As the world edges closer to the next crisis, today the man who has become legendary for his predictions on QE and historic moves in currencies, spoke with King World News about $17,000 gold and the financial devastation that is still to come.

Global Assets Surge 26X In 38 Years!

May 26 (King World News) – Egon von Greyerz: “In 1980, global assets, including property, were less than $20 trillion. Almost 40 years later they have grown to $524 trillion. That is a compound annual growth rate of 9%, which is quite remarkable for a 38 year period. Global assets have gone up 26 fold during this period…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

The Financial Devastation That Is To Come

Egon von Greyerz continues: “In the same period, gold went from an average price of around $650 in 1980 to $1,300 today. So while global assets have gone up 26x since 1980, gold has just managed to go up 2x. Admittedly gold started at $35 in 1971, so it had already benefitted from a substantial rise by 1980. Nevertheless, since 1980, gold has been totally ignored both as an investment and as insurance or wealth protection. The massive increase in money supply through credit expansion and money printing has gone into conventional assets such as stocks, bonds and property but not into gold.

Gold has been a forgotten asset and investment for 38 years and has not even kept pace with inflation with gold’s 1.8% annual growth rate since 1980. So there has been very little interest in gold while other investment assets have surged. We identified gold as a strategic investment for wealth preservation in 2002 at $300 and recommended to our investors to put a substantial percentage of their assets into gold with a minimum of 25%. Since then gold has been performing better than most investment classes. But the rise so far is totally insignificant compared to what is going to come.

We believe that between now and 2025, we are going to see the biggest transfer of wealth in history. The coming transfer will affect global investment markets in a way that will be totally shocking to most investors. All conventional markets, bonds, stocks and property will lose at least 50% to 75% and possibly more. At the same time, gold and silver will not just catch up with the underperformance since 1980. The precious metals will experience a totally unexpected investment mania of spectacular proportions.

As stocks and bonds fall precipitously, the markets will be overcome by a fear that the world hasn’t experienced since the 1929 crash. But this time it is likely to be much worse.

The table below shows world financial assets, including property.

GLOBAL ASSETS 2018

As the table shows, global assets are today $524 trillion. A major part of that is property which is a massive bubble in many countries like the US, UK, Australia, New Zealand, China, Hong Kong, Sweden, Switzerland, etc. Low interest rates and unlimited credit have driven property prices to dizzying heights. So dizzy that they are now ready to fall down to earth very fast.

Looking at gold, the figure of $3 trillion represents all the gold in the world ever produced which is in gold bars or coins, including ETFs, some of which may not have the physical gold. It also includes central banks, many of which don’t have the gold they officially declare. But that gold will then be somewhere else like in China, India or Russia so it clearly exists albeit somewhere else.

As the above table shows, only 0.6% of world financial assets are in physical gold today. Back in 1960, gold represented 5% of global assets but the explosion in other investment assets has reduced the percentage to just 0.6%.

The coming implosion of asset bubbles will lead to a reduction of asset prices of at least 50% between today and 2025. That will obviously cause a major financial crisis and major problems in the financial system, since assets do not just include stocks and property but also bonds and loans. Thus, the banking system will be under tremendous pressure and so will insurance companies and pension funds.

The table below shows global assets declining by 50% in real terms, which in my view is a minimum in the coming crisis. The one exception is gold which will reflect the crisis by gaining substantially in price to reflect its real importance as the ultimate wealth preservation asset. A gold price of $5,000 in today’s prices is a minimum in my view.

$5,000 an ounce for gold would still be only 4% of global assets in the above scenario. At that point gold would be starting to assume its role as money which has always been the case throughout history. As stocks, bonds and property collapse, gold is again assuming its monetary mantle.

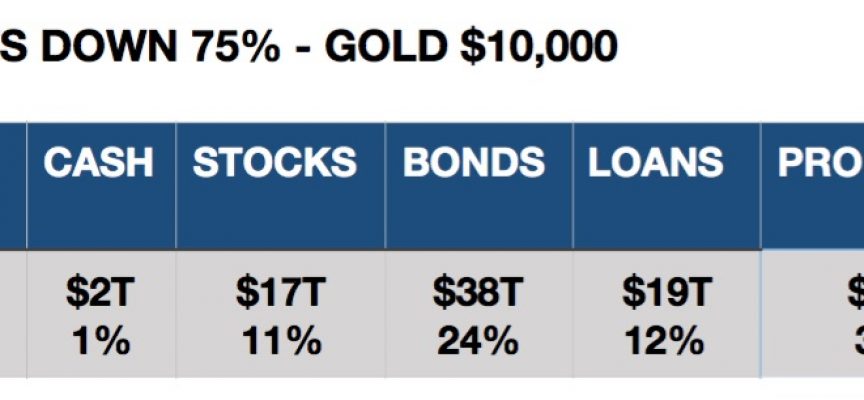

The table below is the minimum scenario in my view.

$17,000 Gold

With asset prices having gone up 26x in the last 38 years, a 75% correction would be totally normal. It would still leave global asset prices 8x higher than in 1980. As the financial crisis intensifies, gold will start to reflect its real inflation-adjusted value. The table above assumes $10,000 gold but the real inflation-adjusted price (with 1980 as the base year) is closer to $17,000.

For anyone who believes that a 75% fall in stocks is impossible, just remember what happened to the Dow in 1929. At that time, the Dow collapsed by 90% in an economic scenario which was much more favorable than today. The US was then a creditor nation and the global debt situation was minuscule compared to today. And not only did the Dow decline by 90%, but it took over 25 years before it attained the 1929 peak. The coming fall is not only likely to be greater than the 75% assumption but it will take even longer than 25 years to recover due to the global nature of the crisis and the major worldwide financial crisis that will ensue.

$10,000 gold combined with a 75% fall in global assets means that gold would represent 17% of total assets. That might sound extremely high, but we must remember that at that point gold will be real money as fiat currencies will be reaching their intrinsic value of zero.

Global assets today are 174x greater than gold. When assets are down 75% and gold $10,000, that makes global asset just 6x greater than all the gold in the world (excluding jewelry). This means that global assets will decline 97% against gold between today and 2025. It might seem that 2025 is an arbitrary date to some extent but it is a date that has significance from many aspects.

Thus, holders of gold who today can buy a meager 0.6% of global assets, will within the next 7 years be able to buy 16%. More importantly, a 97% decline in the value of stocks, bonds and property against gold signifies the most massive wealth transfer in history.

The exact level of the collapse in investment assets and surge of gold is of course impossible to forecast. What is virtually certain is that gold, relative to other assets, will increase substantially in value. It is not for the capital appreciation alone that gold must be held but more importantly as insurance against a rotten financial system and massively overvalued investment assets.”

***ALSO JUST RELEASED: Fear And Panic Beginning To Engulf Global Markets CLICK HERE TO READ.

© 2018 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.