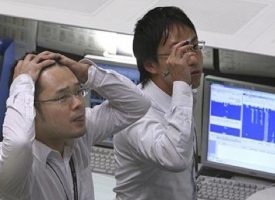

On the heels of the Dow plunging more than 330 points and the U.S. dollar surging, a legendary chairman & CEO overseeing more than $170 billion, who is one of the most respected men in the financial world, issued a dire warning to King World News about global financial markets.

Rob Arnott: "The faster earnings have risen the more vulnerable they've become. So when you have a crash in oil prices and a crash in energy earnings as a result, you're going to get a crash in capital goods expenditures and it ripples across the economy….

Continue reading the Rob Arnott interview below…

Advertisement

To hear which company investors & institutions around the globe are flocking to

that has one of the best gold & silver purchase & storage platforms

in the world click on the logo:

"So what we're likely to see is that 2015 earnings will disappoint and that earnings expectations will ratchet lower. Now, is the market priced to absorb disappointments in earnings? I'm not so sure."

Eric King: "Rob, Is this another mania?"

Rob Arnott: "Well it is and it isn't. Basically deficit spending and monetary stimulus create false earnings…It's bad for the macroeconomy but it's good for those who provide goods and services to the government and the financial services sector.

Entitlement for the 1%

So has the fed created an entitlement for the 1%? Has ramped up government spending created an entitlement for the 1%? Perhaps. Are the affluent entitled to Fed intervention to prevent markets from correcting? Well, that's a weird entitlement but they're certainly expecting it — that if the markets correct, the Fed will jump in with QE4.

Are we entitled to government bail-outs and Fed intervention to prevent over-leveraged companies from bearing the consequences of their mistakes? That's what we seem to have and that's why Main Street is so annoyed with us.

Warped Imitation Of Capitalism

So what we have is a rather warped imitation of capitalism that doesn't allow those who make mistakes to fail. That's kind of sad, because effective capitalism has to allow those who make really dumb blunders to clear the landscape. To allow those with good ideas, good products, and well run businesses, to thrive, to prosper and to build new businesses, innovations, inventions and to employ people in new jobs that are effective that bring something beneficial to the economy.

I'm a capitalist, I love profits but I want profits based on a booming economy, not profits based on a transfer from a stalled economy into shareholder pockets based on deficit spending and monetary ease. So, if this has been a profits bubble, how long can profits stall? It turns out they can stall for a long, long time.

It's fascinating, if you go back historically and you look at the real earnings — earnings adjusted for inflation — for the broad stock market, the 1916 peak in earnings wasn't exceeded until 1955…I'm saying that it can take a while for peak earnings to be exceeded. It took 15 years to convincingly beat the 1980 earnings peak for the S&P 500. It took 20 years for the 1929 earnings peak to be exceeded. It took 19 years for the 1880 peak to be exceeded. So when you have a profits bubble, it can take a while for earnings peaks to be exceeded. We need to be aware of that risk."

Eric King: "Rob, I also want to ask you about a piece that we put out, Insiders Now Dumping Massive Amounts Of Stock. We have the chart there showing insiders are selling their stock as fast as they can — almost in record numbers. What do you make of that?"

Robert Arnott: "… Are you (company insiders) going to use the free money, the very low interest rates to borrow money and buy back stock? And what are you going to do with your own stock? Sell your (company insiders) own stock, and use the borrowed (company) funds to buy back stock.

Phony Stock Buybacks

And one of the things I think is fascinating about stock buybacks is some of them are phony. If you look at stock buybacks, the announced stock buybacks are prodigious, big, and a lot of them are real buybacks. How do I distinguish a real buyback from a phony buyback? Look at the aggregate float of a company. Is it going down?

What's a phony buyback? Company announces a buyback and then pairs it with management stock option redemptions so that the management redeems stock options, sells their stock, the company buys back stock and the float hasn't changed.

Let's Call A Spade A Spade

If the float hasn't changed it's not a buyback, it's management compensation. Let's call it compensation, let's not call it buybacks.

I have no problems with management earning oodles of money if they're making oodles of money for their shareholders. I do have a problem calling it a buyback, when all it is back-door compensation for management.

But actual stock buybacks that reduce the float, that's about half of the total. The other half is actually just management compensation. And that's a lot of what you are talking about — management actually liquidating their ownership.

Eric King: "Rob, we still don't have the massive participation by the public (in the stock market). We do see margin debt at all-time highs but we don't necessarily see the public completely in this market. Are you watching indicators like that?"

Rob Arnott: "Yes … Anyone buying stocks in the US at these levels is making one of two bets: They're either saying, 'I believe this market is cheap, I believe this market is priced to offer better long-term returns than other markets I could invest in.' Well, I don't believe that.

The Greater Fool

Or they're saying, 'I believe I have a sell discipline and the market may be expensive but I believe I'll find a greater fool to sell to. I will use my sell discipline to sell to that greater fool at a higher price. I'll hear the bell chime before the merry-go-round stops and I'll hear the chime before others hear it chime.' I don't believe I have that special expertise. So this is a game I just choose not to play." Rob Arnott's remarkable audio interview has now been released and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW. The legend who oversees $170 billion discusses exacty what investors need to be focused on and what surprises to expect in 2015.

***ALSO JUST RELEASED: BREAKING NEWS: HSBC Forced To Come Clean On London Gold Vault Closures! CLICK HERE.

Vote For Rob!!

***Also, We here at KWN believe that Rob Arnott is truly a "Maverick" and we ask that you vote for him in Wealth Management's survey of "The Most Influential People In Investing." Please vote for Rob Arnott by CLICKING HERE.

© 2015 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the blog page is permitted and encouraged.

The audio interviews with Rob Arnott, Gerald Celente, Michael Pento, David Stockman, Marc Faber, Eric Sprott, Felix Zulauf, Andrew Maguire, John Mauldin, Egon von Greyerz, Dr. Paul Craig Roberts, Lord Christopher Monckton, Bill Fleckenstein, Dr. Philippa Malmgren, Stephen Leeb, John Embry and Rick Santelli are available now. Other recent KWN interviews include Jim Grant — to listen CLICK HERE.