On the heels of the stock market decline and rally in gold, here is an important look at gold, stocks and the U.S. dollar.

S&P 500, Gold & The Dollar

By Michael Oliver, MSA (Momentum Structural Analysis)

May 18 (King World News) – S&P 500 In two reports this quarter (April 26th, page one; May 6th, page one), we made a case for the S&P500 reaching a specific number above the market: 2405.40. In momentum technical detail we gave our rationale for wanting to see that number achieved (even down to the decimal that we wanted). It was especially a welcome number to reach on the upside if you’re a closet bear. See those reports for the explanation…

IMPORTANT:

To find out which high-grade silver mining company billionaire Eric Sprott just purchased

a nearly 20% stake in and learn why he believes this is one of the most

exciting silver stories in the world – CLICK HERE OR BELOW:

After an excruciating report, the S&P500 managed to achieve that number yesterday morning, trading to a high of 2405.77. As soon as that number was tagged, the upside halted—cold.

Now, a day later, the S&P500 is probing towards our first long-term momentum breakage level. But before this drop it did what was needed, and we can thank the bulls for giving us that number. The focus now shifts to the layered downside triggers. All involve violation of long-term trend alert levels on quarterly or annual momentum. We’ll have a full update this weekend. For this week, the Trade Sheet (sent Monday) defines a weekly close at 2353 as a first long-term momentum negative structural event. Currently the index is at 2357.

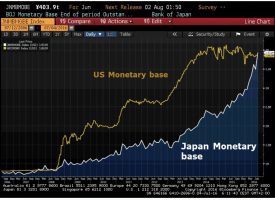

Dollar Index

This has been in MSA’s sights all year. As far back as late December 2016 (in our Forex outlook for 2017) we said that a monthly close at or below 99 would break the Dollar’s annual momentum backbone.

That massive momentum structure traces back more than a decade. Also, a weekly close at or below 97.50 should be considered an actionable major bear signal event. Currently the cash index is trading at 97.48.

Gold

In recent reports we’ve argued that the major twisting and turning by gold since last September has merely been “technical noise” that in no manner alters the long-term annual momentum buy signal that we identified in February 2016 (buy signal $1140 to $1160, and buy signal for GDX at $15.50 to $16). There is no change in that view. We remain long-term bulls on gold and miners. For now we’re watching GDX for a secondary long-term momentum breakout (see the weekend report), and we’re watching for Dollar Index sell signal as a new wind at the back for gold.

KWN has just released one of Bill Fleckenstein’s greatest audio interviews ever and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

***ALSO JUST RELEASED: Legendary Short Seller Warns Stock Markets Will Accelerate To The Downside, But Gold Will See Buying CLICK HERE.

***KWN has already released the fascinating audio interview with Rick Rule discussing stock picks for gold, silver, and uranium, as well as the big picture for the gold and silver markets and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

© 2017 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.