Here’s why the rich aren’t saving, and will the Fed cut 25 or 50 basis points?

Here’s Why The Rich Aren’t Saving

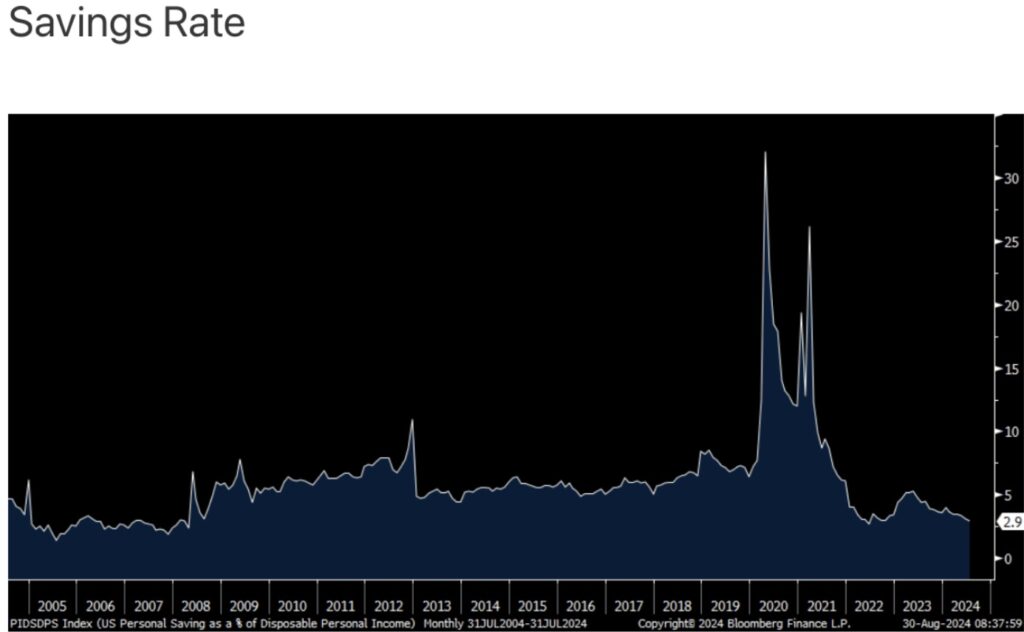

September 1 (King World News) – Peter Boockvar: There are two explanations for the continued drop in the savings rate. One, just read again what Dollar General had to say about a portion of its customer base. Two, with the stock market around record highs, the higher income consumer feels the need to save less. As for the latter, I’ll argue again that the direction of the stock market is a key determinant of high end consumer spend and its big influence on economic growth.

Savings Rate Remains Collapsed:

Wealthy Don’t Feel The Need To Save With Stock Market At All-Time Highs

Next Week’s Release Will Determine 25 Or 50 Basis Point Cut

As for the Fed, next week’s payroll figure and unemployment rate will be the swing factor between a 25 or 50 bps cut in mid September. The former though will be revised about 4 more times before we know the final figure but the latter is what it is and won’t be revised.

This Is How You Will Know Bear Market In Stocks Has Begun

King World News note: The Fed’s rate tightening cycle corresponds with a top in the stock market. As the stock market comes unglued, it will send money fleeing into the safety of physical gold, silver and the high-quality shares that mine the metals.

Just Released!

***To listen to Alasdair Macleod discuss the wild trading he expects to see in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.