With the Nasdaq breaking back above 5000, today a legend in the business sent King World News a powerful piece warning that we are now seeing the calm before the storm. There is some really incredible information in this piece, including two guest commentaries.

From Art Cashin's notes: Help From Across The Pond Let's Bulls Regain Some Ground – A reduction in reserve requirements by the Peoples Bank of China and some wiggle room on Greece gave markets around the globe a bit of relief.

We need to talk a bit about the influence of the PBOC reduction. Some were dismissive of its claimed influence, noting that the Shanghai index closed down 1.65%. So, if the home market closed down, how was that beneficial?

You need to put things in perspective. When the Chinese regulators shocked markets by halting margin trading over the counter, their markets were already closed. The after-market futures plunged 5% in reaction. So, left untouched, the Shanghai market should have traded down nearly 5%. Instead, thanks to PBOC move, they closed down only 1.65%. It was as though they regained over half of Friday's theoretical losses. The same thing happened to global markets thus strengthening the PBOC link hypothesis.

The Greek Cauldron Bubbles Anew – The Greek drama continued to unfold overnight. Here's part of an assessment from my pal, Peter Boockvar, over at the Lindsey Group.

The euro and Greek securities are lower on a Bloomberg story that the staff of the ECB are looking into raising the haircuts that the Bank of Greece gives securities that Greek banks bring to them for repo financing. This would be a step of pulling back the exposure of the Emergency Liquidity Assistance program IF the Greeks don’t come to an agreement with the EU and IMF. The ELA from the Bank of Greece is the only funding source they have right now.

The story went on to say this, “to restrict or veto ELA funding, which is provided at the Greek central bank’s own risk with consent from Frankfurt, a two-thirds majority of the Governing Council is necessary. A growing minority is opposed to continuing to provide the assistance indefinitely, one of the people said.” In response to the story, the National Bank of Greece is down by 8% and Alpha Bank is lower by 4% (dragging down the European bank stock index) with the overall Athens stock market down by about 3% to the lowest level since September ’12 on a closing basis.

Not impacting general market yet.

Closing The Window On Israel – Many of the weekend talk shows noted that Russia has struck a deal with Iran long before the West has moved to remove the sanctions on Iran. Most commentators thought it seemed to be Putin just being Putin, thumbing his nose at the Western Allies and at the U.S. in particular.

We think there may be another purpose and it may be why the deal had to be done quickly.

The deal is for Russia to provide Iran with the very sophisticated Antey-2500 air defense system, an anti-missile; anti-aircraft system that would shield Iran from virtually all attack vehicles, save perhaps the United States' most sophisticated assault weapon (note the singular).

That leaves Israel to watch the Iran nuclear talks, knowing that in months Iran may have a highly effective air shield. The Russian deal may light a powder keg.

You Don't Look A Day Over….. – My good friend and fellow market veteran, Jim Brown over at Option Investor did a little digging on the longevity of market moves. Here's what he wrote:

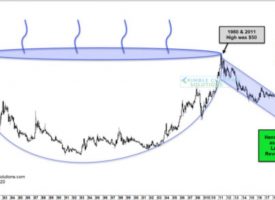

The current bull market is 2,184 days old and has gained +213.1%. That is above average in duration and magnitude. There have been 11 bull markets and 10 bear markets since 1949. The prior 10 bull markets lasted an average of 1,770 calendar days and produced gains of +161.4%. Inside those 11 bull markets were 22 corrections from 10% to 19.9% for an average of two corrections per bull market.

With the current bull market almost four years old and the fourth longest on record it is understandable that investors would be getting a little worried with the S&P trading near a forward PE of 18 but with earnings declining. The S&P has now gone 1,292 days without a correction. The long term average between corrections is 514 days. We are due. Data from Jeff Hirsch.

The S&P is up only +0.69% over the last 75 trading days. It has been 80 days since there was a 2% move. That is the second longest streak since the financial crisis. Calm before the storm?

Consensus – Stocks have still not regained their highs of last Wednesday and Thursday. That will be a key target and challenge for the bulls. Otherwise, we will remain in the zigzag pattern. Greek rumors may begin to shade markets. Stay wary, alert and very, very nimble. ***ALSO RELEASED: China And The Super Wealthy Are Preparing For Something Big But Silver Will Surprise Everyone CLICK HERE.

The audio interviews with Gerald Celente, Egon von Greyerz, Dr. Paul Craig Roberts, Andrew Maguire, James Turk, Rick Rule, Bill Fleckenstein, Dr. Philippa Malmgren, Eric Sprott, Robert Arnott, Michael Pento, David Stockman, Marc Faber, Felix Zulauf, John Mauldin, John Embry and Rick Santelli are available now. Other recent KWN interviews include Jim Grant — to listen CLICK HERE.