The question everyone is asking is will the Fed cut interest rates, and if so, when? Plus there is a look at consumers, retail and real estate.

Let’s Take Our Time With Rate Cuts

February 28 (King World News) – Peter Boockvar: I forgot to mention yesterday the very important comments we heard from the new (6 months in) KC Fed president Jeff Schmid who replaced Esther George, someone I was a fan of. It was the first speech he gave titled “Guideposts for a New Central Banker” so we finally got a sense of his thinking though he does not vote this year. He commented on both rates and importantly on the Fed’s balance sheet, where the latter I believe is a big deal this year in terms of how much more it shrinks in size.

He’s in the ‘lets take our time’ camp with rate cuts. “With inflation running above target, labor markets tight, and demand showing considerable momentum, my own view is that there is no need to preemptively adjust the stance of policy…I believe that the best course of action is to be patient, continue to watch how the economy responds to the policy tightening that has occurred, and wait for convincing evidence that the inflation fight has been won.”

Fed Wants To Shrink Balance Sheet Further

On the balance sheet, he is clearly on the side of wanting to get it smaller. Under a section of his speech titled “Minimizing the Federal Reserve’s Financial Footprint”, which I say amen to, he said this specifically applies to the Fed’s balance sheet. He does talk about the huge increase that the Fed took on during times of crisis such as the GFC and Covid but then said “However, maintaining a persistently large presence in markets in normal times comes with costs and increases the possibility of unintended consequences. These concerns have been highlighted by the KC Fed in the past and are concerns I also share. To be specific, I offer three examples:”

1)”First, maintaining a large portfolio of long-term Treasury and mortgage debt can create distortions in the price of assets and the allocation of credit. These distortions risk misallocations that can ultimately sow the seeds of future imbalances in the economy.”

2)”Second, a persistently large balance sheet can have unintended consequences on the structure of the financial system. In making asset purchases, the Fed is lowering longer term interest rates and flattening the yield curve. Failure to unwind these purchases can challenge the ability of banks to borrow short and lend long. This is the business model that many community banks rely upon. And the Fed’s sizeable overnight reverse repo facility may have unintended consequences on the allocation of liquidity and the role of depository institutions in the economy.” I’ll add, this is the first time I’ve heard a central banker talk about the damage the flattening of the yield curve, via QE, can have on bank profitability. Amen.

3)”Third, maintaining a large balance sheet can give the uncomfortable impression that monetary and fiscal policy are intertwined. As we’ve seen of late, a large balance sheet exposes the Fed to operating losses. And maintaining an excessively large Treasury portfolio offers the impression that the Fed’s balance sheet is supporting government debt markets. Over time, both have the potential to threaten the Fed’s independence.” Another amen, a central banker essentially admitting that QE is the monetization of US debt.

He finishes on this that he does agree with using the balance sheet as “an important monetary tool, especially in times of crisis. However, once a crisis has passed, it should be a priority for the Fed to reduce its balance sheet and to lessen its footprint in financial markets.” Amen.

This is a big deal for markets as the year progresses if Powell agrees with him…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Let’s hear from a few retailers on the state of the US consumer along with some other notables.

From Macy’s:

“The likelihood of a recession is now lower than it was a year ago. (I’ll add that is certainly the consensus now). Inflation has slowed, but so has labor and wage growth. As such, we expect our consumer to remain under pressure.”

On the credit quality situation, “The first thing is that the consumer remains under pressure. And as a result, what we’re seeing across the industry are higher credit card balances and higher delinquencies, really returning to more normalized levels. As you know, the last few years had an abnormally low or historically low level of net credit losses, delinquencies as folks were flush with cash. But now we’re back to more normal times. And so, what’s reflected in our credit card revenues, which does exclude the impact from the late fee ruling, is really the increase in net credit losses as we’re more in a normalized environment.”

Lastly on inventories, which for many retailers seems to be in much better shape, “I think that inventory should be on or around flat to last year as we begin to improve sales.”

From EBAY:

“First, despite significant macro pressure on discretionary spending across our major markets, we saw organic y/o/y GMV growth improve during each quarter of 2023, resulting in GMV growth down roughly 1% for the full year.”

“As we discussed last quarter, we observed softer demand for discretionary goods during the beginning of Q4, as consumers dealt with elevated inflation and higher interest rates in our key markets. Shoppers were more discerning in their purchase behavior as we approached the holidays, and the promotional environment adapted to meet their expectations. However, we started to see our business improve towards the end of November, particularly in the US, driven by consumers looking for value to stretch their limited holiday budgets.”

“Moving to our outlook. We have started the year with relatively uneven demand across our major markets.”

From Lowe’s:

“In the 4th quarter, comparable sales declined 6.2% as DIY customers continued to remain cautious with their home improvement spend and harsh weather impacted larges parts of the US in January.”

“Microeconomic factors like persistent inflation and a stagnant housing market continue to make DIY customers and consumers hesitant to spend on big ticket purchases for their homes. And those that did engage in home improvement activities took on smaller non-discretionary projects with a heightened focus on value. This impacted demand for bigger ticket interior categories like kitchen and bath, flooring and appliances.”

From Urban Outfitters:

“Turning now to the health of our customers. We believe they as a group are in good shape. They’re not as exuberant as they were when first coming out of the pandemic. They don’t have as many weddings and events to attend. They are less apt to move and have recently refurbished their living spaces. So, demand for categories like dressier, footwear and home furnishings are trending softer, but they do enjoy a secure job and are earning more money than ever. They tend to be optimistic, want the latest fashion, and are willing to spend some of those extra earnings to enjoy them.”

Bottom line on what we’ve heard so far from retailers over the best few weeks, I’ll leave it to the CFO of Walmart who said yet again, ‘The US consumer is choiceful’ and I’ll add, continuing to prioritize its spend.

Shifting gears to commercial real estate, from Jones Lang Lasalle:

They see things as glass half full, “Sentiment in the global real estate market has improved since our last earnings call in early November, a result of the drop in the 10 yr US treasury bond yield and a growing consensus that interest rates have reached peak levels across most major economies. While falling debt cost will lead to a more predictable operating environment going forward, it will take time and prolonged stability for pricing to fully adjust. The path forward may be uneven, but we are confident that bid-ask spreads will normalize and transaction volumes will improve revenue.”

“Liquidity remains available and debt markets are active, favoring asset types such as residential, industrial and data centers. In the current market environment, smaller deal sizes remain the most attractive to lenders, although we have seen a modest number of larger deals coming to the market over the past few months.”

“On the leasing side, occupiers continue to take a cautious approach but office demand is stabilizing as many companies are making progress on their return to office initiatives.” While we all take about the office situation here in the US, and many who just don’t want to go to the office 5 days a week, it’s back to normal in Asia. “Asia Pacific leasing demand remains resilient with most markets ahead of pre-pandemic levels of office attendance.”

On the industrial side, “4th quarter leasing activity declined in the US and Europe as the industrial sector continues to manage through the record amount of space that was leased following the pandemic.” Asia Pacific though was strong here too.

Lastly Of Note

Lastly of note, “The retail sector saw solid leasing activity in the 4th quarter across most markets, benefiting from resilient consumer spending and a recovery in international travel.”

I’ll ask again out loud, how does Blackstone keep telling us that their BREIT fund is immune to the valuations pressures all around them?

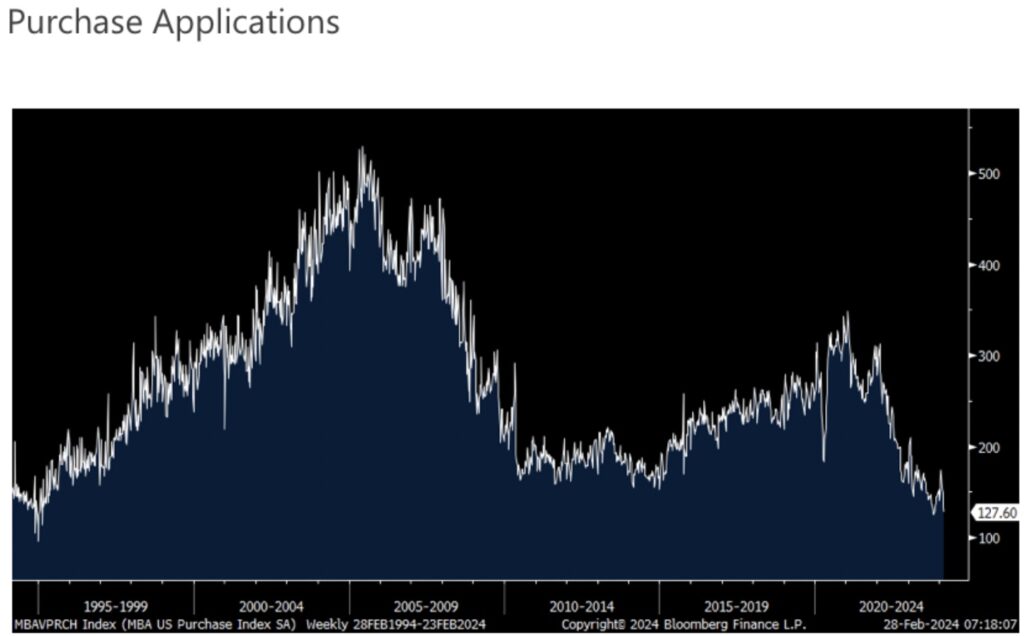

With another week of a 7%+ average 30 yr mortgage rate, the MBA said purchase applications fell 4.5% w/o/w, down now for a 5th straight week and back near the lowest level since 1995. Refi’s fell by 7.3% w/o/w, lower for a 3rd straight week. Bottom line, affordability remains a big problem for those who want to be first time home buyers.

Meanwhile In Europe

In Europe, the February Economic Confidence index fell to 95.4 from 96.1 and that was below a hoped for rise to 96.6. Weakness was seen again in manufacturing but also services, retail and construction. The only component that was higher m/o/m was consumer confidence which rose by .6 pts but after falling by 1 pt in the month before. At best, there is no growth coming from the Eurozone and the euro is lower in response with bond yields slightly lower and stocks mixed. We know notwithstanding the economic challenges, stocks there have performed pretty well.

Here was a comment from ECB Governing Council member Peter Kazimir today:

“There is no reason to rush a rate cut. June would be my preferred date, April would surprise me and March is a no go.”

To listen to Alasdair Macleod discuss what is happening behind the scenes in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.