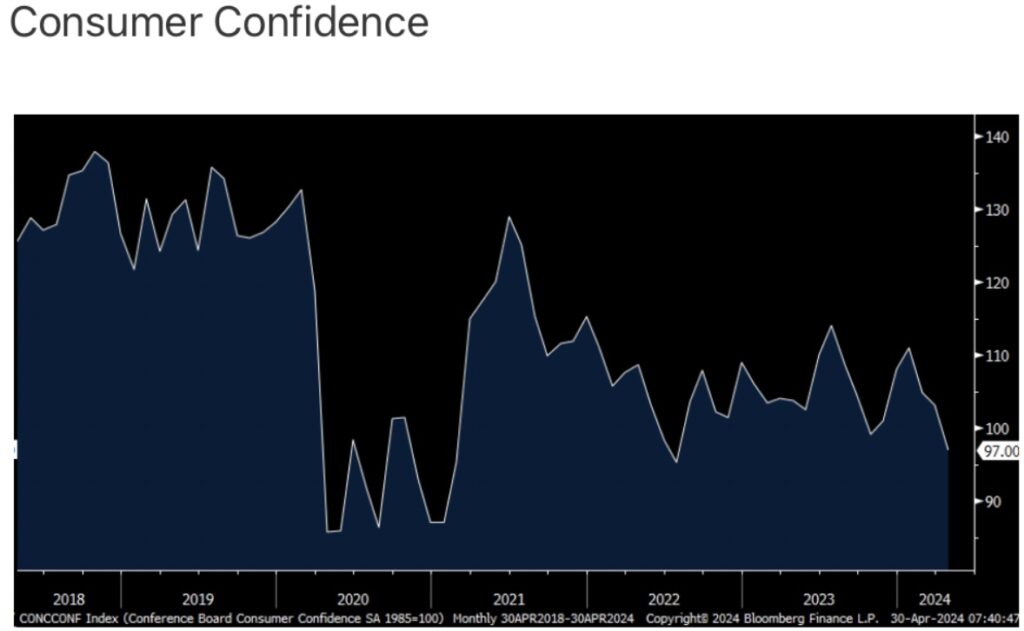

The April Conference Board Consumer confidence index fell to 97 from 103.1, 7 pts below expectations and that is the weakest print since July 2022.

Consumer Confidence Is Breaking Down

The Present Situation fell by 4 pts while the Expectations component was down by almost 8 pts. One yr inflation expectations held at 5.3% for the 3rd month in the past 4.

The key culprit in the confidence drop was the softer answers to the labor market questions. Those that said jobs were Plentiful fell by 1.5 pts to the lowest level since November. Those that said they are Hard to Get rose by 2.7 pts, the most since November.

Also of note, there was a 2.6 pt drop in those expecting ‘more jobs’ in the coming 6 months, the least since October 2011 and that INCLUDES Covid.

This Is Economic Freefall:

Collapsed To Lowest Level In 13 Years!

Income expectations fell too, by 1.9 pts m/o/m for those expecting an increase.

Spending intentions also fell across the board for autos, homes and major appliances.

The cumulative impact of multiple years of higher inflation has clearly taken its toll. The Conference Board said “According to April’s write-in responses, elevated price levels, especially for food and gas, dominated consumer’s concerns, with politics and global conflicts as distant runner-ups.”

Bottom Line

Bottom line, worries about the labor market were the biggest factor in the confidence drop, while inflation stresses remain. While just another labor market anecdote, here is more evidence that the labor market is on shakier ground than what the BLS has reported.

In February, and thus somewhat dated, S&P CoreLogic said its national home price index rose 6.4% y/o/y, giving first time buyers no relief when combined with a mortgage rate around 7%.

To listen to Alasdair Macleod discuss what will make investors a fortune in the coming storm CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.