Here is a look at gold’s new trading range ahead of the move to $5,000.

Gold

November 20 (King World News) – Here is a portion of a communication from John Ing that was sent to King World News: … gold, the classic hedge against inflation and general chaos reached record highs at $4,400 per ounce, before pulling back, consolidating recent gains. Gold has taken a defensive rule, particularly with US – China tensions, and after years of deficit spending, investors and central banks have sought refuge in the metal.

After all gold’s role has been a store of value for thousands of years. Gold was pivotable in the establishment of the US dollar as a reserve currency. In 1944, in Bretton Woods New Hampshire, the Federal Reserve promised to buy and sell gold at a fixed price of $35 per ounce and foreign banks pledged to keep their currencies tied to the dollar. The dollar was as good as gold since they could always be converted into gold, held at the Federal Reserve.

The economic order forged at Bretton Woods brought massive benefits to the US and the West, but then in the Fifties, the United States ran persistent balance of payments deficits with other countries, hollowing out America’s industrial base. The French complained about America’s “exorbitant privilege” which allowed the US to pay for imports with dollars. Foreign central banks soon were left with surplus dollars even after they invested in America’s capital markets or debt. Then President De Gaulle from France, concerned of America’s deteriorating finances, demanded that their surplus dollars be converted into gold. The US resisted but a two-tier system emerged that allowed the price of gold to trade in the free market, with the official gold price pegged at $35 an ounce. However that agreement proved temporary, as the French swapped their official dollars for more gold and sold that gold in the open market at higher prices.

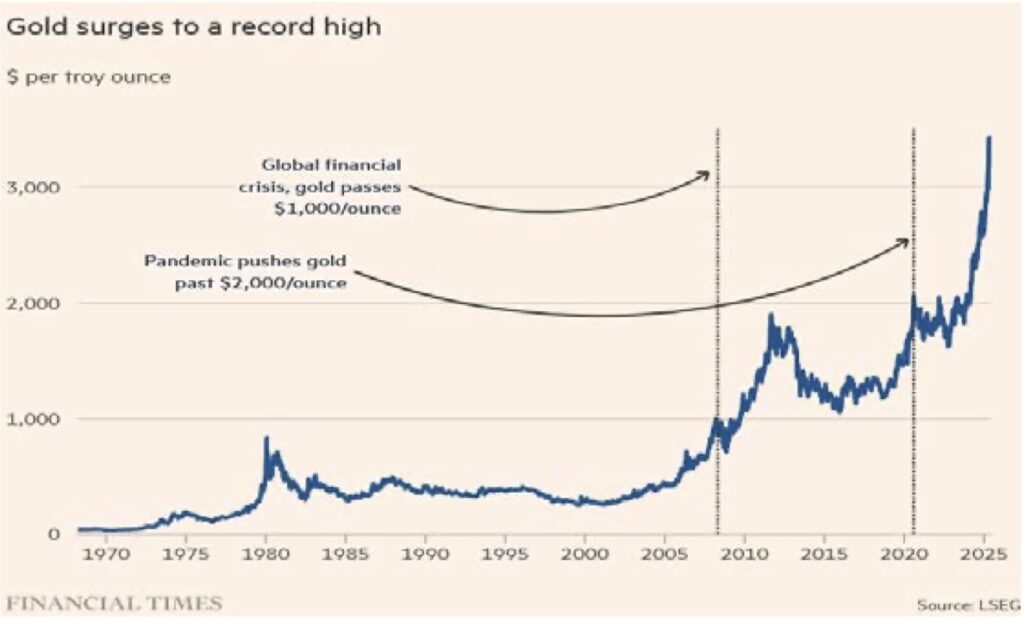

Consequently to stop a run on the dollar on August 15, 1971, President Nixon closed the gold window, defaulting and established a fiat currency (backed only by the good faith of the United States) in order to halt the panic. The gold price went from $35 to $800 an ounce in 1980 or 2,300 percent and as the free price of gold soared, the US dollar devalued further against the price of gold, losing its purchasing power. Since then, gold has topped $1,000 during the financial crisis of 2008-2009, $2,000 during the Covid pandemic, followed by a new peak at $3,000 on Mr. Trump’s Liberation Day. Risk? Gold is simply a barometer of investor anxiety. In all cases gold was a store of value. The currency of choice is trust. We believe that in a de-dollarized world, America’s dysfunctional finances and weaponization of the dollar will power gold even higher. The best lies ahead.

Meantime, geopolitical uncertainties have fueled a new gold rush. Central banks have purchased huge quantities of bullion, accumulating about 25 percent of the world’s supply in the last three years, reducing their reliance on the US dollar, rendered untrustworthy by strained government finances. Over the past decade, gold holdings have now surpassed US Treasuries as the second largest held in central bank reserves. We believe that geopolitical risks today is greater than ever and faced with these uncertainties, gold will record newer highs. Gold is the canary in the coal mine.

Meantime China keeps buying gold amid a fragile world economy and fears of a repeat of the beggar-thy-neighbor currency protectionism. At the same time, there is concern over the massive Keynesian stimulus from Mr. Trump’s fiscal remedy of lower interest rates which has unleashed the animal spirits in the stock market, increasing the risk of a bad ending. Amid trade tensions, China once held more than a trillion of US Treasuries and have been selling down their holdings for the fifth month in a row to $700 billion, resulting in higher bond yields and more costly for the federal government to finance its deficits. America is vulnerable, needing help to finance its deficits because at more than 8 percent to GDP, the country requires capital inflows every business day to pay its bills. China, the largest creditor in the world holds the Trump card.

Gold miners have been among the best performers this year as retail demand and M&A activity heats up. Third quarter profits have resulted in increases in returns to shareholders through share repurchases and dividend increases. Yet the stocks are still cheap, particularly when compared to the artificial intelligence sector. To be sure, gold’s recent pullback was overdue and is the pause that refreshes – a new trading range has been established. We continue to expect gold to reach $5,000 an ounce.

ALSO JUST RELEASED: Silver Just Saw Another Historic Upside Breakout, Plus A Stunning Gold Chart! CLICK HERE.

ALSO JUST RELEASED: UK Regulator’s Admission Of 41% Inflation And Systemic Fear Of Bank Runs CLICK HERE.

ALSO JUST RELEASED: Crisis, Crash, Control The US CLICK HERE.

ALSO JUST RELEASED: Massive Fraud In The Gold Market Just Exposed CLICK HERE.

ALSO JUST RELEASED: Gold, Silver And The Bursting Of A Credit Bubble CLICK HERE.

ALSO JUST RELEASED: Look At What Has Collapsed To Levels Last Seen During 2020 Panic CLICK HERE.

ALSO JUST RELEASED: Here Is The Big Picture As Gold Price Remains Above $4,000 CLICK HERE.

ALSO JUST RELEASED: Nomi Prins – China Is Buying A Lot More Gold Than They Are Reporting CLICK HERE.

ALSO JUST RELEASED: The Metals Shortage Is Real And This Time It’s Global CLICK HERE.

ALSO JUST RELEASED: Silver Price Remains Radically Undervalued vs 1980 High CLICK HERE.

ALSO JUST RELEASED: Another Day In Clown World: Look At What Just Collapsed CLICK HERE.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.